Gold remains the primary safe-haven asset, but silver allows traders to diversify portfolios and hedge Forex positions in a less crowded trade. The global Covid-19 pandemic is forcing the global economy, which entered the crisis on a contracting trajectory, into a recession. While the extent of the recession remains unknown, it is positioned to be more severe than currently priced into markets. It provides a distinct long-term bullish catalyst for precious metals like gold and silver. Price action converted its short-term resistance zone into support, from where a breakout is favored.

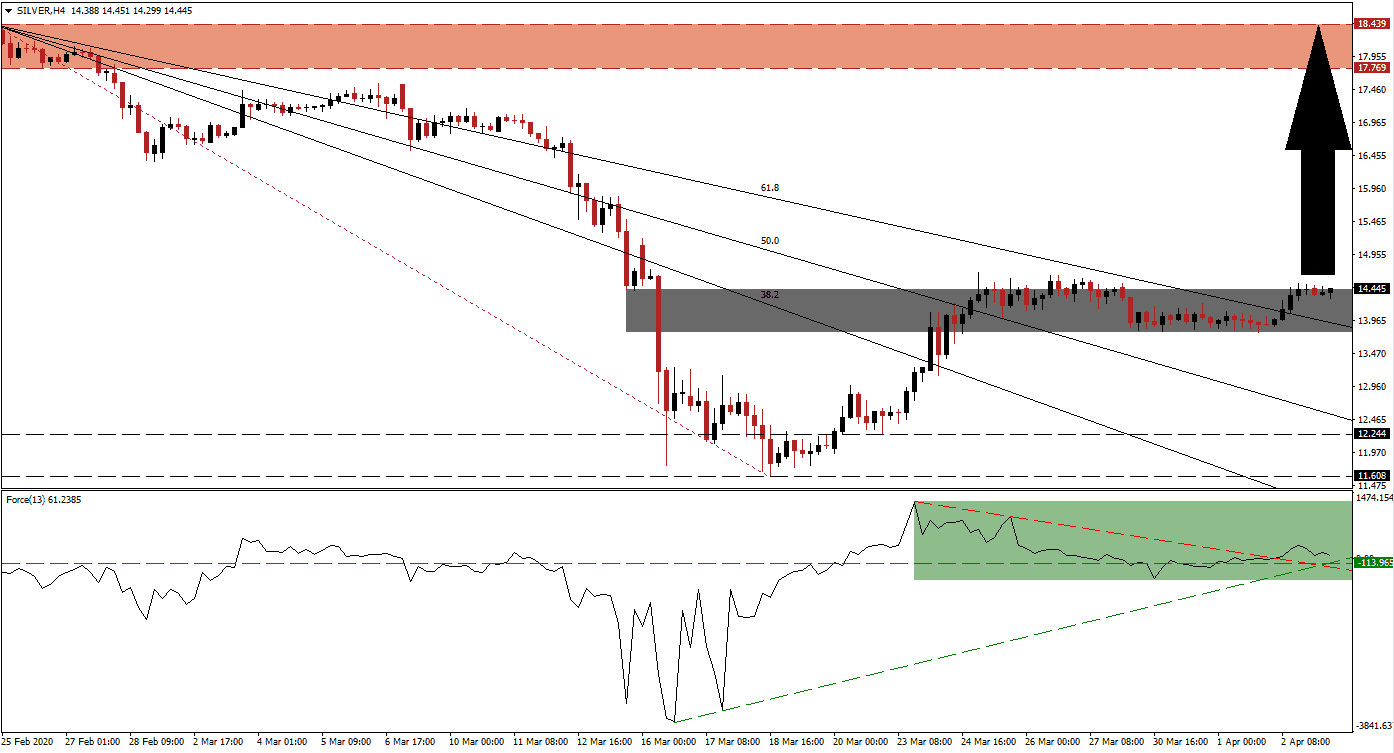

The Force Index, a next-generation technical indicator, confirms rising bullish momentum, enforced by its ascending support level. A brief contraction below its horizontal support level was quickly reversed and carried the Force Index above its descending resistance level, as marked by the green rectangle. This technical indicator remains above the 0 center-line, granting bulls continued control over silver. You can learn more about the Force Index here.

Today’s US NFP data is expected to provide the next catalysts for this precious metal, resulting in a breakout above its short-term support zone located between 13.789 and 14.437, as marked by the grey rectangle. An essential bullish boost was delivered after silver pushed through its descending 61.8 Fibonacci Retracement Fan Resistance Level, converting it into support. Price action may challenge this level before mounting a sustained, accelerated advance.

Due to the absence of a significant resistance level after a breakout above its short-term support zone, silver is anticipated to reach its next resistance zone located between 17.769 and 18.439, as identified by the red rectangle. The 2020 peak is positioned just above it at an intra-day high of 18.920. Confirmed Covid-19 cases surpassed the one million mark yesterday, doubling in less than one week. While serious infections number roughly 5%, the death toll of closed cases surpassed 20%. The economic fallout is likely to be more severe, positioning price action to challenge the 20.000 level this year.

Silver Technical Trading Set-Up - Breakout Scenario

Long Entry @ 14.400

Take Profit @ 18.400

Stop Loss @ 13.400

Upside Potential: 4,000 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 4.00

In the event of a collapse in the Force Index below its descending resistance level, currently acting as support, silver could be forced into a short-term reversal. The downside potential remains limited to its 50.0 Fibonacci Retracement Fan Support Level, located just above its support zone between 11.608 and 12.244. Any correction from existing levels will represent an outstanding buying opportunity on the back of a dominant bullish outlook.

Silver Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 13.100

Take Profit @ 12.400

Stop Loss @ 13.400

Downside Potential: 700 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 2.33