Despite criticism of the New Zealand government’s reliance on infrastructure projects to grow out of the Covid-19 global pandemic, the New Zealand Dollar continues to push higher. An understanding was established that capital resources to keep the country under full lockdown are limited. A sound plan for sustained recovery is urgently needed but remains absent. New Zealand is currently bleeding market share in what the government deems non-essential goods with a high risk of never regaining lost export markets. The NZD/CHF shows signs of upside exhaustion after reaching its short-term resistance zone.

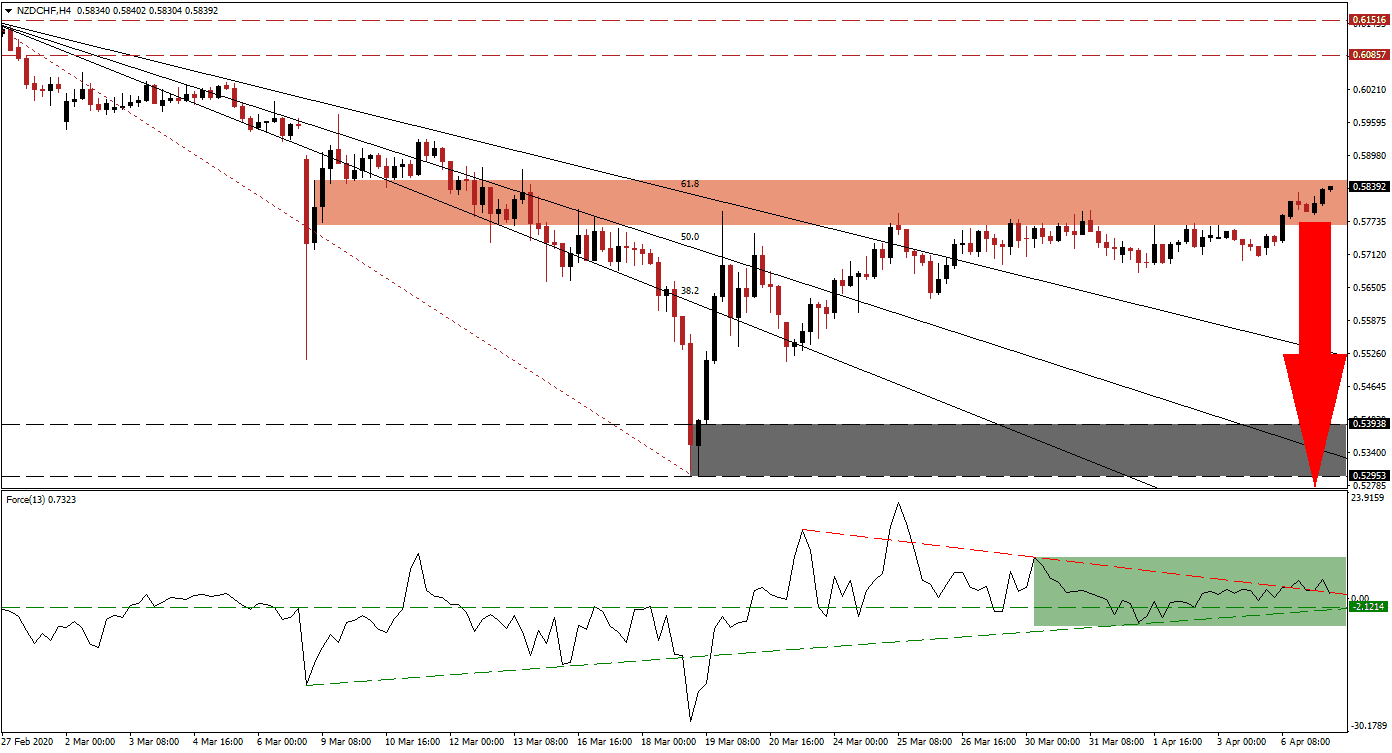

The Force Index, a next-generation technical indicator, points towards a gradual decrease in bullish momentum. A series of lower highs allowed for a descending resistance level to be formed, which applies breakdown pressures on the Force Index. Following a bounce off of its ascending support level, as marked by the green rectangle, more downside is favored to materialize. This technical indicator is positioned to collapse below its horizontal support level into negative territory, ceding control of the NZD/CHF to bears. You can learn more about the Force Index here.

Underneath the surface of the New Zealand government’s response to the virus, significant oversights and mistakes are apparent. Plans to scrub the planting of one billion trees to support its vital forestry sector and limitations of non-essential components of the supply-chain will hinder the long-term recovery potential of the economy. The NZD/CHF is expected to face breakdown pressures inside of its short-term resistance zone located between 0.57662 and 0.58506, as marked by the red rectangle.

A breakdown is favored to initiate a profit-taking sell-off, which will close the gap between this currency pair and its descending 61.8 Fibonacci Retracement Fan Support Level. Switzerland is leading the approach to support small and medium-sized businesses, the backbone of each developed economy. It ensures an economic recovery will equally lead most countries. The Fibonacci Retracement Fan sequence may guide the NZD/CHF into its support zone located between 0.52953 and 0.53938, as identified by the grey rectangle. More downside cannot be ruled out with 38.2 Fibonacci Retracement Fan Support Level already below this zone.

NZD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.58350

Take Profit @ 0.53000

Stop Loss @ 0.59350

Downside Potential: 535 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 5.35

An acceleration in the Force Index to the upside, assisted by its ascending support level, is likely to spark a breakout attempt. Given the dominant fundamental conditions, the upside remains limited to its next resistance zone. Price action will challenge this zone between 0.60857 and 0.61516. Forex traders are advised to consider this an excellent short-selling opportunity.

NZD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.59800

Take Profit @ 0.61500

Stop Loss @ 0.59000

Upside Potential: 170 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 2.13