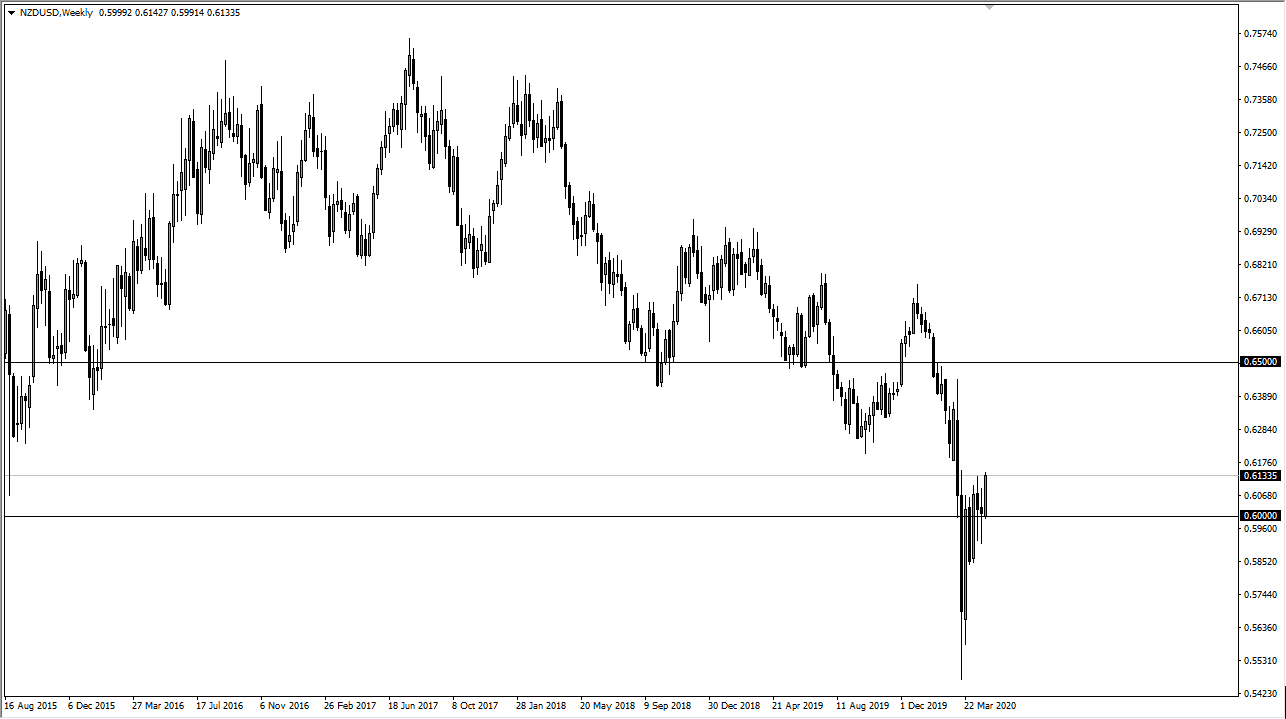

The New Zealand dollar has enjoyed a resurgence during the month of April, as we have seen a lot of “risk on” behavior in stock markets around the world as well as other assets. This is based upon the idea of perhaps the coronavirus slowing down and economies opening up, which of course has more people willing to take financial risks. If that is going to be the case, then it makes sense that the New Zealand dollar should take out to the upside. I do not like the idea of trying to get “all in” right away, but it certainly looks as if the New Zealand dollar is trying to make a statement near the 0.6150 level as we close out the month.

To the upside I anticipate that the 0.63 level will be a target, and most certainly the 0.65 level will if we get enough bullish pressure. I believe at this point it is obvious that the market is likely to continue to see a lot of volatility and you should keep in mind that the New Zealand dollar/US dollar currency pair is less liquid than the other majors, so it does tend to move a bit quicker. Because of this, it is worth noting that the market could be a leader or a follower, depending on a whole slew of factors. Nonetheless, one of the biggest factors in this currency pair is going to be what the Federal Reserve continues to do, and of course more importantly, how the US dollar is reacting to all of this increase liquidity.

That being said, pedaling to get a bit too negative, you could see the New Zealand dollar get crushed because it is particularly sensitive to Asia, a place where we are starting to see infections rise again. If we start to see economies do the same thing Singapore tested, and other words closing back down, this could have an adverse effect on the Kiwi dollar. Otherwise, if we do get a lot more “risk on” out there, then this might be one of the better currency pairs to be going long of. Expect fireworks, and although right now it looks like we probably have more upward mobility than downward, just about anything can happen in this pair over the next several weeks. I suggest letting the market tell you which direction it wants to go, and then building a position slowly throughout the month.