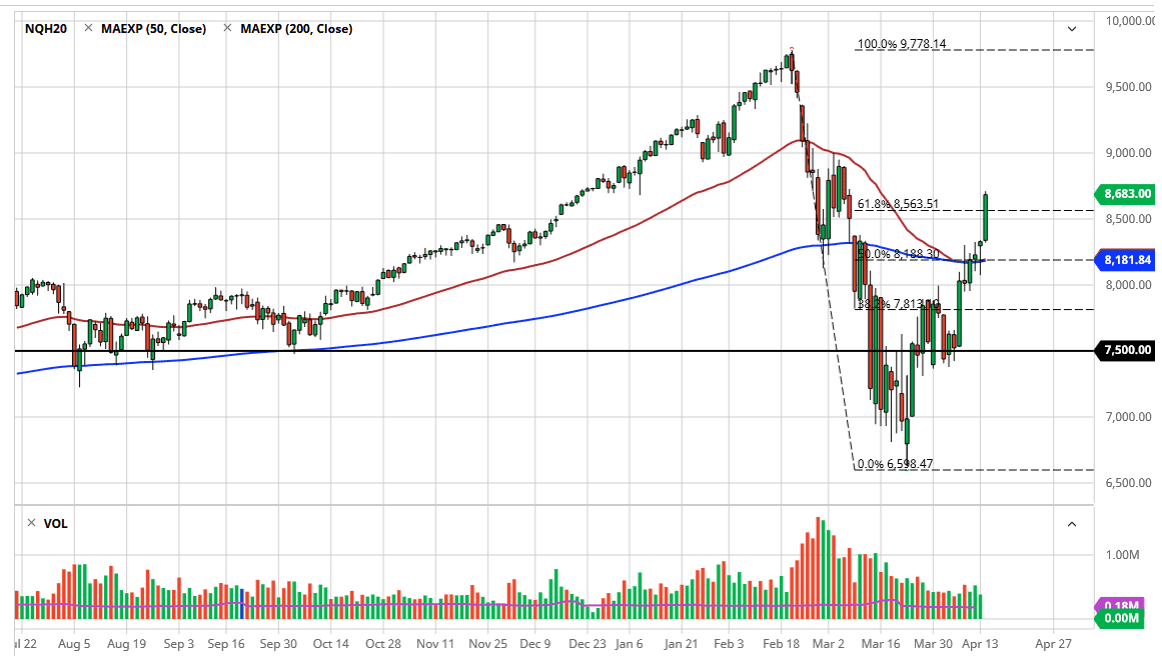

The NASDAQ 100 has exploded to the upside during the trading session on Tuesday, breaking above the handful of technical indicators that I had been paying attention to. For starters, we got above the crucial 8500 Price, which is a large, round, psychologically significant figure. Even more importantly was the fact that 8500 was the top of a gap where the market had shown so much in the way of negativity. Now that the gap has been blown through like it wasn’t even there suggests that this market is going to continue to go much higher. Ultimately, this market looks as if it is going to go racing towards the $9000 level which is the next major resistance barrier.

Even more impressive is the fact that we ripped through the 61.8% Fibonacci retracement level like it wasn’t even there, so at this point it looks like the NASDAQ 100 is simply going to continue to rocket higher. Pullbacks at this point will more than likely be looked at as value, as a lot of the major firms on Wall Street have already suggested that the bottom of the stock market was in. At this point, it very well could be true, but a pullback certainly needs to happen sooner or later. That being said, this is a completely electronic marketplace and therefore has been the domain of high-frequency trading for ages. This is what the machine can do, push the markets around drastically.

The Federal Reserve is going to be buying everything you can, so at this point I think we are getting a little bit of “irrational exuberance”, to quote Alan Greenspan from 30 years ago. Ultimately, a lot of hope has been put into the idea of coronavirus numbers coming down, so at this point it’s likely that we will eventually get some type of solution, and therefore everything is going to be back to normal, at least that’s the theory. Having said that though, there is an underlying concern about the massive damage that has been done to the economy. Furthermore, one has to think about how different people are going to behave, which clearly won’t be the same as it was before the coronavirus pandemic. We have a long road ahead of us, but you can’t argue with the stock market. You simply are profitable, or you are not. Whether or not you are right is completely irrelevant.