During yesterday's trading, gold prices retreated to the $1570 support and then returned to stability around the $1594 level in the beginning of trading on Thursday, with the return of pressure on the US dollar after another round of US manufacturing data. Gold price has been on a downward trend since it recently peaked at around $1640 an ounce. It has now dropped below the 23.60% Fibonacci level. Despite the decline, gold futures rose by 1.9% in March and increased by 4.8% for the first quarter of this year. The yellow metal got some support from the rapid spread, increasing numbers of infections and deaths due to the coronavirus outbreak, which caused the collapse of global stock markets.

What has halted the gold gains, the ideal safe haven for investors in times of crisis, was the results of the isolation and closure measures that were followed by the United States of America and many affected countries in order to reduce the human losses from this dreaded disease. And that caused almost a complete paralysis to the world economy.

US economic data yesterday came in better than expected, but analysts said it did not include much of the impact from the COVID-19 pandemic. The ADP survey detected a loss of a total of 27,000 jobs in the US non-agricultural sector, below expectations that indicated a decrease of a total of 180,000 jobs. Despite the results, it is likely to be a forerunner of what will come after the increase in unemployment claims last week to a record 3.28 million claims. Separately, ISM Manufacturing PMI fell to 49.1% in March from 50.1%. Economists had expected the index to drop to 44%.

Gold moves came at a time when global stocks were under renewed pressure amid continuing concerns about the economic effects of the epidemic, which are difficult to understand for investors. On Tuesday, US President Donald Trump warned of two "very painful" weeks in light of the continuation of the COVID-19 pandemic. The White House has released new expectations that between 100,000 and 240,000 Americans can die from the coronavirus pandemic even if current guidelines for social distancing are followed.

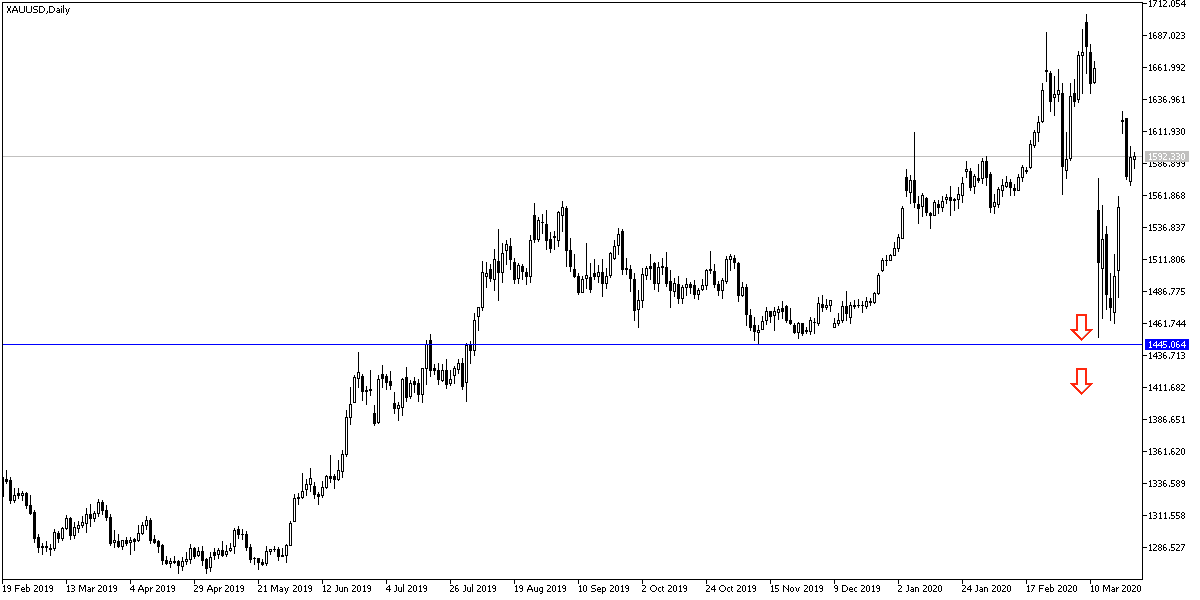

According to gold technical analysis: Currently, the gold prices are hovering around $1600 an ounce and is still in a trading range between $1550 and $1650 on the short term. Given the potential breach, bulls will target short-term profits at 23.60% Fibonacci level at $1598 or higher at $1621. On the other hand, bears are looking to bounce back at 38.20% Fibonacci level at $1570 or less at $1548.

As for performance on the daily chart, it appears that the gold price has recently pulled out from a bullish channel. This is the second time in the past two weeks, and there is significant resistance from bears struggling for long-term control. Long-term profits will target around $1518 or less at $1450. On the other hand, bulls will target the next bounce in gold prices at $1643 or higher at $1700 again.

Gold price will interact today with the announcement of the US economic data, led by the unemployed claims reading.