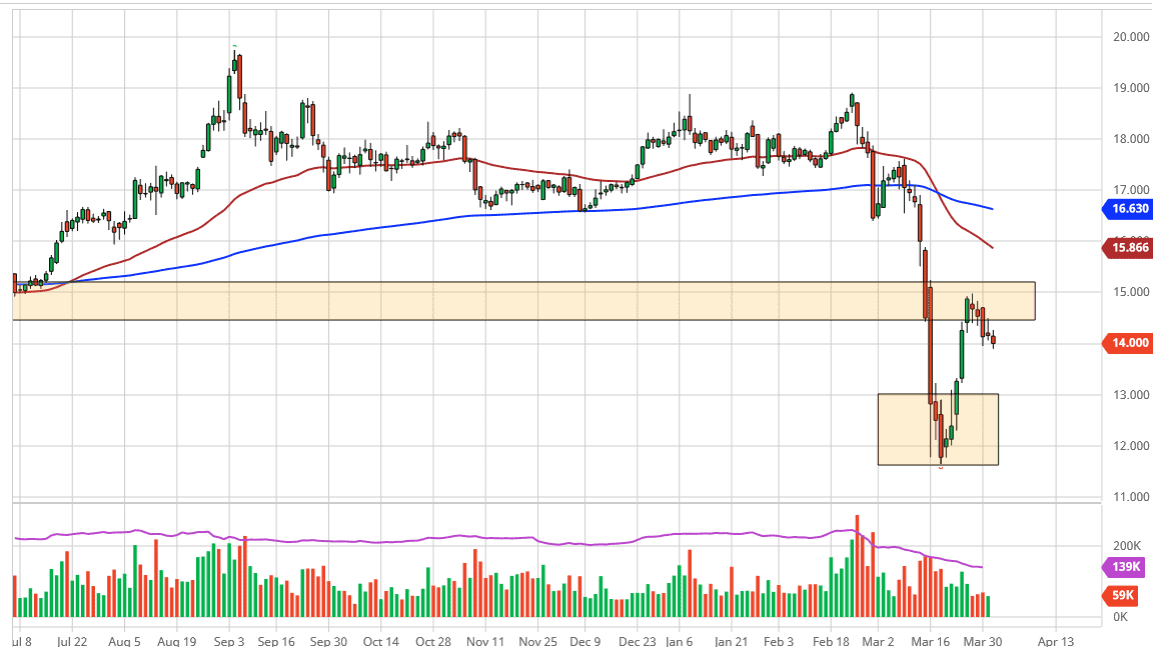

Silver markets have gone back and forth during the trading session on Wednesday, reaching below the $14.00 level. That is an area that could offer a bit of support, and if the market were to break down below there and more importantly close below there, then it’s likely that the market goes down towards the $13.00 level. The $13.00 level is very important, as it was significant resistance previously. So-called “market memory” comes into play at that point, so that is where I believe that silver is trying to get to.

Furthermore, it makes a certain amount of sense that silver would drop from here due to the fact that there is almost no industrial demand. I believe that the industrial demand will continue to drop due to the fact that the coronavirus has shut down so many different sectors. Even if the Chinese economy is back to full strength, the US economy and Western Europe have both come to a standstill. In other words, there are no customers. This means that there will be less manufacturing regardless, and therefore silver has a pretty bleak outlook.

From a technical analysis standpoint, I believe that the $15.00 level will continue to be crucial. If we were to break above that level, then it would be a very bullish sign, but I don’t see that happening very quickly. If the market was to break above the $15.00 level, then I think it opens up the door to the $16.00 level next. That’s also roughly where the 50 day EMA is hanging around, so that of course will cause a lot of resistance. A break above that level then opens up the door to the $17.00 level, so I think it’s only a matter of time before the sellers would come in after that rally.

I think the one thing you can probably count on is an extraordinarily volatile market, as the global outlook feature so many different moving pieces. I think that the US dollar has a certain amount of influence as well, considering that the commodity is priced in that very currency. If the US dollar strengthens, that could also cause downward pressure on the silver market. I think there are far too many reasons to believe that the negativity comes back, at least in the short term to get overly bullish. I would keep my position size relatively small though.