Bitcoin usually leads the cryptocurrency market in either direction. Litecoin is known to lead trend reversals mimicked by other digital assets. The crash due to institutional selling laid bare one fundamental issue with the sector, mining. Profitability for miners was eroded with the collapse in prices, forcing many to shut operations. It resulted in a massive drop in the hashrate, contracting from its 2019 peak of above 500 Th/s to below 130 Th/s over the past few days. Bitcoin experienced a similar collapse. The Litecoin algorithm features a mechanism to increase mining profitability by raising the difficulty. It grants a fundamental catalyst to the LTC/USD, anticipated to accelerate into its short-term resistance zone.

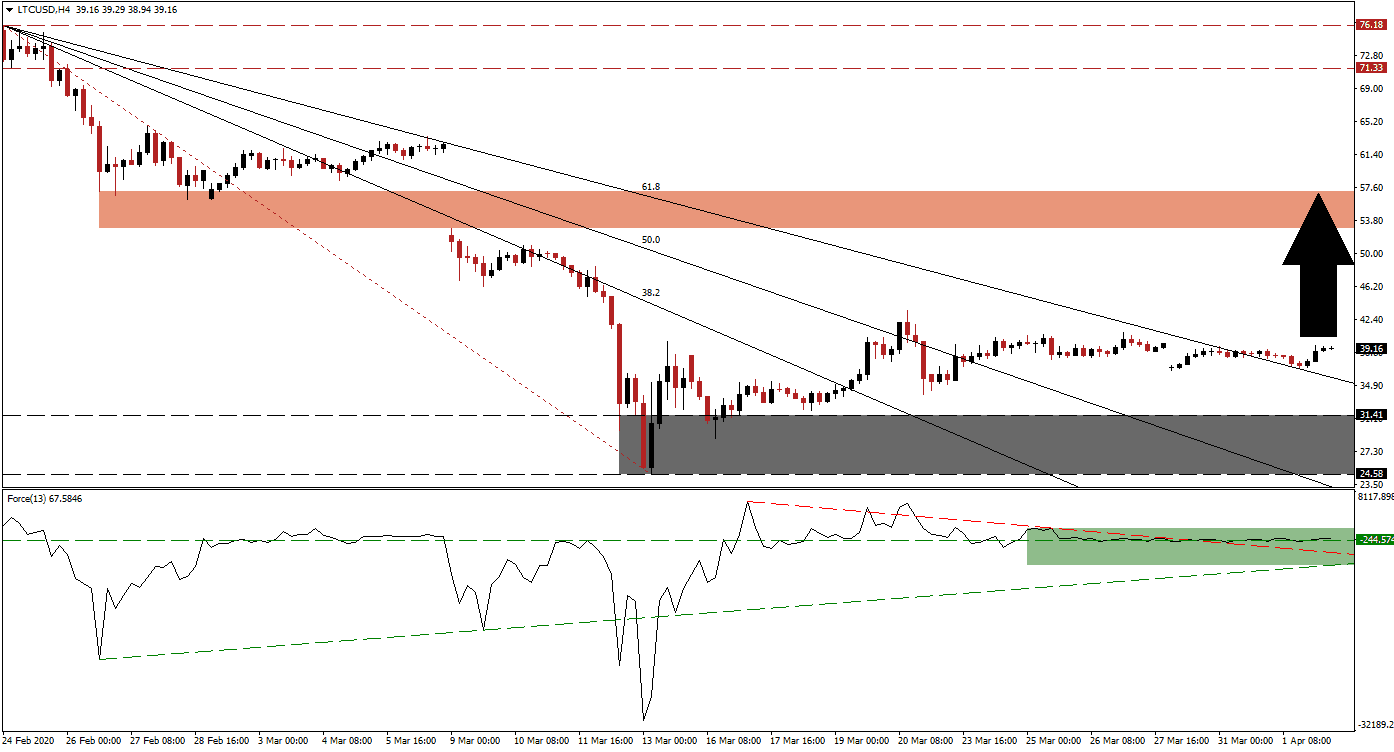

The Force Index, a next-generation technical indicator, recovered from a new 2020 low during the peak of the sell-off. It spiked to a multi-week high before gradually retreating, while maintaining its position above the horizontal support level. Adding to bullish pressures is the move in the Force Index above its descending resistance level, as marked by the green rectangle. The ascending support level is additionally increasing upside pressures, and bulls are in control of the LTC/USD with this technical indicator above the 0 center-line. You can learn more about the Force Index here.

Following the breakout in this cryptocurrency pair above its support zone located between 24.58 and 31.41, as marked by the grey rectangle, the LTC/USD pushed through its complete Fibonacci Retracement Fan sequence. The entire sector remains under bearish pressures, as more forced selling by institutional clients to meet margin calls cannot be ruled out. Mining profitability for Litecoin dropped to an estimated $1.20 per Gh/s, which compares to Bitcoin’s $0.08, expected to contract further. It may entice smaller miners to switch from Bitcoin to Litecoin, enhancing a previously mentioned catalyst.

Price action may challenge its descending 61.8 Fibonacci Retracement Fan Support Level before extending its breakout sequence by accelerating into its short-term resistance zone. This zone is located between 52.94 and 57.20, as identified by the red rectangle. It includes a previous price gap to the downside. Volatility is favored to increase as the Covid-19 pandemic is forcing a global recession. Litecoin’s planned MimbleWimple privacy protocol testnet launch provides a floor under selling pressure in the LTC/USD, for the time being.

LTC/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 39.15

Take Profit @ 57.15

Stop Loss @ 33.50

Upside Potential: 1,800 pips

Downside Risk: 565 pips

Risk/Reward Ratio: 3.19

In the event of a contraction in the Force Index below its ascending support level, the LTC/USD is likely to revisit its support zone. Underlying fundamental conditions point towards long-term growth in price action. Traders are recommended to consider a reversal from the current level as a buying opportunity. This cryptocurrency pair is better positioned to recover than its peers in the Top 10 list measured by market capitalization.

LTC/USD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 32.00

Take Profit @ 25.00

Stop Loss @ 35.00

Downside Potential: 700 pips

Upside Risk: 300 pips

Risk/Reward Ratio: 2.33