New Zealand reported better-than-forecast March export data, while imports increased as well. Prime Minister Ardern eased restrictions, presently at alert level 3, allowing over 500,000 to return to work. Many companies decided to allow employees to work from home, while strict new safety measures and social distancing must be maintained. Economists call for a one-off direct cash payment from the government to consumers once the alert level is reduced to 2, hoping it will spark economic activity. Over NZ$20 billion have been spent on wage subsidies and other support measures. The next budget is expected to show more stimulus for consumers and businesses. With the lack of bullish momentum, the NZD/JPY is positioned to extend its breakdown sequence.

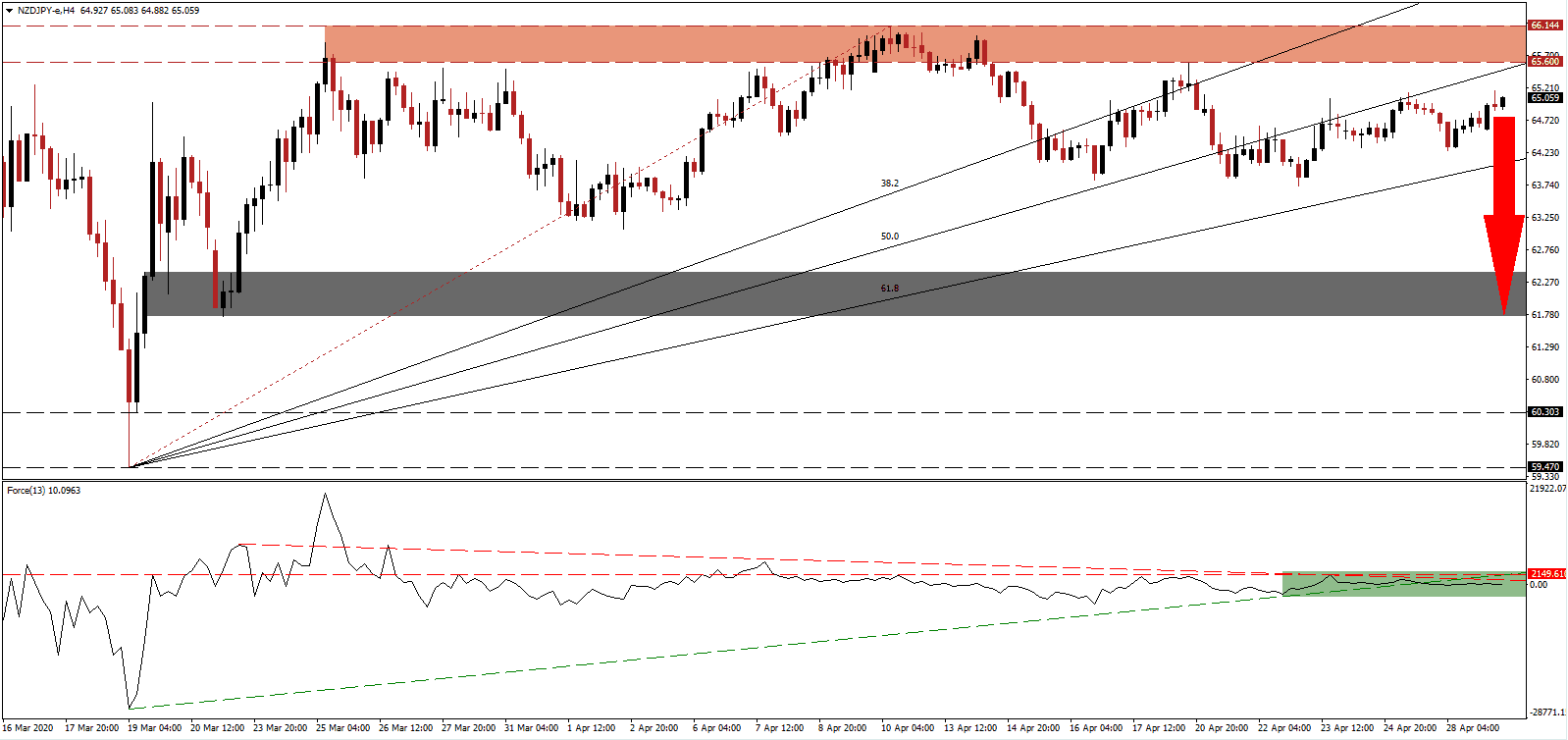

The Force Index, a next-generation technical indicator, is faced with a rise in bearish momentum after converting its ascending support level into resistance. It remains below its horizontal resistance level, as marked by the green rectangle, with additional downside pressure provided by its descending resistance level. This technical indicator is on the verge of crossing below the 0 center-line, from where bears will resume complete control of the NZD/JPY, initiating more selling in this currency pair.

Economists caution over the predicted substantial recovery in the third-quarter and note the size of the overall economy will be significantly smaller for several years. A debt-funded increase in consumer spending will merely provide a short-term injection while detribalizing the long-term outlook. After the NZD/JPY collapsed below its resistance zone located between 65.600 and 66.144, as identified by the red rectangle, bearish pressure expanded. They were confirmed following the second rejection in this currency pair.

Following the Covid-19 pandemic, the global economy will reshape in a slow and painful process. It is neither reflected in minds nor financial markets. The Japanese Yen is set to benefit from the pending modifications due to its safe-haven status. Forex traders are advised to monitor the ascending 61.8 Fibonacci Retracement Fan Support Level, as a breakdown below it is favored to attract the next wave of sell orders. It will additionally provide the required volume for the NZD/JPY to accelerate down into its short-term support zone located between 61.750 and 62.429, as marked by the grey rectangle.

NZD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 65.000

Take Profit @ 61.750

Stop Loss @ 66.000

Downside Potential: 325 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 3.25

A breakout in the Force Index above its ascending support level is anticipated to lead the NZD/JPY into a temporary breakout in this currency pair. New Zealand lacks a clear path forward unless it demonstrates a willingness to move away from past mistakes. Until details emerge, the risk remains to the downside, and Forex traders are recommended to consider any price spike as a selling opportunity. The next resistance zone is located between 68.055 and 68.619.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 66.600

Take Profit @ 68.100

Stop Loss @ 66.000

Upside Potential: 150 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.50