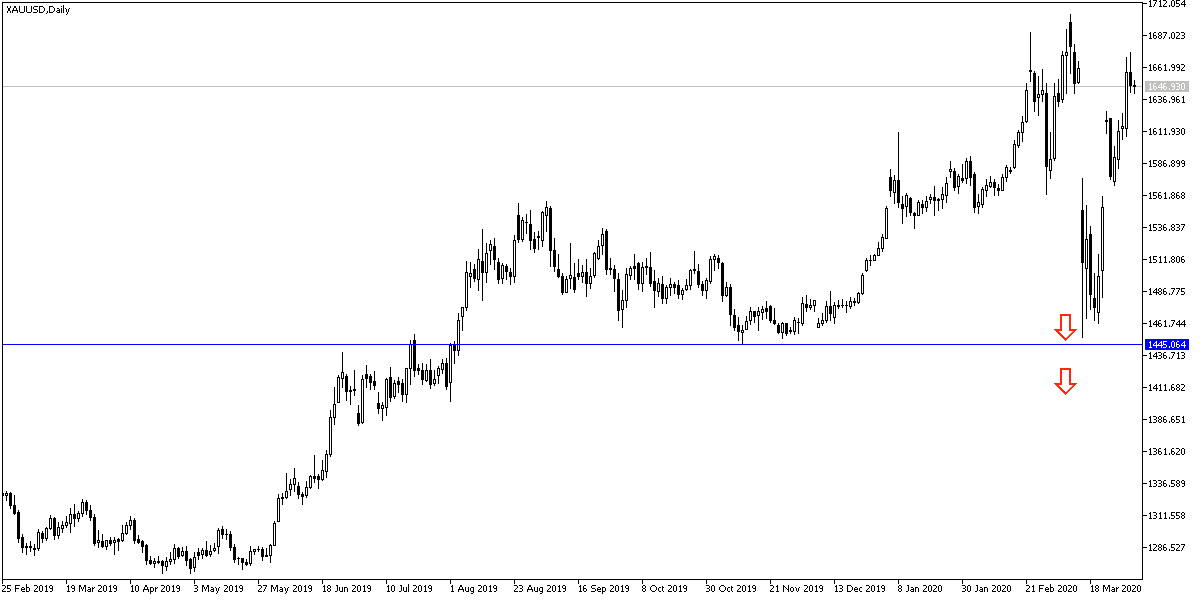

Despite the decline in gold prices during yesterday's session to the $1642 level, after reaching to the $1673 resistance in the same session, and its stability around the $1649 level in the beginning of today’s trading, gold is still moving within the range of a bullish channel that draws its strength from stability above the $1600 resistance. There is no doubt that the global human and economic losses due to the coronavirus outbreak are a powerful catalyst for the yellow metal in moving upward and continuously. Where the number of the cases exceeded the one million person milestone, and caused the death of more than 80,000 people, and the global economy was completely paralyzed by governments’ closures all over the world to contain the disease.

The US dollar suffered heavy losses against all major currencies on Tuesday as investors saw a steady decline in the number of new cases of Coronavirus in some major economies, which, if sustained, could result in a more severe and longer depreciation of the US currency in the coming months.

Recently, Austria and Denmark drew up plans to gradually lift their "embargo" for their people, companies, and economies from mid-month onwards, while markets were absorbing official figures that showed that coronavirus hotspots in Spain and Italy were experiencing a persistent continuing decline in the number of new coronavirus infections. Other countries including the United States and more in Europe also saw declines.

Successive declines in the number of new cases indicate gaining momentum against the coronavirus and markets have given hope that other governments, especially those in major economies, can soon think of lifting the so-called closings that are expected to drive an unprecedentedly sharp drop in GDP Gross for this quarter and creates a double budget deficit that could raise debt-to-GDP ratios by 20 percentage points in the worst-case scenario for some countries.

This is definitely bad news for the US dollar, which has benefited a lot from the historical meltdown in the financial markets in March due to the COVID-19 virus.

According to gold technical analysis: The general trend of the gold price is still bullish, and therefore downward correction attempts may be opportunities for investors to return and buy gold as long as risks from the Coronavirus persist. The closest support levels for gold are now 1642, 1633 and 1620, respectively. As for the bulls target, the resistance will be 1675, the key to the current performance force, and a paved way to cross the $1700 psychological resistance again.

Gold prices will react to the announcement of the content of the US Federal Reserve recent meeting.