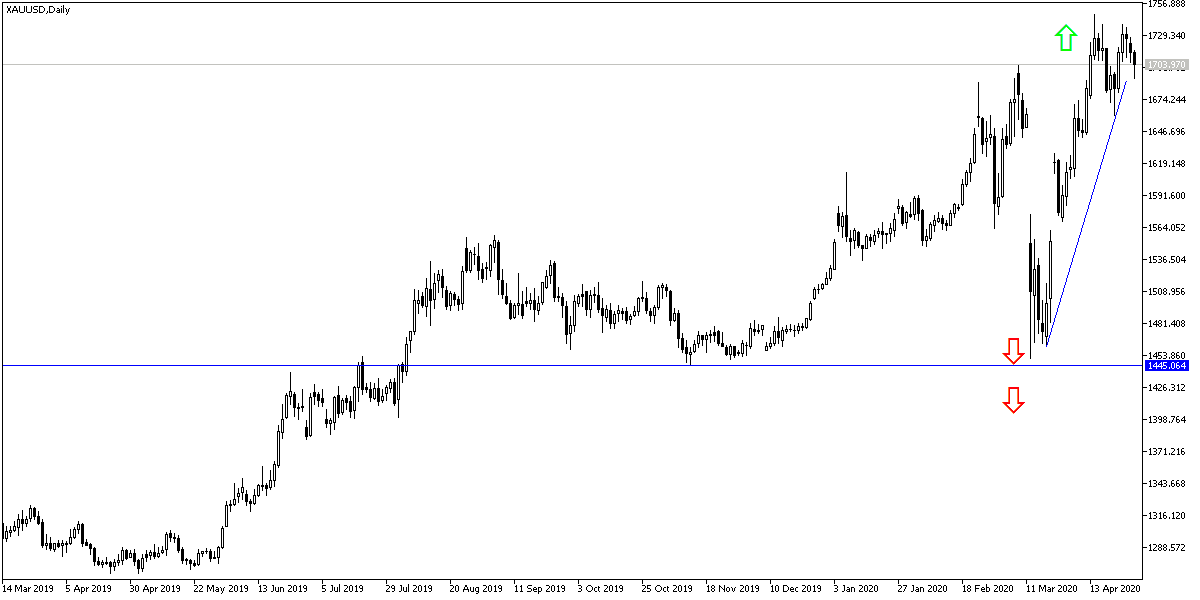

The risk appetite amid the trend of global economies to abandon the policy of economic closure has contributed to the decline in gold prices to the $1710 support, after gains reaching the $1738 resistance during last week's trading, near its highest level in eight years. The moves were in a limited range in light of yesterday's economic calendar having no important economic releases, and amid investors' anticipation of the most important events during the rest of the week, with the announcement of monetary policies from central banks and monitoring the steps of countries to start reopening the global economy.

Financial markets began trading this week amid gains after the Japanese central bank canceled ceiling of government debt it will buy to support the economy. Therefore, the Japanese Nikkei225 Index increased by 2.7%, the Kospi index in South Korea increased by 1.8% and the Hang Seng Index in Hong Kong rose by 1.9%. In Europe, Italy has set a schedule to ease restrictions, and other countries are to announce details of their plans soon. Accordingly, the German DAX rose by 3.1%, the French CAC 40 rose 2.5% and the FTSE 100 in London rose by 1.6%.

From the U.S., nearly 150 companies at S&P500 are due to announce their earnings this week. This includes the Big Five; Amazon, Apple, Facebook, Microsoft and Google, which together make up about a fifth of the index. The yield on the 10-year Treasury note rose to 0.65% from 0.59% late Friday. It is still far below the 1.90% level that it was close to at the beginning of the year. Returns tend to decline when investors lower their outlook for the economy and inflation.

For energy markets, the cost of a barrel of US oil due for delivery in June fell by $4.16 or 24.6%, to settle at $12.78 a barrel. Brent crude fell 6.8% to $19.99 a barrel.

And with the return of the British Prime Minister to resume his duties after a period of treatment from coronavirus, the UK government has embarked on a new corporate loan program in response to the assertion that measures already taken have largely failed to support businesses in an economy that is rapidly collapsing. Accordingly, British Treasury Secretary Rishi Sonak told Parliament that small companies will soon be able to apply for new loans that will save up to 50,000 pounds, or 25% of turnover, with the government paying interest for the first 12 months.

According to gold technical analysis: Despite yesterday's move, the price of gold is still moving within its historical bullish channel and is stabile above the $1700 resistance. It still supports the move towards historical levels in the near future as long as the Coronavirus persists. The re-opening of the world economy and the emergence of a new wave of disease outbreaks may push gold again towards resistance levels at 1725, 1745 and 1780, respectively. The nearest gold purchase levels are now 1700, 1685 and 1660, respectively.

Gold price will react today with the announcement of American consumer confidence, and the investors’ risk appetite.