Gold prices benefited a lot from the American labor market disastrous results, which were announced at the end of last week’s trading, which contributed to pushing gold prices towards the $1626 resistance, and settling around the $1629 level at the beginning of this week’s trading. Bulls still have the opportunity to push prices to stronger levels, but there are fears of a new liquidity crisis with the continued rapid spread of the Corona epidemic, that has hit the world’s economies more strongly, setting the stage for an imminent global economic recession. The US dollar has become a favorite haven for investors more than gold.

Gold futures for June rose by $10.50 or 0.64% to $ 648 an ounce at 20:06 GMT on Friday at the COMEX on the New York Mercantile Exchange. Gold prices recorded a weekly increase of 1.04%, thus increasing annual gains so far by more than 8%. As for silver, the sister commodity of gold, it headed in the opposite direction to end the trading week lower. Silver futures for May fell 1.1% to $14.495 an ounce. The white metal recorded a weekly decrease of 0.85%, increasing its losses since the beginning of the year by 19%.

On the economic side. The US economy lost a total of 701,000 jobs in March alone, which is higher than the market expectation of losing 100,000 jobs only. This contributed to the rise in US unemployment from a 50-year low at 3.5% in February to 4.4% - analysts had expected an unemployment rate of 3.8%. The sectors of the US economy have suffered devastating setbacks due to the closure policy to contain the deadly epidemic. The entertainment and hospitality sector lost 459,000 jobs. These results came as a complement to the latest results, which showed that more than 10 million Americans have applied for unemployment benefits in the past two weeks, with companies closing and others dismissing their employees.

In the same context, ISM data showed that the Services and Complex PMI recorded the lowest level since August 2016. Global stock markets are still experiencing more volatility as the coronavirus destroys global economies and makes the crude oil market unstable.

Why isn’t gold prices rising as they usually do in crises? Generally speaking, the short answer is a record decline in the supply of metal and an increase in the strength of the US dollar. But recently, many mining companies have got the green light to resume operations amid massive demand for gold, which is boosting inventories around the world.

During the market turmoil last month, the US dollar index DXY rose to 105.00, fter the Federal Reserve intervened, however, the index quickly collapsed to below 100. During the past week, the dollar index, which measures the performance of the US currency against a basket of six competing currencies, exceeded the 100 level, and accordingly, recorded a weekly increase of 2.2%. Nevertheless, the consensus among economists is that as long as governments introduce an expansionary fiscal policy and central banks inject trillions of dollars of liquidity into the markets, gold will eventually increase in value.

For other metals, copper futures fell to $2.19 a pound. Platinum futures fell to $723.40 an ounce. Palladium futures fell to $2101.89 an ounce.

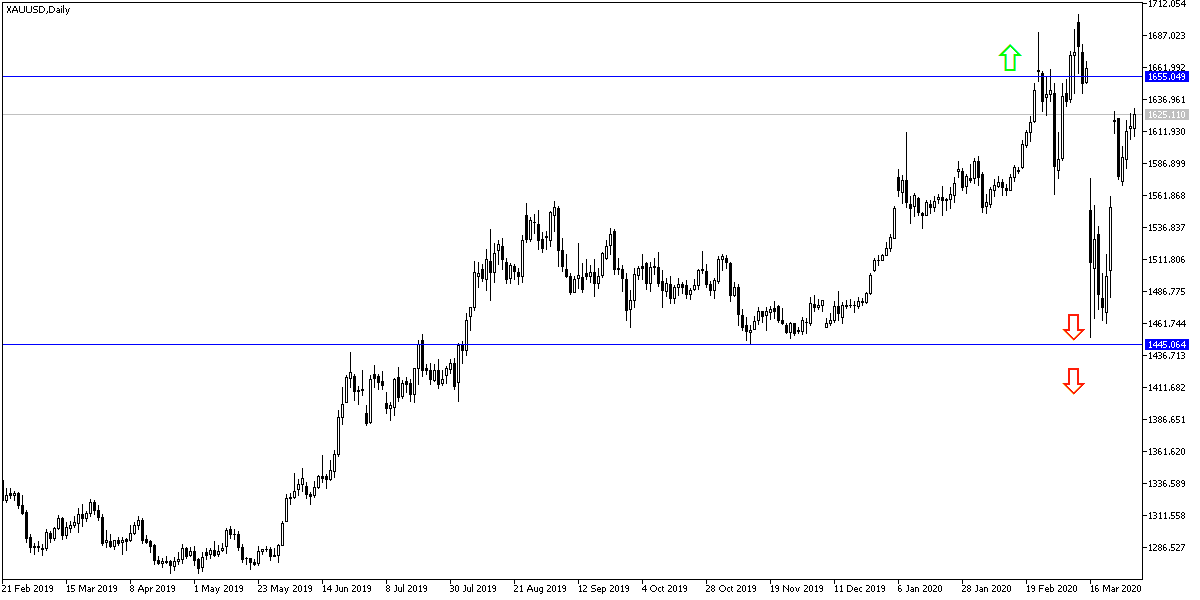

According to gold technical analysis: As I mentioned in recent technical analyzes, I now confirm that the stability of gold prices above the $1600 resistance will remain supportive of the possibility of an upward correction in the near future, but the strength of the US dollar will remain a barrier against the metal achieving stronger gains on a short time. Investor demand for the dollar is still the strongest. Prices pushing towards the resistance levels of 1625, 1640 and 1675 will give gold investors the opportunity to bypass the $1700 historical resistance again. At the same time, the bearish control will return if the metal price returns to move towards the support level of 1585 dollars. I do not expect a big movement of gold today, given that the economic calendar is free of any important and influential data. Only statistics for human and economic losses due to the Coruna epidemic will have an effect on performance.