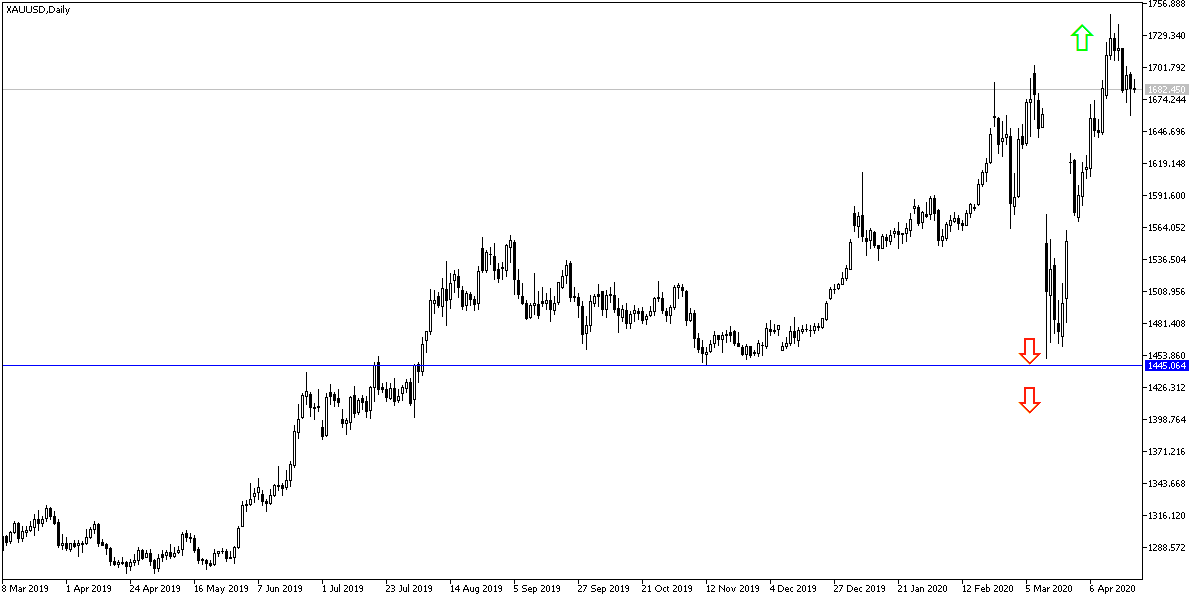

I mentioned in recent technical analyzes that gold price is still in a stronger upward trend and that any decline in prices is only an opportunity to reap profits and return to buying gold again. The starting base this time was the $1660 support, which was recorded during Tuesday trading session, the bulls returned to push prices to the $1719 resistance, where it is stable at the time of writing. Last gains are the highest in more than seven years. The continuing global concern about the continued Corona epidemic pushing the global economy into the abyss, increased investor appetite to buy gold as a safe haven after the fall in global crude oil prices to the lowest in history.

In the metal markets, gold futures for June rose $47.10, or 2.79%, to $1734.09 an ounce. Silver futures for June rose $0.335, or 2.25%, to $15.21 an ounce. June copper futures rose 2.49%, to $2.285 an ounce. June platinum futures rose $6.40, or 0.84%, to $764.80 an ounce. Palladium futures fell in the middle of the trading week as falling demand and market losses this week affected the industrial metal. Prices have recovered in recent weeks after tumbling to the lowest level in 2020 at around $1,400, and many analysts are optimistic about the future of palladium, but a rush to liquidity could set a ceiling on the rise of palladium to $3,000 by the end of the year.

Despite health warnings of rushing to reopen the economy so that a violent wave of injury and deaths does not occur with the deadly Corona epidemic, the US administration is determined to gradually open the largest economy in the world, which suffers greatly from the current strict closure policy. The United States of America still has the largest global numbers of infections and deaths from the epidemic, but the continuation of the closure means more pressure on the American economy and put Trump's future as President of the United States of America at stake, especially with the approaching US presidential elections.

According to gold technical analysis: Technical indicators still give the opportunity for gold prices to rise more, especially with the continued global concern of a devastating economic recession if the Corona epidemic continues for a longer period. Bulls will still have control of performance as they cross the $1700 psychological resistance barrier and may push the price to resistance levels at 1725, 1745 and 1770 respectively if investors continue to escape risk. As I mentioned before, I can now confirm that gold can be bought from every bearish level and the closest support levels for gold are now 1700, 1685 and 1660, respectively.

Gold will react today with the announcement of the PMI reading for the industrial and services sectors for the Eurozone, Britain and the United States, in addition to the US jobless claims and new home sales data.