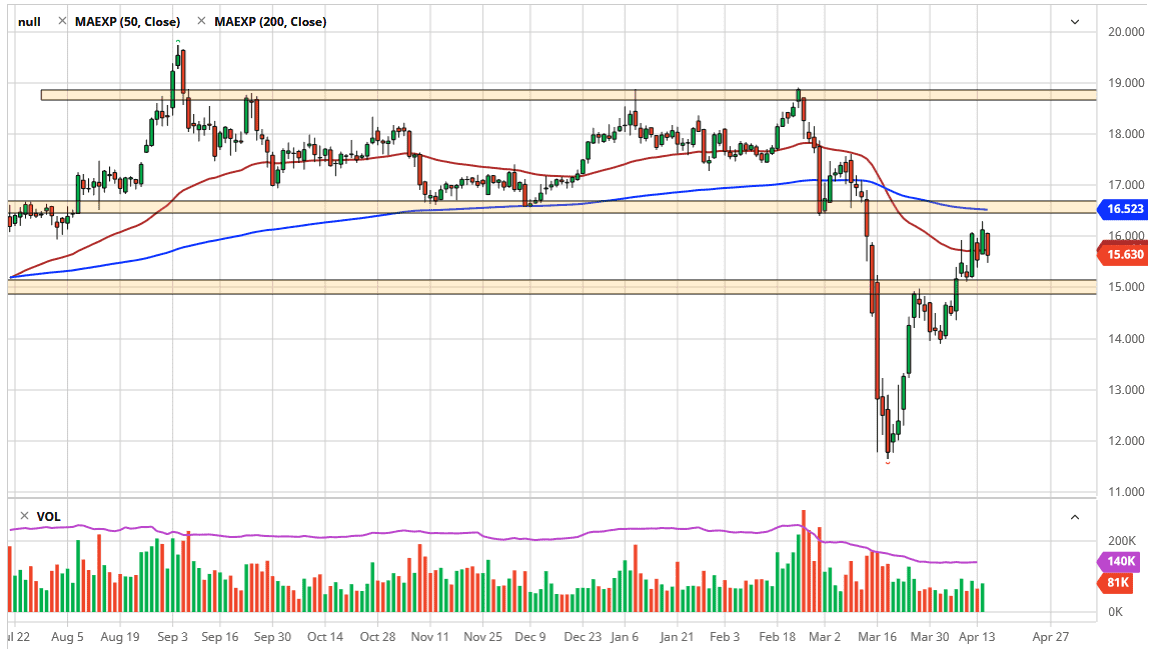

The silver markets pulled back a bit during the trading session on Wednesday, as the $16 level has offered so much in the way of resistance. This is an area that has been tested multiple times, but we have pulled back a bit occasionally. Ultimately, the $15 level underneath will offer support, and I think at this point it’s likely that the market continues to bang around in what I see as a $1.50 consolidation area. The $16.50 level above continues to be massive resistance, just as the $15.00 level underneath will offer support. I anticipate that silver will spend quite a bit of time in this area as we are asking a lot of questions of the market at the same time.

The silver markets are in fact a precious metal, so you need to pay attention to that aspect. Clearly, there is a lot of fear out there that could drive money into precious metals, and I think it makes sense that traders will continue to buy silver but will clearly prefer gold based upon historical performance. Remember, silver unfortunately is attached to industrial usage so there’s only a certain amount of demand for that part of the equation.

The 50 day EMA is causing a bit of interest as well, and the trading community started to buy silver to push it back above there. Ultimately, this is a market that is going to be an underperform are due to the fact that the industrial usage just won’t be there. That being said, I do like silver longer term due to Federal Reserve printing of currency, but I also am aware the fact that it will be hampered and an underperform are against gold. When my favorite trades lately has been to buy gold and sell silver in the futures market and collect the difference in momentum. You of course have to have similar size positions, and be able to float the margin, but you can do similar things in the CFD markets.

That being said, I am a buyer of silver in the sense that I have been buying physical silver for years, and I don’t see that as changing anytime soon. Of course, when you are buying physical silver, you’re not messing around with leverage so you can afford to hang around and wait for price to come back in your favor. There will more than likely be buyers of dips down towards the $15 level, but I don’t see any massive breakout coming.