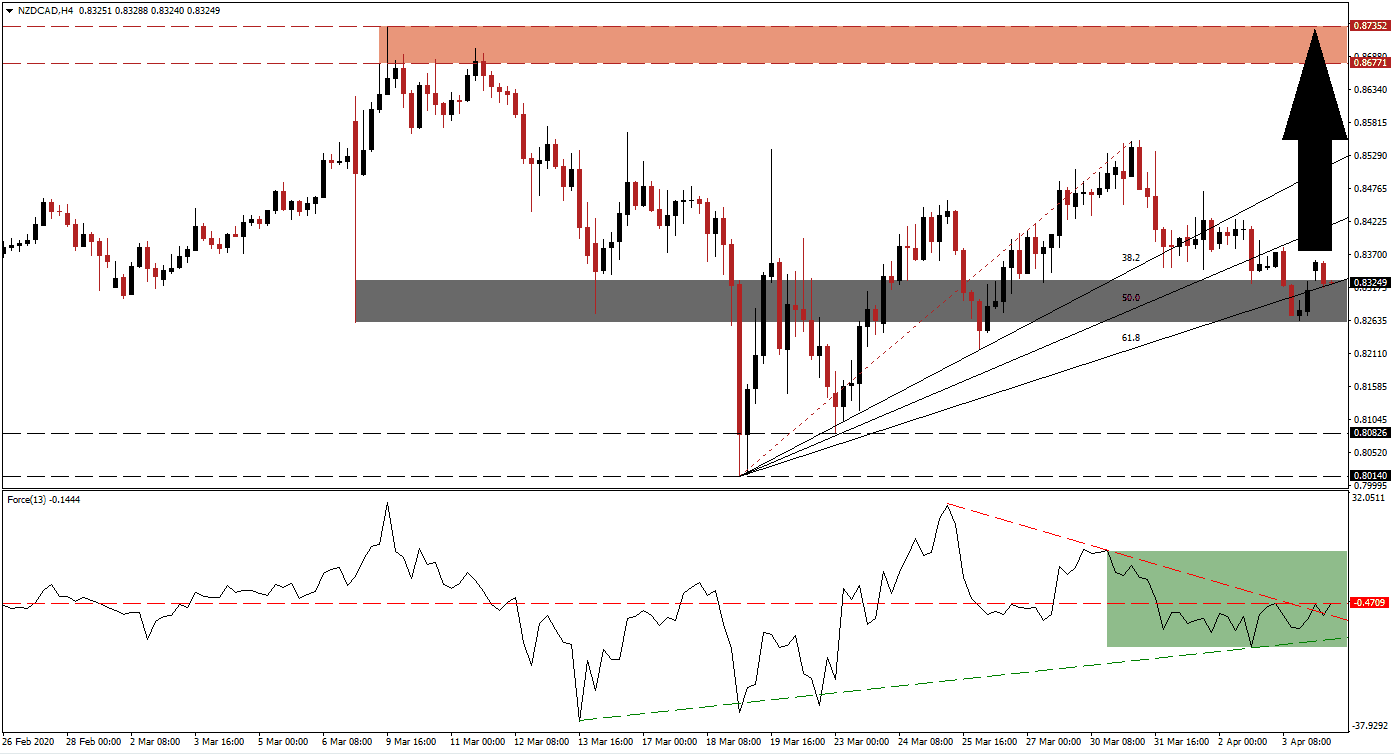

New Zealand is likely to suffer long-term damages related to industry destruction from the Covid-19 pandemic. Similar to Australia, the country is expected to refocus on its domestic economy and change existing supply chains. According to Deputy Prime Minister Peters, the nation can emerge more powerful and wealthier than before if precise measures are exerted. Economists warn of a limited recovery following the lockdown due to imposed restrictions. The NZD/CAD retreated from its post-breakout peak and confirmed the conversion of its short-term resistance zone into support. Price action is well-positioned to resume its rally from current levels.

The Force Index, a next-generation technical indicator, confirms the presence of expanding bullish momentum, evident by a series of four higher lows and the formation of an ascending support level. The Force Index eclipsed its descending resistance level, as marked by the green rectangle. It is now challenging its horizontal resistance level from where a breakout is favored. This technical will cede control of the NZD/CAD to bulls with a crossover above the 0 center-line, providing a technical catalyst.

Canada joins the list of countries where a structural shift in the composition and reliance of the economy is considered. Proposed plans include less dependence on the oil and gas sector, with a push into alternative energy sources. Supply chains will be recalibrated after the global pandemic highlighted fundamental weaknesses. Existing conditions indicate steeper disruptions for the Canadian economy as compared to New Zealand, granting a fundamentally bullish bias to the NZD/CAD. Price action is likely to utilize its short-term support zone located between 0.82601 and 0.83275, as marked by the grey rectangle, as a platform to launch a breakout and accelerate farther to the upside.

Providing an additional boost to upside pressure was the breakout in this currency pair above its ascending 61.8 Fibonacci Retracement Fan Resistance Level. One essential level to monitor is the intra-day high of 0.85509, the peak of the existing breakout sequence, and end-point to the re-drawn Fibonacci Retracement Fan sequence. A move above this level will catapult the NZD/CAD into its next resistance zone located between 0.86771 and 0.87352, as identified by the red rectangle.

NZD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.83250

Take Profit @ 0.87250

Stop Loss @ 0.82000

Upside Potential: 400 pips

Downside Risk: 125 pips

Risk/Reward Ratio: 3.20

A breakdown in the Force Index below its ascending support level is likely to force the NZD/CAD into a temporary sell-off. Forex traders are advised to consider any correction from current levels as an excellent buying opportunity. Given the dominant fundamental conditions, combined with developing technical aspects, the downside is limited to its support zone located between 0.80140 and 0.80826.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.81500

Take Profit @ 0.80800

Stop Loss @ 0.81800

Downside Potential: 70 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.33