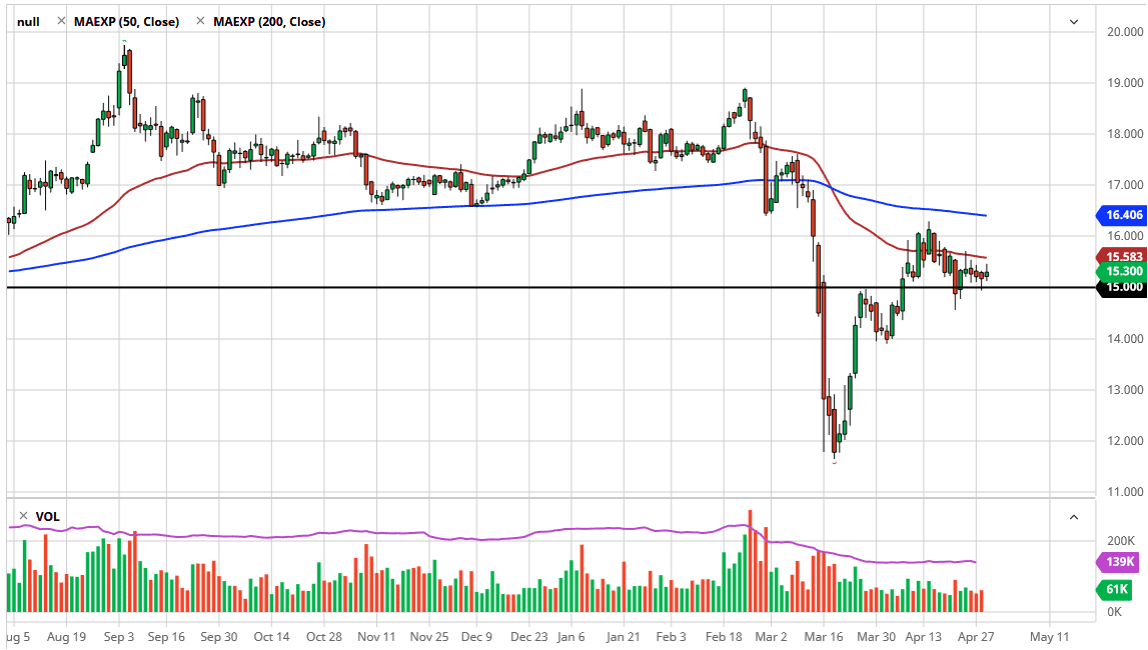

The silver markets initially pulled back during the trading session on Wednesday but found enough buyers to turn things around and reach towards the top of the previous candlesticks from the week. At this point, silver looks as if it is ready to reach towards the 50 day EMA, an area that has a certain amount of technical importance built into it. That being said, I believe that this is a market that will continue to see exhaustion in that general vicinity, as silver has the misfortune of being somewhat tied to industrial production, which is most certainly down.

However, the Federal Reserve has made it clear that they are going to pump up the economy for the rest of our lifetime, so this should continue to help the precious metals aspect of silver. In other words, I am bullish of this market, but I believe given enough time we will get the occasional pullback that you can use to add to a position. I do not have any interest in trying to short this market right now, because quite frankly it has far too much in the way of headaches ahead of it to simply jump in with your entire investment.

The $16.00 level above should be a massive psychologically important level, just as the 200 day EMA is starting to reach down towards that area. I think that given enough time we will probably break above there, but it may take several attempts to do so. The $14.50 level underneath should offer massive support, just as the $14.00 level should. I like the idea of buying dips and simply taken advantage of value as it occurs, but I do not do it in the futures market simply because it is so expensive. The volatility of course makes holding silver contracts exceedingly difficult, so keep that in mind. I like the idea of buying physical silver, but if you have the ability to trade CFD markets, you may find that to be a decent vehicle in order to trade this market. Because of this, you will have the ability to add slowly, just as somebody who is trading physical metal can do. With that being the case, it is likely that we will see more volatility than anything else, so make sure you can keep your stop losses relatively wide, as the markets are trading on pure emotion most days.