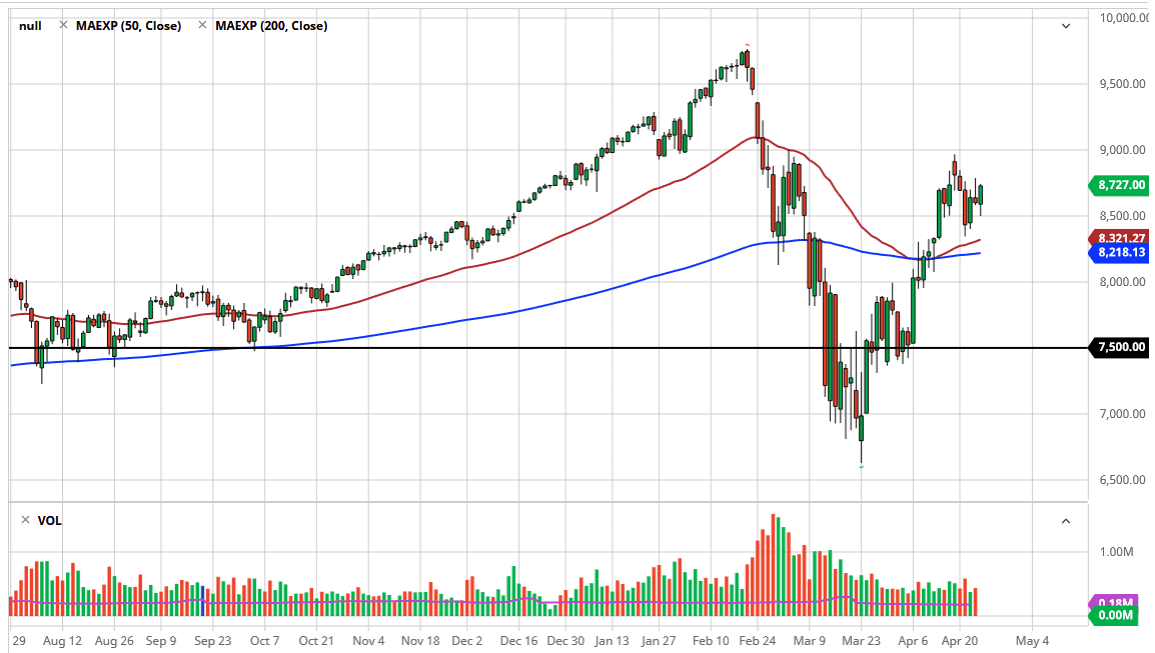

The NASDAQ 100 has initially fallen during the trading session on Friday, but as everybody left with the exception of the Americans, the market shot higher as the Plunge Protection Team is in full effect heading into the weekend. That being said, it certainly looks as if the market is trying to find some type of base at the 8500 level, but there are a massive amount of headlines for continued bullish pressure without some type of serious consolidation. After all, the market had rallied rather drastically, and now the question is whether or not we can maintain this type of momentum. My suspicion is that we will struggle, mainly because the volume has been anemic to say the least.

The 9000 level above is massive resistance and if we broke above there then I would think at that point we are more than likely going to go to the all-time highs again. This has been a ridiculous rally all things considered, but the one thing you cannot argue with is price. It is been an interesting dichotomy watching the news media, because the markets are much different than they once were. In other words, a lot of people argue that the market can go up like this for exceptionally long because it divorces itself from economic reality. The true reality is that markets have absolutely nothing to do with the economy. Sometimes, you will hear people suggesting that “markets are looking out 6 to 9 months”, but that is an impossibility considering that there is no clarity for what the future is. Beyond that, it is nonsense because there is no way that high-frequency traders are looking out to the fall. They are looking at little pockets of liquidity and bouncing this market back and forth. Most algorithms are probably geared towards the upside because quite frankly we have been in an uptrend for over 10 years. I anticipate that a lot of the trading on Friday was all about algorithms going back and forth, and then it means that the buyers would win the day, especially as Europeans went home. I still see a significant amount of resistance above, so I anticipate that fading the rally probably works for short-term traders. As far as a longer-term move is concerned, we need to get past either the 9000 handle above, or the 8400 handle below to have something sustainable in either direction.