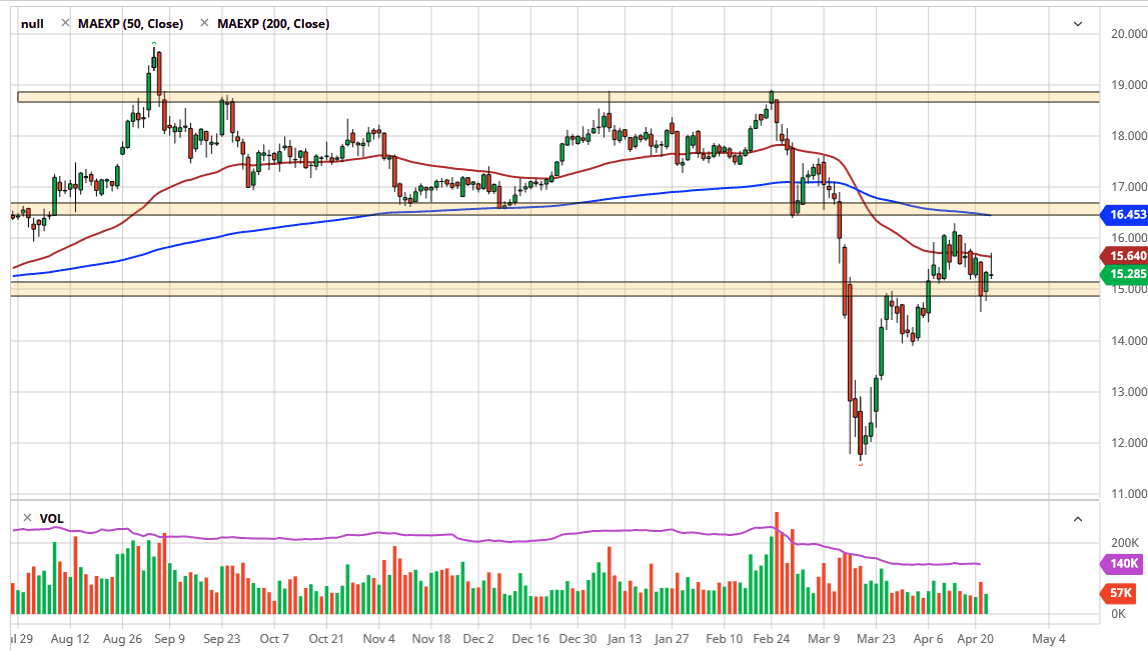

The silver markets initially tried to rally during the trading session on Thursday but gave back a lot of the gains as we reached the 50 day EMA. By forming the shooting star that we have, it is likely that the market is ready to pull back a bit. There are plenty of support levels underneath though that should offer buying opportunities but quite frankly I think that this is a market that is going to continue to struggle to find buyers underneath, due to the fact that the world is currently struggling with the idea of whether or not there is going to be any growth. Remember, silver does have a little bit of a precious metals aspect of it, but it also has a few other things that come into play that could cause a bit of an issue.

Silver also has a major industrial component to it that should continue to weigh upon it, so I think silver is simply going to underperform gold. Most precious metals traders that I now prefer to buy the yellow metal over silver, because it is a better and cleaner performer when it comes to the “anti-US dollar” player in the “safety trade.”

Regardless, I do like the idea of buying silver, but I would be a bit cautious about putting a huge amount of money into it in one shot. I do like buying physical silver more than anything else, as I do believe that eventually the inflationary problems will continue to push metals to the upside. That being said though, I believe that you are much better off going long the gold market. To the upside, I recognize that the 50 day EMA is offering a significant amount of technical resistance, and if we can break above there it is likely that the market goes looking towards the $16.00 level, and then perhaps towards the 200 day EMA at the $16.45 level. In general, I like the idea of buying short-term pullbacks of that we can take advantage of value, and I believe that there is plenty of support near the $15.00 level and then of course the $14.50 level. It is not until we break down below the $14 level that I would be a bit concerned about the overall attitude, and of course trend of the market. Silver is very choppy, so be cautious about your position sizing.