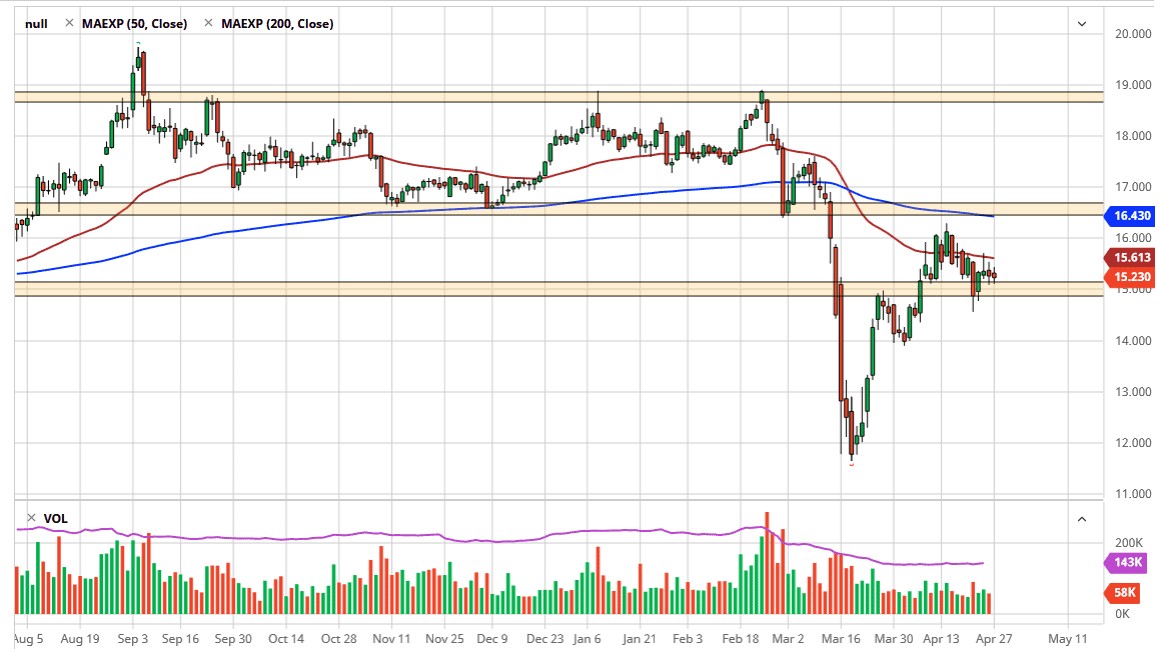

Silver markets have done extraordinarily little over the last several trading sessions, as the market dances around the $15.20 level. The most obvious support level is the $15.00 level, an area that of course is a large, round, psychologically significant figure. While precious metals have done reasonably well in comparison to other assets, silver play second fiddle to the gold market to say the least.

The reason for this is quite easy to figure out, as gold is simply a precious metal while silver also has an industrial use, thereby making it trade more like a base metal. With that in mind, it probably has more in common with copper than it does gold under the certain set of circumstances we find the world and right now. When you think about it, there is not going to be much in the way of demand for silver or other metals, as construction and in this case, production, is hitting a brick wall. There is little in the way of demand for electronics and the like, which is kryptonite for the silver market.

This is not to say that silver should be shorted. The only time that I sell silver is when I am doing a spread trade, which involves a buying gold in selling silver simultaneously in the same size positions. In that sense, you are simply collecting the difference between the two as gold has outperformed. It makes sense that gold would outperform silver due to the fact that central banks around the world continue to throw money around, and that debases currencies. The concern of course is hyperinflation down the road, which of course gold works against quite well. Silver will work as well, but it has to be negative annotations of industrial demand being lacking, so therefore I tend to buy silver with little to no leverage.

I have been buying silver in physical form for several years now, so therefore if it drops $0.25 it does not affect me very much. However, if you are using futures or some type of highly levered contract, a $0.25 move could be deadly. You can also trade the ETF market, to take advantage of the longer-term uptrend without overexposing yourself. If you are trading CFD markets, just keep your position size relatively small and look for buying opportunities closer to the $15 level, followed by the $14.50 level, and then finally the $14 level.