The price of an ounce of gold increased by $60 in the beginning of this week’s trading, and the price of the yellow metal jumped to $1670 an ounce, before settling around the $1660 level in the beginning of today’s trading. Despite yesterday’s gains in global stock markets, amid optimism that the numbers of coronavirus deaths and infections, especially from Europe, would start to calm down, gold got support from the announcement of British Prime Minister Boris Johnson to admission to intensive care due to his critical health condition of coronavirus symptoms.

Going back to the statistics of the Corona epidemic, which most affects the global financial markets and investor sentiment. More than 1.3 million COVID-19 cases are currently monitored globally, and at least 72,638 people have died from this disease. 273,546 people have recovered. The number of cases in the United States reached more than 347 thousand people, and caused the death of more than 10335 people. Another 18,953 people have recovered. New York is still the epicenter of the outbreak, with a total of 130,789 cases and at least 4,758 deaths. State Governor Andrew Como said the death toll had remained stable for two days, which was a sign of hope that the curve might start to decline.

On the economic side. Eurozone investor confidence fell to a record low in April, coinciding with the spread of the deadly Coronavirus, worldwide, forcing many countries to impose closings, according to data results from Sentix, a behavioral research firm. The Sentix investor confidence index decreased by 25.8 points to an all-time low of -42.9. Economists had expected a reading of -30.3.

"Without exception, all regions of the world are in deep recession," Sentix said. "Never before has the assessment of the current situation collapsed sharply in all regions of the world within one month." "A rapid V-shaped recovery is unlikely," the research center added.

The survey was conducted between April 2 and 4 among 1173 participants, including 268 institutions. The main index remained in negative territory for the second month in a row. The survey's current status index fell to a record low of -66 from -14.3 in March. Sentex said the monthly decline of 51.75 points was a record high since the start of data collection in 2003.

Sentix said that the current situation is much worse than the crisis in 2009, and that economic expectations so far underestimate the process of deflation. Sentix also said that the Eurozone should prepare itself for severe economic and social testing.

By detailing the results, the German investor confidence index fell to -36, its lowest level since March 2009. The current status index fell to -59, its weakest level since May 2009. The expectations measure rose to -9 from -20.5. The US investor confidence index fell to -39.1 from 0.2 in March. The index of the current situation fell to -59 from 17.8. Both readings were the lowest since 2009. The forecast scale fell to -16.5, the lowest since October. In the Asian region, investor confidence recorded its lowest level since December 2008 at -21.8. The current situation index fell to a record -41.3.

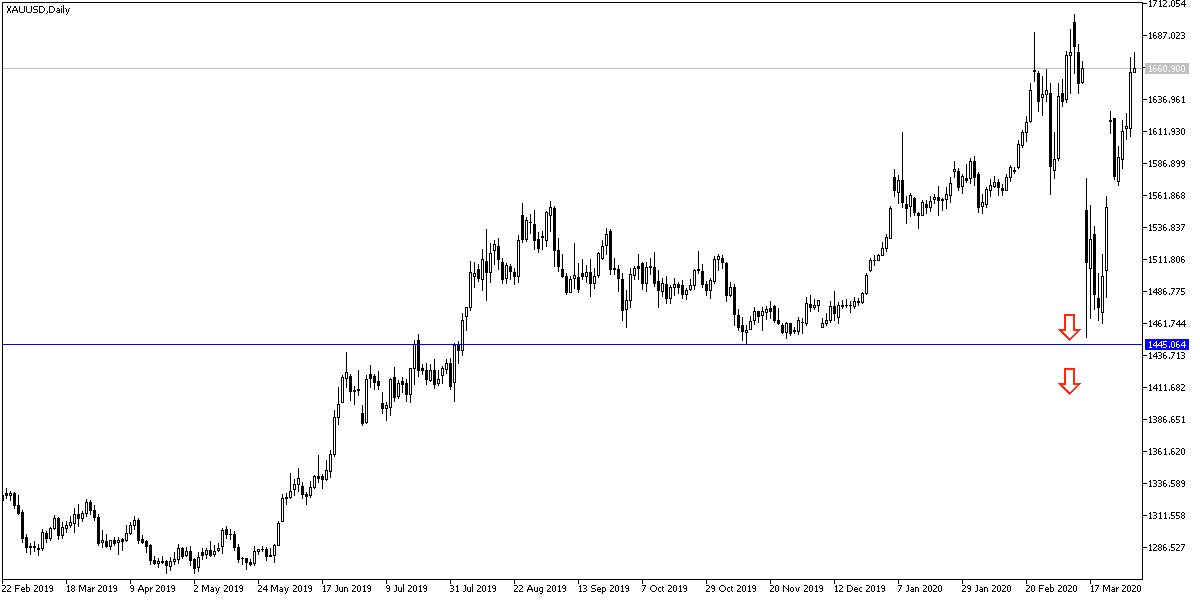

According to the technical analysis of gold: The global concern regarding the continuation of the Corona pandemic and its threat to the future of the global economy will support the shift of investor focus to buy gold as a safe haven. After Monday’s gains, the yellow metal has the strongest opportunity to move towards the $1700 psychological resistance again. Bulls may lose their current control if gold prices return to move towards support levels at 1652, 1640, 1620, dollars again.

Gold will react today to the announcement of the Reserve Bank of Australia monetary policy and the latest statistics regarding the Corona pandemic.