New Zealand remains in a nationwide lockdown, but discussions on how much longer the most extreme measures should be kept in place are intensifying. While the spread of Covid-19 has slowed, the costs to the economy are staggering. Plans are debated to allow partial economic activity to resume with strict measures in place to avoid long-lasting economic damages. The New Zealand Transport Authority places the societal value per life saved around NZ$5 million. The government currently spends over NZ$500 million per day on subsidies, a measure unable to remain in place for an extended period. After the NZD/JPY reached its short-term resistance zone, pressures for a profit-taking sell-off are increasing.

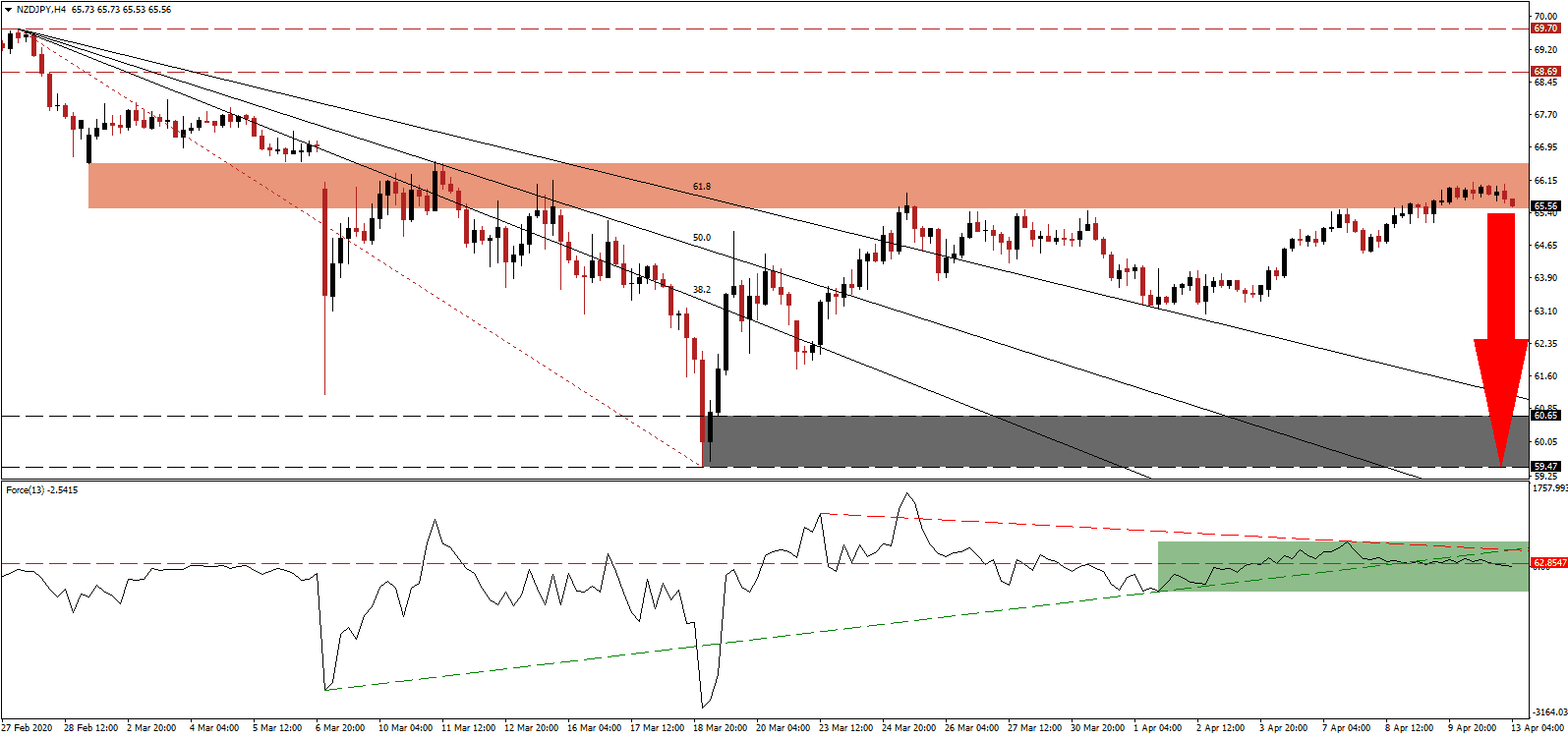

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum. Following a significantly lower high, it contracted below its ascending support level. It then converted its horizontal support level into resistance, as marked by the green rectangle. Additional downside pressure is exercised by its descending resistance level. This technical indicator also crossed below the 0 center-line, ceding control of the NZD/JPY to bears. You can learn more about the Force Index here.

With China reporting a rise in new cases, the majority imported from returning citizens, it appears that the global pandemic may be tougher to tackle than previously thought. The risk of resuming restricted activities prematurely to protect the economy remains elevated and may cause new cases to soar over the summer. New Zealand’s economy depends heavily on China, where the virus was initially reported, and prolonged economic hibernation is adding a bearish bias to the NZD/JPY. A breakdown below its short-term resistance zone located between 65.50 and 66.54, as marked by the red rectangle, is anticipated to materialize.

Forex traders are advised to monitor the intra-day low of 64.47, the base of the previous rejection of the NZD/JPY by its short-term resistance zone. A push below this level is expected to accelerate price action into its descending 61.8 Fibonacci Retracement Fan Support Level. It is approaching the top range of its support zone located between 59.47 and 60.65, as identified by the grey rectangle. The safe-haven status of the Japanese Yen is adding to bearish pressures on price action. You can learn more about a support zone here.

NZD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 65.55

Take Profit @ 60.00

Stop Loss @ 66.85

Downside Potential: 555 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 4.27

In case of a breakout in the Force Index above its descending resistance level, the NZD/JPY could be pressured into a temporary advance. Given existing fundamental conditions, the upside remains limited to its resistance zone located between 68.69 and 69.70. It will offer Forex traders a second opportunity to enter new net short-positions on the back of dominant bearish pressures on this currency pair.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 67.35

Take Profit @ 69.25

Stop Loss @ 66.50

Upside Potential: 190 pips

Downside Risk: 85 pips

Risk/Reward Ratio: 2.24