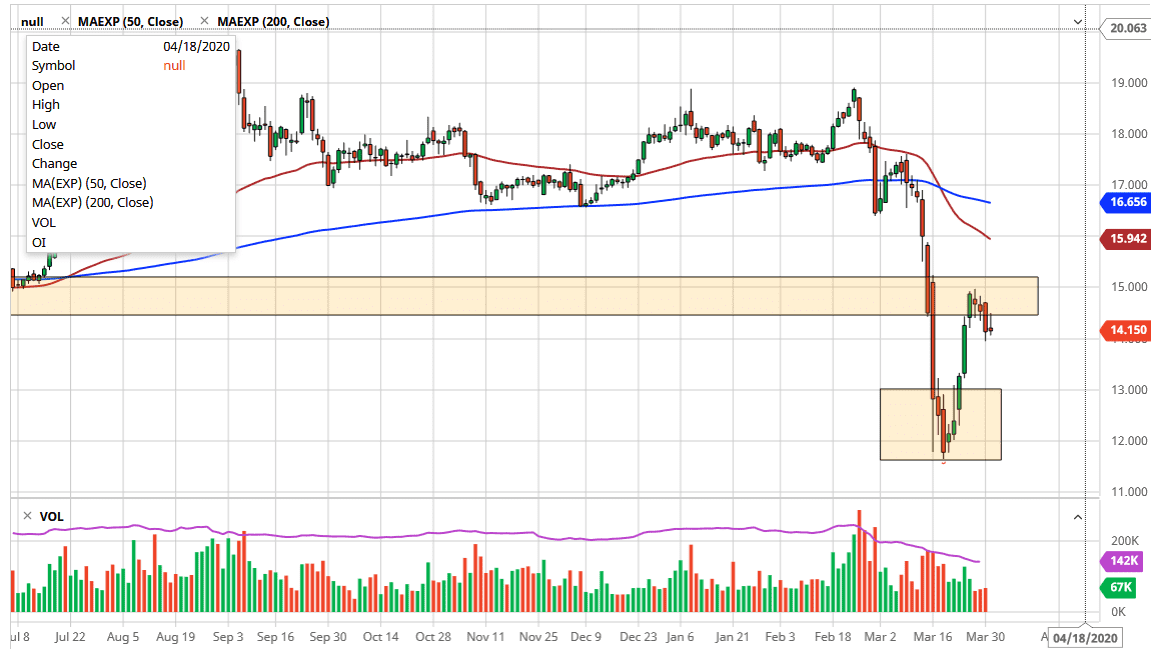

Silver markets initially rally during the trading session on Tuesday but gave of the gains to form a bit of an inverted hammer. The inverted hammer sits on the crucial $14.00 round figure, which of course will attract a lot of attention in and of itself. If we were to break down below the $14.00 number, then it’s likely that the market will probably drop towards the $13.00 level. At that point, I believe that the market will probably start to see buyers due to the fact that it was such significant resistance previously. After all, it would coincide with “market memory.”

Looking at the overall attitude of the markets, we have clearly seen a lack of momentum to break above the $15.00 level, so therefore it’s very likely that we would see a bit of a drop. That doesn’t necessarily mean that the market is going to break down drastically, just that it is running out of momentum. Rate of changes everything in the financial markets, and the rate is most definitely slowing down. As long as that is the case, the market will more than likely drift until enough interest in silver returns.

The biggest problem with silver at the moment isn’t necessarily whether or not it is going to be bullish longer term, but the fundamental driver. After all, the precious metals markets will continue to get a bit of a boost for safety and of course overall global concern. However, there is also the industrial component to silver which is absolutely decimated at this point. I just don’t see how that picks up anytime soon. It is because of this that I believe silver will continue to lag gold, even though the so-called “gold to silver ratio” is historically high. Between that and the massive shorts on the COMEX by J.P. Morgan, silver is going to continue to struggle in the futures market. For what it’s worth, the spot market and physical market has diverged completely from the futures market recently as demand for the physical bullion continues to spike. I do think that eventually silver will catch up and start rallying but a pullback in hands a “higher low” is probably necessary in order to end of the market offer real staying power. That being said, if we turn around a break above the $15.00 level, then the market goes looking towards the $16.00 level.