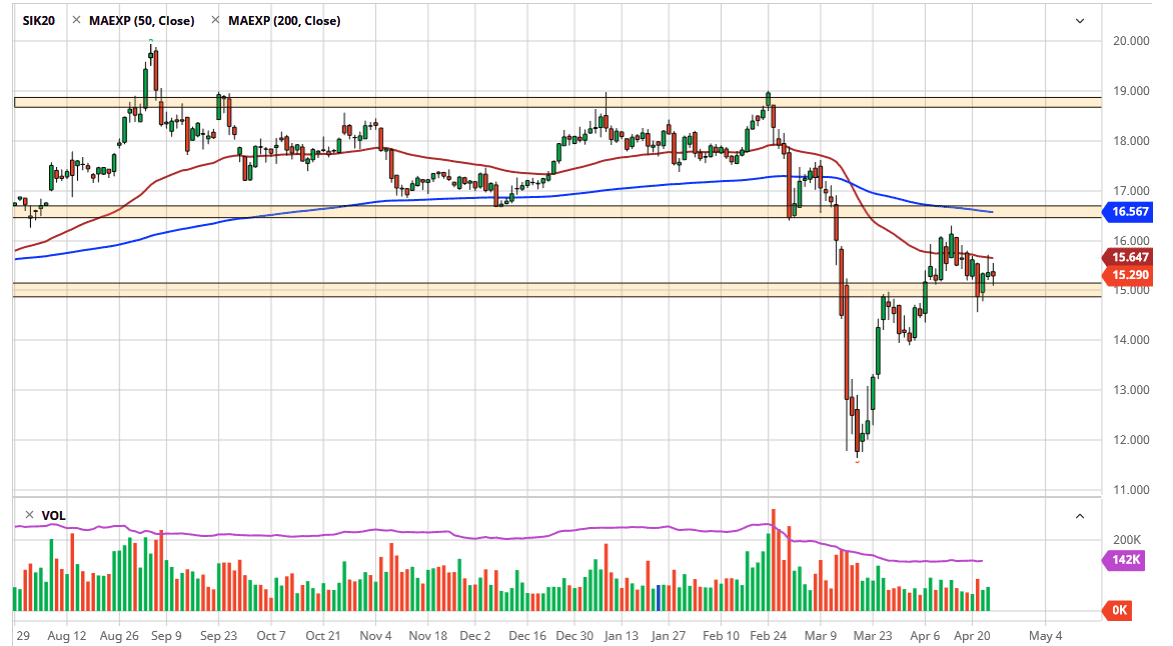

Silver markets went back and forth during the trading session on Thursday, as we continue to see a significant amount of volatility just above the $15.25 level. The $15.00 level underneath offers a lot of support as well, so therefore I think it is likely that we will see the silver market try to figure out where to go next. The $15.00 level is significant support, and I think that the market will probably continue to see that area attract a lot of attention, extending down to the $14.00 level.

The silver market will lack the gold market due to the fact that there is a serious lack of demand when it comes to industrial metals, and therefore it is probably best to go long of gold rather than silver, although I am the first person to admit that you should probably have some silver in your portfolio. I buy physical silver, mainly because I am in the United States and do not have the access to CFD markets that many of you do. Because of this, my only other alternative is the futures market which has an extreme amount of leverage.

That being said, I think that looking at a pullback as an opportunity to start buying is probably the best way to go going forward. I like the idea of trying to pick up silver “on the cheap”, and this potential pullback should in fact offer that scenario. At this point in time, if we were to break higher than we would probably clear the 50 day EMA which is a good sign but is going to run into some trouble at the $16.00 level and the 200 day EMA above there which is closer to the $16.50 level. At this point, I would anticipate more trouble. That being said, it is typical of silver to be very choppy overall, so it would not be a huge surprise to see that come to fruition. I believe that the next couple of days might be a bit soft with silver, but I do believe in the upward proclivity over the longer term. As an alternative, some people have been buying gold while shorting silver, collecting the spread difference between the two as one will outperform the other depending on the direction. You could make an argument for a bit of a bullish flag, but at this point I think it is a bit difficult to imagine that kicking off.