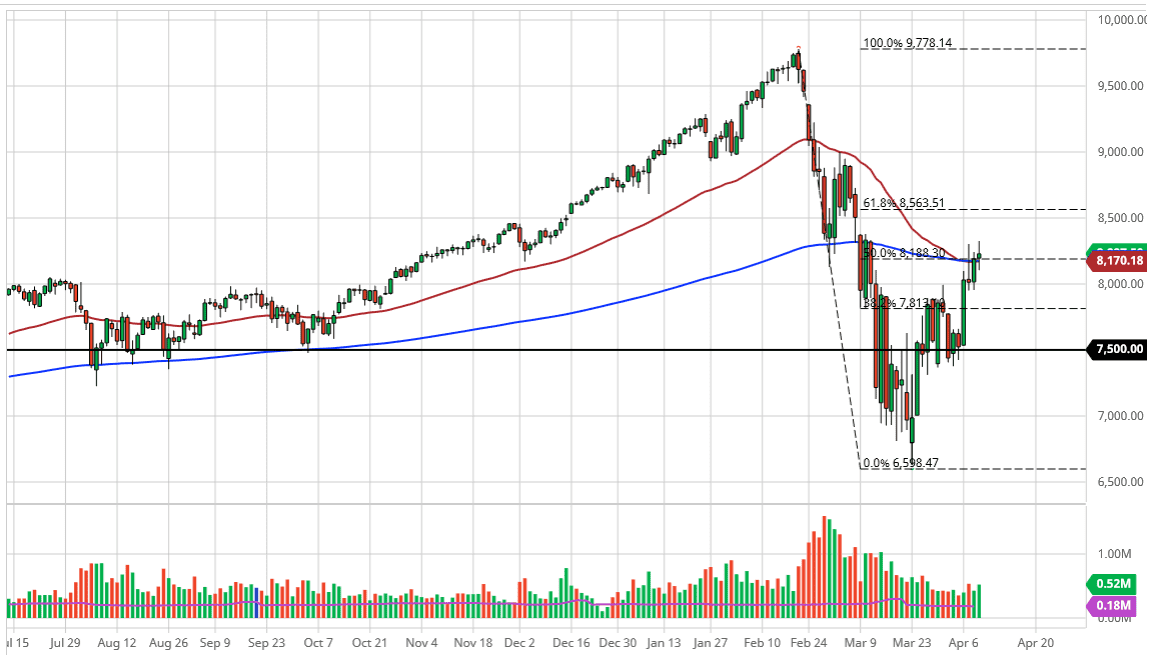

The NASDAQ 100 on Thursday went back and forth to form a neutral candlestick and of course was closed on Good Friday. That being said, it looks to me like the market is trying to figure out what to do now, because although we are at basically the most recent highs, we are sitting at the 50 day and the 200 day EMA as it is flat. We are also at the 50% Fibonacci retracement level, and that of course could attract a lot of attention as well. Above the top of the candlestick there is also a gap that has yet to be filled so that brings a new twist into the situation also.

The NASDAQ 100 has benefited from a lot of different moving pieces, not the least of which will have been a slowing down of coronavirus deaths. However, the Federal Reserve throwing $2 trillion worth of liquidity into the market in the form of loans and buying junk bonds has changed a lot of the dynamics. The initial reaction of course was to go higher in all of the stock markets, but one has to wonder the way this market close whether or not people aren’t thinking “What does the Federal Reserve know that I don’t?” Clearly, it’s a good sign that they are going to take a major credit crunch off the table, but there is still a lot of concern out there when it comes to the longer-term damage to the global economy. I think the open is going to be very interesting on Monday, so therefore I look at the candlestick on Friday as a bit of a binary signal.

If we can break above the top of the candlestick, then I think we go higher to try to fill the top of the gap closer to the 8500 level. However, if we break down below the bottom of the candlestick, we could go down to the 8000 handle in the short term. At this point, it’s difficult to determine what the weekend brings, but obviously the headlines will continue to push this market back and forth, so we have a couple of levels worth paying attention to place our trade. I keep my position a bit small though, mainly because the leverage can cause a lot of problems in what has been a very emotional marketplace as of late.