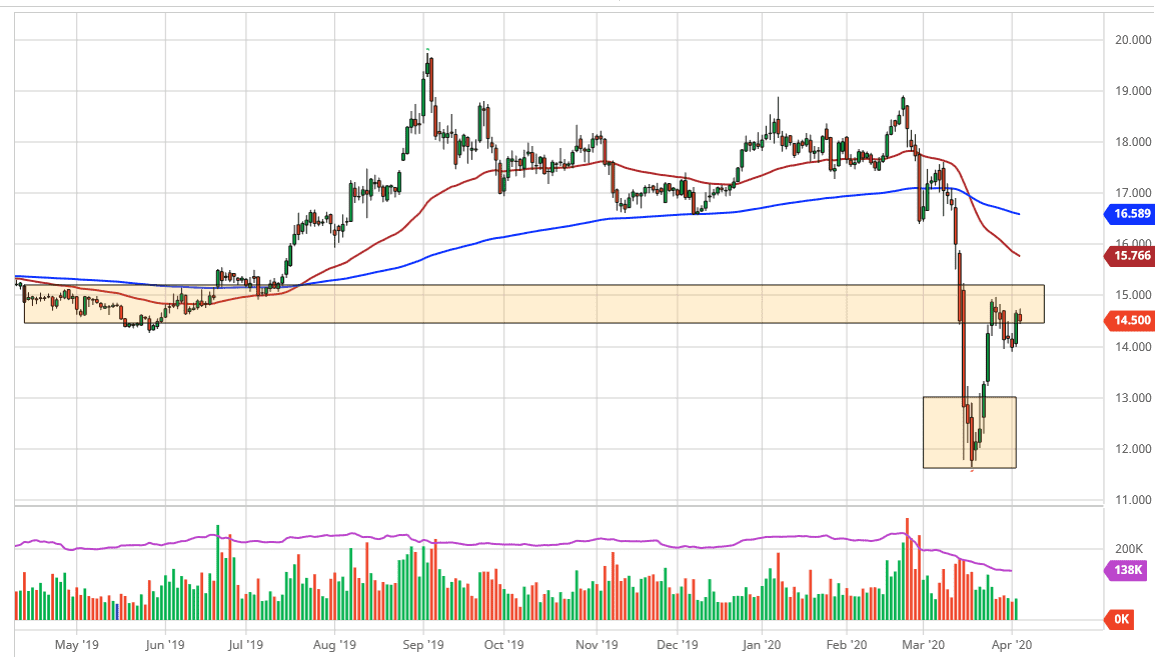

The silver markets initially tried to rally during the trading session on Friday but pulled back a bit as the $15 level above continues to loom large. If we can break above that level, then it’s a very bullish sign and it looks like we could go as high as $17 based upon the measurement of the pole, which of course started just below the $12 level. Ultimately, this is a market that I think does go higher based upon the precious metals aspect of it, but I also recognize that silver is going to lag the gold markets, at least as far as that piece of the pie is concerned. After all, it also is used as an industrial metal.

Silver is going to get a bit of a boost due to physical and precious metals demand but as far as industry is concerned, it’s very unlikely that the silver markets will take off to the upside in the same way that other precious metals markets will, most specifically gold. In fact, I believe that the most obvious way that a lot of traders have been playing the precious metals sector is too short silver and by gold. You make up the difference but ultimately, it’s likely that you will see both of these markets go higher.

To the downside, I believe that the $14 level underneath is going to be a major support level, but even more importantly is going to be the $13 level as it is the top of the previous consolidation area. With that in mind I think that it’s only a matter of time before buyers would come in and that region. In fact, that makes quite a bit of sense considering that if you believe in the longer-term uptrend, you could drop down there to make a “higher low” before bouncing and confirming the bottom.

Regardless, the world economy is all over the place and most of it isn’t good. Central banks around the world continue to loosen monetary policy, so that could help silver rally eventually. It might take some time, but I do think it happens given enough time. To the upside, the $17 level gets hit, either on a break above the top of the ball flag, or on a pullback to find a larger base. Because of this, I have been buying physical silver in the last couple of weeks again, but ultimately levered positions are something you’re going to have to be a little more cautious with.