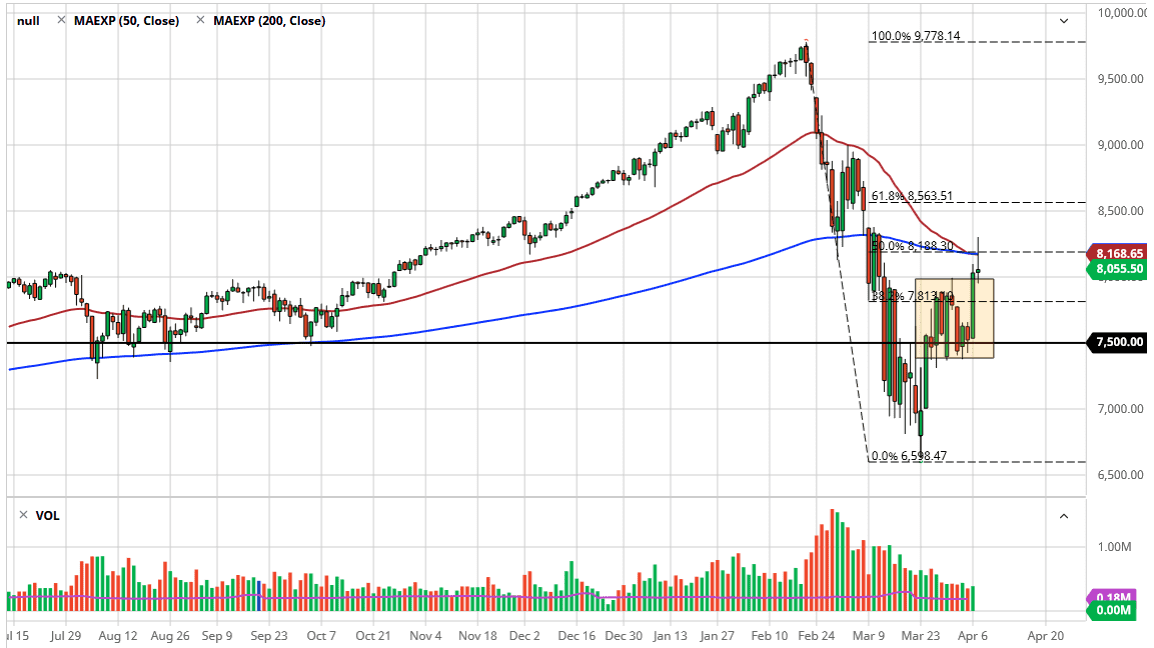

The NASDAQ 100 to force itself to the upside during the trading session on Tuesday but as you can see, we rolled right back over to form a shooting star. In fact, the lackluster close was very poor indeed, and I think at this point it’s likely that we do get a bit of a pullback. This isn’t necessarily to say that we are going to see a massive meltdown, just that the market may not be ready to break out to the upside quite yet.

The 200 day EMA offered enough resistance to turn things around and push this market lower, just as the 50 day EMA did. In fact, the so-called “death cross” is forming so longer-term traders will look at that as an opportunity to start selling again. I don’t necessarily buy into this indicator because by extension it’s very late, but I also recognize that some traders do. With that, if we break down below the bottom of the candlestick for the trading session on Tuesday, extensively the 8000 handle, then I believe that this market probably starts to pull back, maybe as much as 500 points. I do expect the 7500 level to offer a significant amount of support, extending down to the 7400 level.

If we do break down below there, then it’s likely that we go crashing towards the 7000 handle, perhaps even lower than that. Ultimately, I do think that this is a market that may have gotten a bit ahead of itself over the last couple of weeks, because quite frankly the economic situation isn’t as good as the markets are trying to price and at the moment. Granted, we have had a massive move lower, and a bounce of course would have been expected, but at the end of the day I do think that the markets are going to struggle to hang on to the gains. It’s likely that we only need some type of extraordinarily negative headline to come out that could get sellers involved. Keep in mind that the futures market also is driven by panic selling in Asia and Europe, so this may happen before the Americans even get back to work. Alternately, if we were to break above the top of the shooting star, then it allows the market to go looking towards the gap above, perhaps reaching towards the 8500 level. While I do think that happens eventually, I believe that a pullback makes quite a bit of sense.