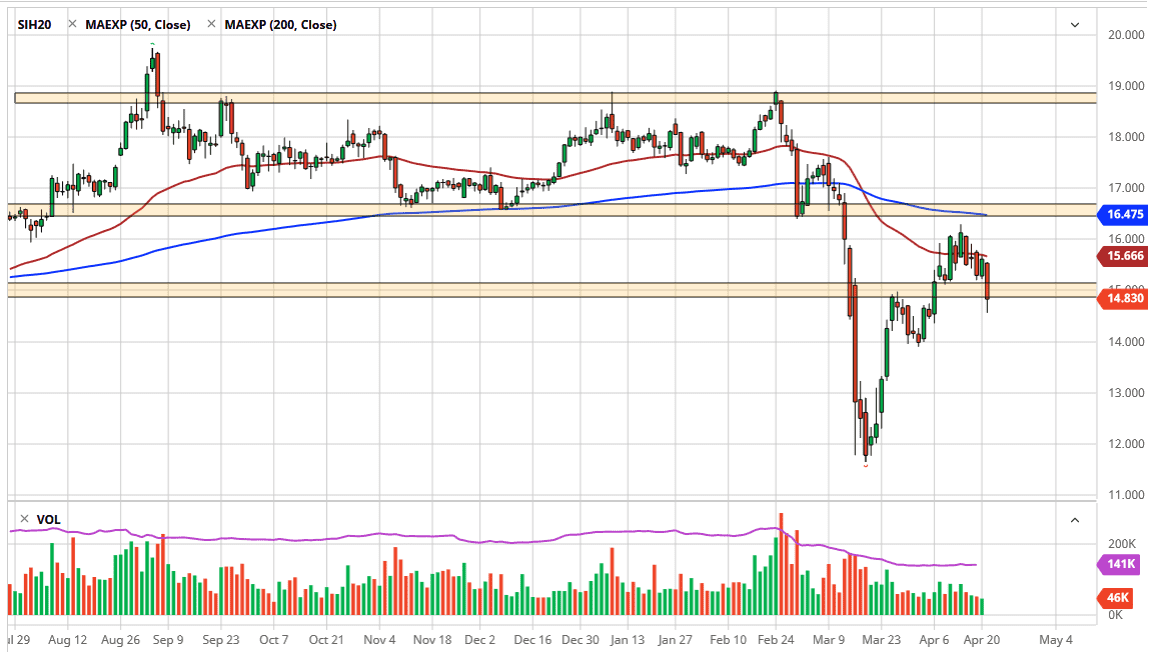

Silver markets fell hard during the trading session on Tuesday, as the 50 day EMA looks to be offering a significant amount of resistance. The fact that the market broke down below the $15.00 level of course is negative, but I have been talking about the possibility of this happening for some time. As you can see, the market looks likely to go looking towards the upside given enough time, based upon the fact that we have bounced quite nicely during the trading session on Tuesday.

The market has dropped down to the $14.55 level, which I think is essentially where significant buyers are hanging about. I had been talking about the $14.50 level, but that is close enough for government work. At this point in time, it is likely that the market will bounce and continue to go towards the top of the candlestick for the Tuesday session, and then by extension the 50 day EMA above there which currently resides at the $15.66 level. It does not mean that it is going to be a quick move, but the possibility is that we do grind in that general direction.

If we break down below the $14.50 level, then I think the next major support level is closer to the $14.00 level, which of course is a large, round, psychologically significant figure and of course the bottom of the flag part of the bullish flag structure. The market breaking down below there would of course be extraordinarily negative, and of course it is completely possible.

When you are trading, you have to be looking at both sides of the equation, as risk is the biggest part of the equation. I do recognize that precious metals have been getting a bit of a bid in this chaotic time, and I think that will continue to be the case going forward. That being said, the reason this market will probably lag a bit is that there is so much in the way of industrial components when it comes to the price of silver that will of course be a major headwind. The global economy continues to slow down so it makes sense that silver would drag on a bit as well. All things being equal, I believe that silver will continue to be bullish, but it will underperform gold as I have been saying for several weeks now. To the upside, be where the 200 day EMA at the $16.47 level.