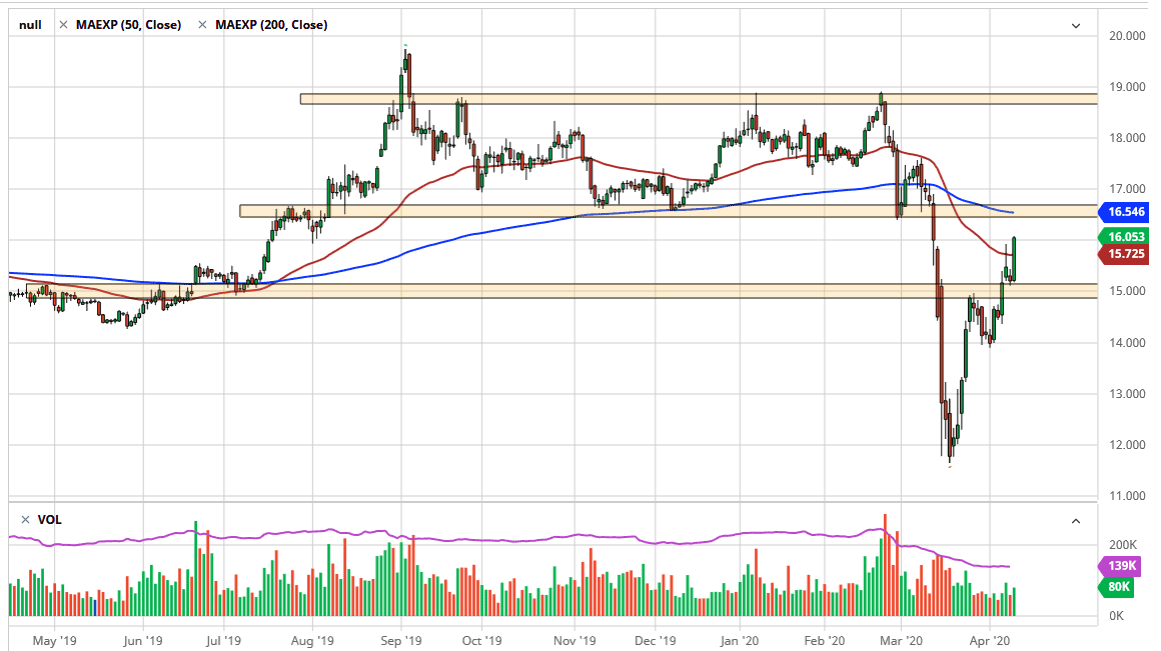

Silver markets were closed on Friday obviously, as it was the Good Friday holiday. However, the Thursday candlestick was very bullish, breaking above the top of the shooting star from a couple of days ago. By doing so, and closing above the $16 level, it shows silver continues to show a lot of bullish momentum.

That being said, silver is a little bit different than gold in the sense that it not only is a precious metal, but it is also an industrial one. Because of this, and all of the stimulus out there we could see a bit of a “double whammy” for silver if industry does in fact start to get back to work. I don’t know that’s going to be the case though, at least not until people stop shutting down societies. That being said though, the precious metal aspect of this market certainly has been focused on, as we are getting ready to reach towards the $16.50 level which is where we see the 200 day EMA.

A pullback from here could make some sense considering that the market close so high during the day on Thursday, but I think there’s plenty of support down at the $15.00 level to turn this thing around. If it does hold, then I think the market is simply going to be a “buy on the dips” type of opportunity. The fact that we closed above the shooting star from a couple of days ago shows that a certain amount of resistance have been broken, and therefore you should pay quite a bit of attention to this.

At this point, I don’t see any scenario where I am a seller until we get well below the $15 level, and perhaps even the $14 level. One thing is for sure, if we were to break down below the $14 level it could send this market down to the $12 level over the longer term. That being said, it’s difficult to imagine with central banks around the world throwing money at anything that moves that we don’t see precious metals rally, silver included. This doesn’t mean that silver will produce as well as gold as far as returns are concerned, but it certainly should go in the same general direction as both look very bullish and of course gold broke out to a fresh high as well, finally closing above that significant $1750 level.