In an impressive move by investors in light of the worry that dominates global markets from the rapid spread of the deadly Corona virus in more than 175 countries around the world, during yesterday's trading session, the US dollar fell at a time when gold prices fell, and in the same path, US stocks fell. Gold prices fell to the $1570 level in the beginning of Wednesday’s trading and could not maintain the $1622 resistance during Tuesday's session. At the beginning of the week's trading, gains did not exceed $1626 dollars an ounce and it settled around the $1588 level at the time of writing. Gold futures fell, affected by US consumer confidence data, which came better than expected and with the announcement of higher Chinese manufacturing activity, despite the decline, but gold prices recorded gains for the monthly and quarterly performance on the back of concerns about the shock of the COVID-19. Consumer Confidence fell to a reading of 120 in March, from a revised 132.6 in February, but some expectations called for a decline to 115.

Gold futures rose 1.9% on monthly performance and increased 4.8% for the first quarter of 2020.

Yesterday, data from China showed signs of a modest economic recovery. Where the Chinese Manufacturing PMI rose in March to 52, from a record low of 35.7 in the previous month as Chinese factories resumed work after closing for months.

In general, the gold price reacted to fears of the COVID-19 epidemic, which was first monitored in Wuhan, China in December 2019, and the epidemic affected more than 826,000 people and caused nearly 41,000 deaths worldwide. The disease caused the closure of commercial activity in areas of America and other countries around the world, which prompted investors to search for safe havens, the most important of which is gold, but the strength of the US dollar is costing gold the opportunity to move towards new record and historical highs. The US dollar index DXY gained 1% during the month of March and 2.8% for the first quarter of this year.

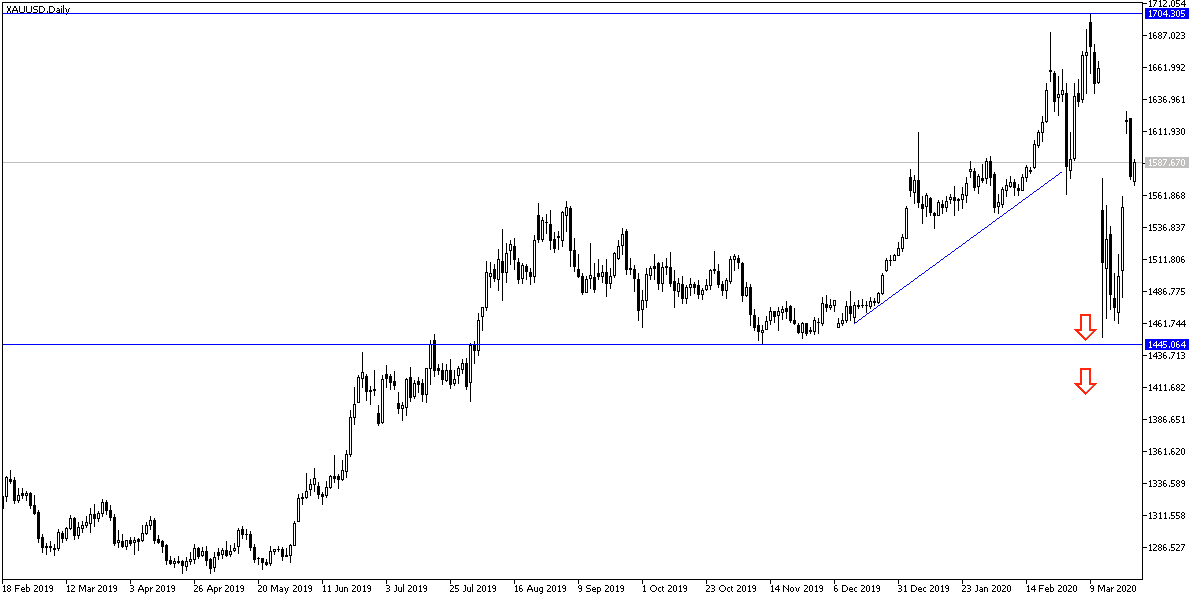

According to the technical analysis of gold: The price of gold will still need to stabilize around and above the $1600 resistance to confirm the bulls' control of the performance and support new purchases. After the recent decline, gold investors will search for new buying areas, and the most appropriate ones are currently at 1560, 1532 and 1520, respectively. I still prefer buying gold from every downtrend. Full control of the Corona virus and its economic consequences may still need months to come.

Gold price will react today with the announcement of the Industrial Purchasing Managers' Index data from Eurozone, Britain and the United States. Then with the announcement of US nonfarm payroll numbers from the ADP survey.