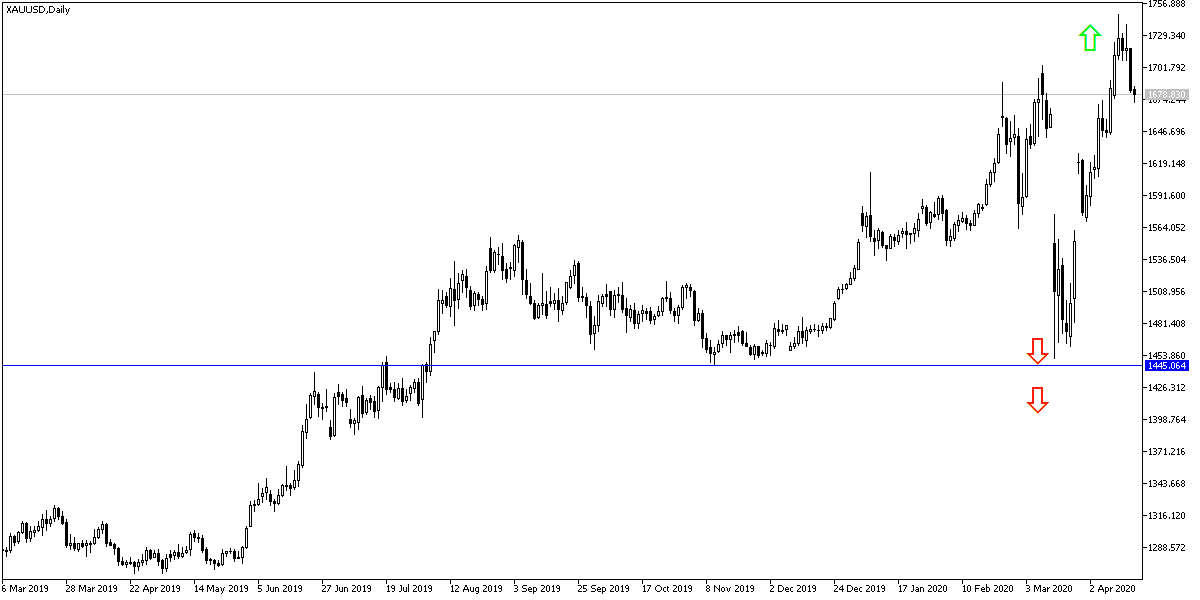

Gold prices did not celebrate much for its gains, which reached the $1747 resistance, its highest level in nearly eight years, and closed the week's transactions around the $1686 level. Coronavirus epidemic remains the strongest influence on global financial markets performance and investor sentiment. Trillions worth economic stimulus plans - from global central banks and governments - does not stop, as the global economy still faces the specter of severe recession due to the global economic shutdown to prevent further spread of the epidemic.

The International Monetary Fund, consisting of 189 countries and its lender, the World Bank, pledged last Friday to intensify their efforts to alleviate the global economy from the coronary virus pandemic. The affirmation of the two agencies came at the end of the spring meeting, as they heard calls for more debt relief for the poorest countries hit by the health crisis.

For its part, Director of the International Monetary Fund Christina Georgieva and World Bank President David Malpas stressed that their agencies are well aware of the growing threat of a health crisis expected to plunge the global economy into the deepest recession since the Great Depression of the 1930s.

"The great global downturn in the first half of 2020 is inevitable," Georgiyeva said in comments on Friday to the Development Policy Committee, which is the supreme policy committee that guides operations at both the International Monetary Fund and the World Bank. The length of the crisis is exceptionally high.” The International Monetary Fund predicts that the global economy will contract by 3% this year, the worst economic downturn since the 1930s and much more severe than the 2008 financial crisis.

Both the International Monetary Fund and the World Bank received support this week from the G20 leading industrialized nations on stopping debt payments for the rest of the year by the world's poorest nations - such as Afghanistan, Ethiopia, and many sub- Africa Saharan countries. The debt suspension covers about 77 countries, which will run from May 1 to the end of this year.

In a closing statement on Friday, the Development Committee, which is composed of financial officials from all over the world, directed both the World Bank and the International Monetary Fund to review the debt burdens of middle-income countries and "explore a set of financial and tax solutions quickly”, because of "the stress in those countries on a case by case basis”.

Countries classified as middle-income include countries such as Indonesia, Peru, Lebanon, and Iraq. The IMF and World Bank officials have not provided any timetable when they will have plans ready for this larger group of debtor countries.

On the same path. The US Federal Reserve is leading the stimulus policy of global central banks, which has pushed governments in the same direction and thus restoring stability to financial markets and increasing liquidity.

According to gold technical analysis: Despite the correction of last Friday's trading session, the general trend of gold prices is still within the bullish channel formation, and gold investors are ready for any decline to return to buying the metal again as long as the Corona epidemic reaps more human and economic losses around the world. The closest support levels for gold are now 1678, 1660 and 1645, respectively. A return to stability above the 1700 resistance will bring the momentum to move towards new record and historical levels.