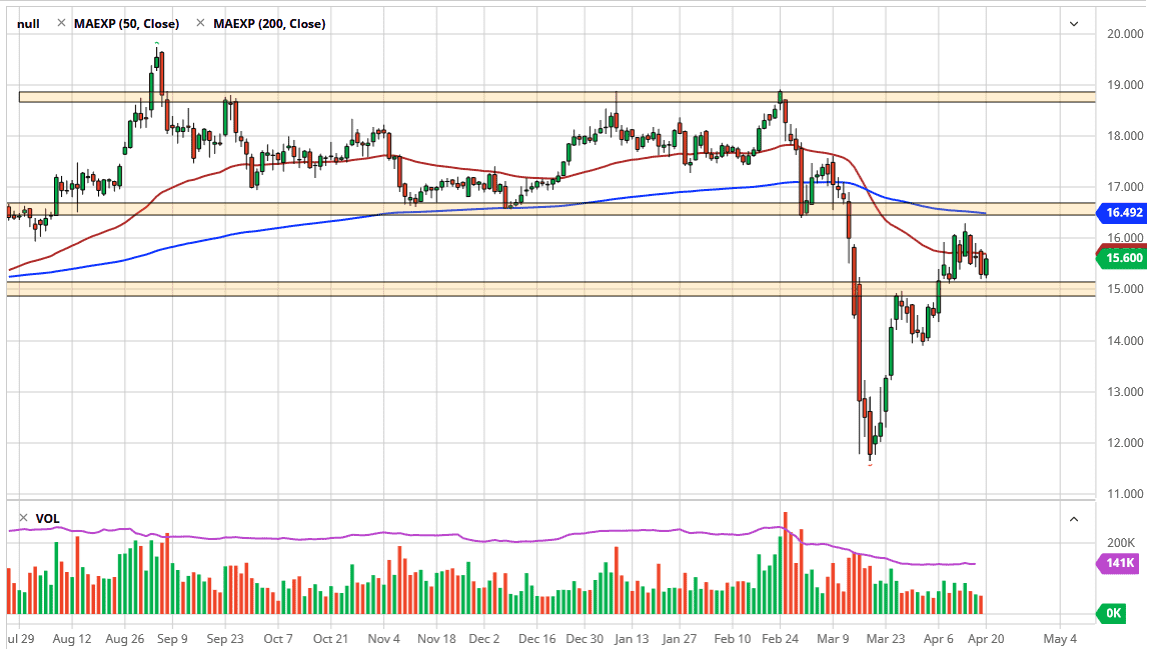

Silver markets have rallied a bit during the trading session on Monday, reaching towards the 50 day EMA as it continues to be a bit of a fulcrum for price. The 50 day EMA is flat so that tells you how flat the market is in this general vicinity. Ultimately, this is a market that will continue to be pushed and pulled by a couple of different things. After all, the market is a precious metal, and that has a bit of a “safe haven” type of market. Ultimately, this is a market that will get a bit of a boost due to the fact that central banks around the world continue to flood the world with fiat currency. However, the silver market also has the industrial component that is keeping it down.

There will be a lot of negativity attached to it due to the fact that industrial demand will be almost nothing. After all, the silver markets reflect the demand for silver in electronics and the like. Ultimately, this is part of the reason why silver will underperform gold in times like this, as although it does offer a bit of safety, the demand just isn’t there as far as being practical.

In this spirit, we will quite often see a bit of a “bread trade” between the gold and silver markets, meaning that people will buy gold and short silver. At that point, they will pocket the difference between the two contracts. At this point, silver seems to have a lot of support at the $15 level, extending all the way down to the $14.50 level, so I don’t think that you can be a seller of this market here, as the market, unless of course you are doing the “spread trade”, has shown such a massive amount of bullish pressure from the downside. I believe that the resistance above is closer to the $16.00 level, and most certainly at the $16.50 level above that. The 200 day EMA is at roughly $16.50, and that of course will offer a bit of noise as well. Ultimately, paying attention to this market you can see that we have seen a massive grind higher, but again, if you are looking to play the precious metals trade probably want to be doing it in the gold market instead of silver as gold is much more of a pure precious metals trade.