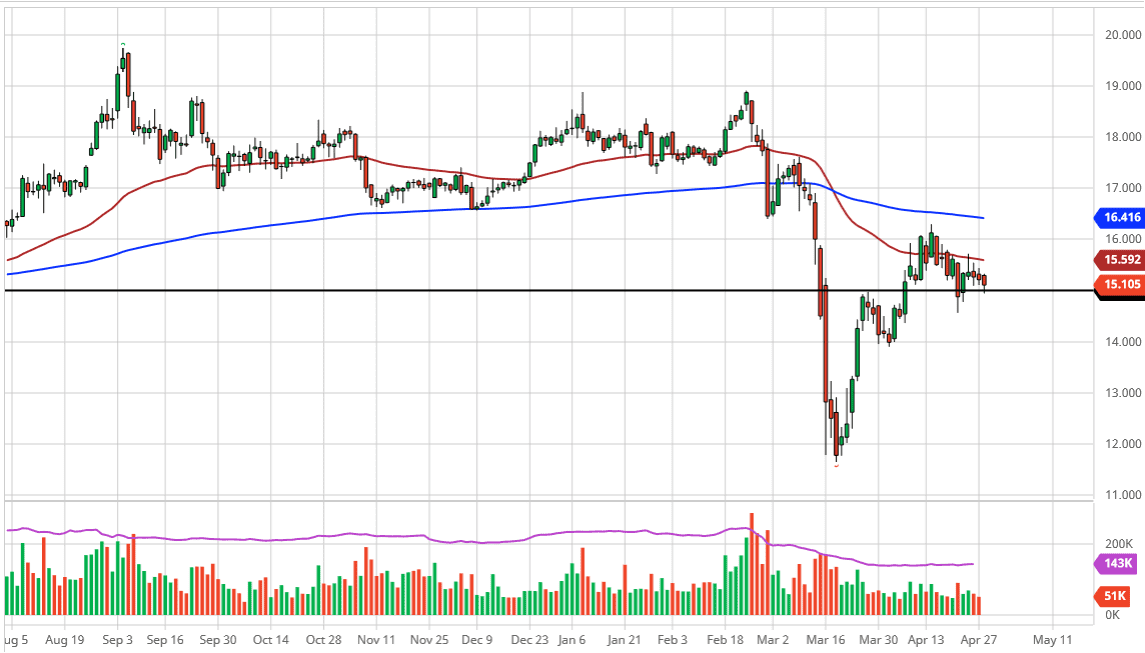

Silver markets have pulled back a bit during the trading session on Tuesday to reach towards the $15.00 level, an area that of course will attract a certain amount of attention as it is a large, round, psychologically significant figure. In fact, by the end of the day we did up forming a bit of a hammer and that of course is a bullish sign. With that being said, if we can break above the top of the hammer it is likely that we will try to reach towards the 50 day EMA which is closer to the $15.60 level.

The previous candlesticks showed a deceleration of momentum, and I think we are going to see more of the same as this market simply has nowhere to be in the short term. Given enough time, I think that if we can break above the 50 day EMA, it is possible that the market goes looking towards the $16.00 level next, perhaps followed by the 200 day EMA at the $16.40 handle.

All that being said, silver is a little bit different than gold, as although it is a precious metals market the reality is that it has a major industrial component to it, and therefore it is going to suffer due to the fact that the economy is at a standstill. Quite frankly, there is almost no demand for industry right now so of course that is weighing against the value of silver but given enough time the precious metals aspect should have an effect. Furthermore, eventually industrial demand will pick back up and that should drive silver higher as well.

With all those things in the back of my mind, I recognize that the $14.50 level underneath should be supported, just as the $15.60 level should be resistance. If we can break out of this range then the market is likely to continue going higher, and perhaps carrying on the recovery that it had seen from the absolute bottom. This is a very noisy market, but you could make an argument for some type of bullish flag pattern shape. Nonetheless, I am bullish so given enough time I anticipate that will go back towards the $19 level although it may take several months to get there so I would be cautious about over leveraging my position in silver and therefore recommend small positions if you have the ability to do so.