New Zealand’s Finance Minister Robertson warned the economic fallout from Covid-19 will by far surpass that of the 2008 global financial crisis. GDP and unemployment will significantly suffer, according to his remarks. The country has been in total lockdown, except for essential services, for almost one week out of the thirty days the government announced. With an unemployment rate of 4.0%, estimates for wage subsidies total NZ$12 billion, a figure that can substantially increase if the global pandemic extends deep into the second half of this year. The rejection in the NZD/SGD by its short-term resistance zone is expected to lead to more downside.

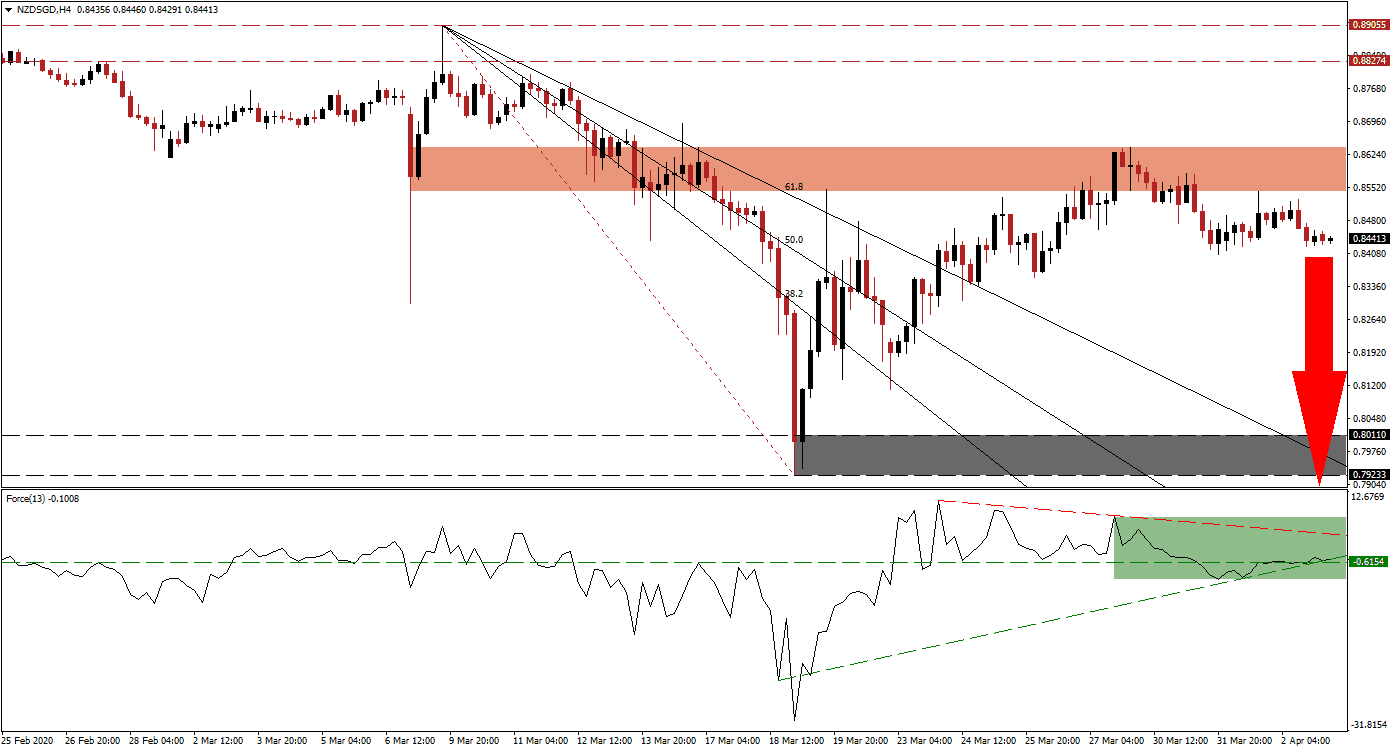

The Force Index, a next-generation technical indicator, points towards the gradual loss in bullish momentum through the formation of three lower highs that allowed for a descending resistance level to materialize. It is pressuring the Force Index to the downside, as marked by the green rectangle. A double breakdown is favored, below its horizontal support level and its ascending support level. Bears have taken control of the NZD/SGD with this technical indicator in negative territory.

Following the collapse in price action to levels last seen in March 2009, a massive reversal took it above its complete Fibonacci Retracement Fan sequence. The NZD/SGD was then rejected by its short-term resistance zone located between 0.85432 and 0.86394, as marked by the red rectangle. Forex traders are recommended to monitor the intra-day low of 0.84053, the low of the breakdown from the top range of this zone. A sustained contraction below this level is anticipated to initiate the next wave of net sell orders in this currency pair.

Singapore has been ahead of the curve in combating the virus. While a global recession is likely, the government will partially finance the unprecedented stimulus from national reserves and positioned its economy for a recovery expected to lead Asia. The NZD/SGD is on track to close the gap to its descending 61.8 Fibonacci Retracement Fan Support Level. It is crossing through its support zone located between 0.79233 and 0.80110, as identified by the grey rectangle. More downside cannot be ruled out.

NZD/SGD Technical Trading Set-Up - Rejection Extension Scenario

Short Entry @ 0.84400

Take Profit @ 0.79200

Stop Loss @ 0.85850

Downside Potential: 520 pips

Upside Risk: 145 pips

Risk/Reward Ratio: 3.59

In case the Force Index pushes through its descending resistance level, the NZD/SGD may attempt a breakout. Given the fundamental conditions for both economies, the outlook for this currency pair remains bearish. Forex traders are advised to consider any advance from current levels as an excellent short selling opportunity. Price action will face its next resistance zone between 0.88274 and 0.89055.

NZD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.86500

Take Profit @ 0.88250

Stop Loss @ 0.85850

Upside Potential: 175 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 2.69