Silver markets did very little during the trading session here on Thursday, as the market continues to dance around the 50 day EMA. After all, the market has seen both sides of that EMA in five of the last six sessions. Because of this, it looks as if we are trying to decide the next direction for this market, which makes sense considering we are clearly in a scenario where people are trying to find some type of safety. Granted, the silver market does have the precious metals aspect to it, but it’s only part of the picture as the silver market also has the industrial metals component as far as demand is concerned.

As the global economy has come to a standstill, it’s a bit difficult to imagine a scenario where there is a lot of industrial demand for silver. The precious metals aspect isn’t quite strong enough to make silver take off like gold can. It is because of this that the markets will continue to diverge, and the so-called “gold to silver ratio” is something that remains useless. Yes, it did matter at one point but that was years ago and not now.

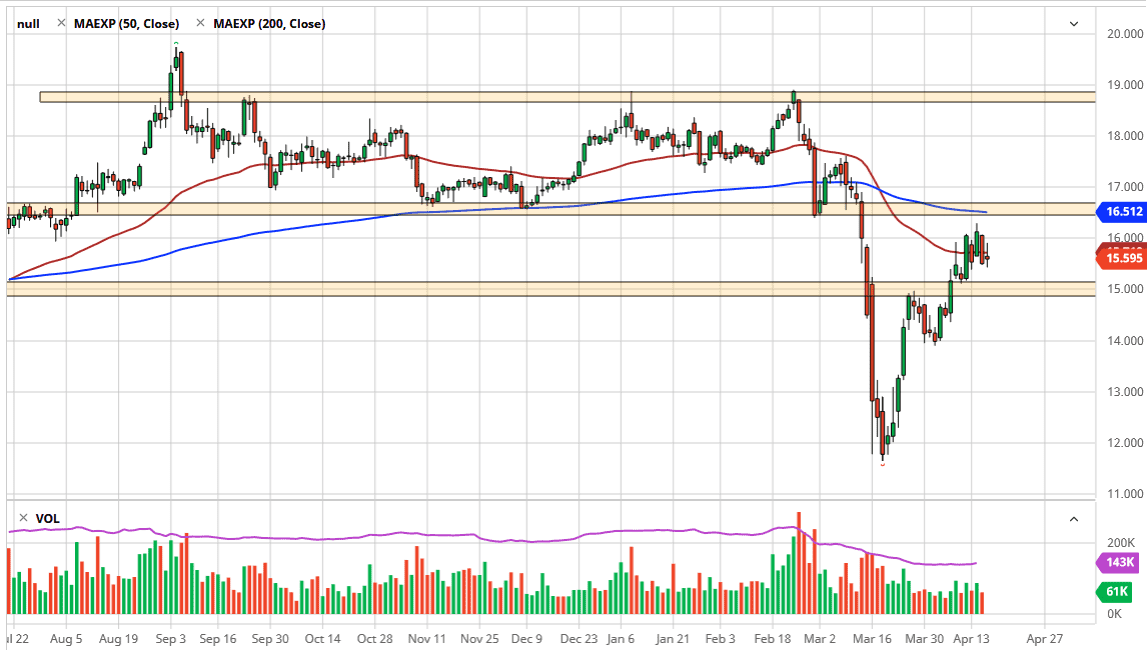

Looking at the chart, I believe that the $15.00 level underneath should be massive support, just as the $16.50 level should be significant resistance. The 200 day EMA is closer to the $16.50 level, and as a result I think that is a lot of downward pressure just waiting to happen as well. It is because of this that I think the upside of this consolidation is probably protected. On the other hand, if we pull back from here one of the main drivers of support near the $15 level is the fact that we had previously had a bullish flag form just below there. In other words, we are stuck between two major areas, and therefore I think it makes quite a bit of sense that the market simply go sideways, until we get the next set of big headlines. Ultimately, this is a market that I think does rise, but I think it underperforms gold going forward as the industrial part of the equation will continue to work against the market. Even if we did break down below the $15 level, I think there is even more support down at the $14 level due to the bullish flag that had previously formed in that region.