The resumed strength of the US dollar contributed to the suspension of gold price gains, which reached the $1747 resistance, the highest level in eight years. The correction pushed gold towards the $1707 level, with a loss of 40 dollars before settling around the $1714 level at the beginning of trading on Thursday, and before the announcement of the last important US economic releases for this week. The results of the economic releases clarify the outcome of the devastation caused by the Corona virus and its accompanying strict closure to prevent further infections and deaths.

The United States started to announce more data results from various sectors of the economy. Yesterday, it reported that industrial production, which includes manufacturing, mines and utilities, recorded the largest decline in March since 1946. In general, the decline in spending exacerbates the problems facing retailers. US retail sales fell - 8.7% in March, an unprecedented drop, as the outbreak forced the business to close almost entirely nationwide.

The sales deterioration far exceeded the previous record low of - 3.9% that occurred during the depths of the Great Recession in November 2008. The US Department of Commerce said car sales fell by 25.6%, while clothing store sales collapsed, falling by 50.5%. Restaurants and bars recorded a revenue drop of nearly 27%.

The dollar's gains came with increased demand for it as a haven in light of concerns about the global economic impact of the coronavirus and the sharp collapse in crude oil prices. The US dollar index, DXY, which measures the performance of the dollar against a basket of six major competing currencies, rose 0.6% in Wednesday's trading. And the strong dollar presses the price of the yellow metal. It rose on Tuesday at its highest level since October 2012.

Despite the decline in the price of gold, optimism is on the rise over the long-term price prospects. For a longer period of time, the world economy will suffer the shocking economic effects of the Coruna epidemic.

To date there are 2.02 million COVID-19 cases worldwide, and 130,528 people have died, according to data compiled by Johns Hopkins University. At least 507,330 people have recovered. The United States of America has the largest number of cases, with a total of 61,317 infected and most deaths in the world, with a total of 27,085 people. In Europe, Spain has the largest number of cases with a total of 177,633 cases and 18,579 deaths recorded. There are 165,155 cases in Italy, but the highest number of deaths in Europe is 21,645.

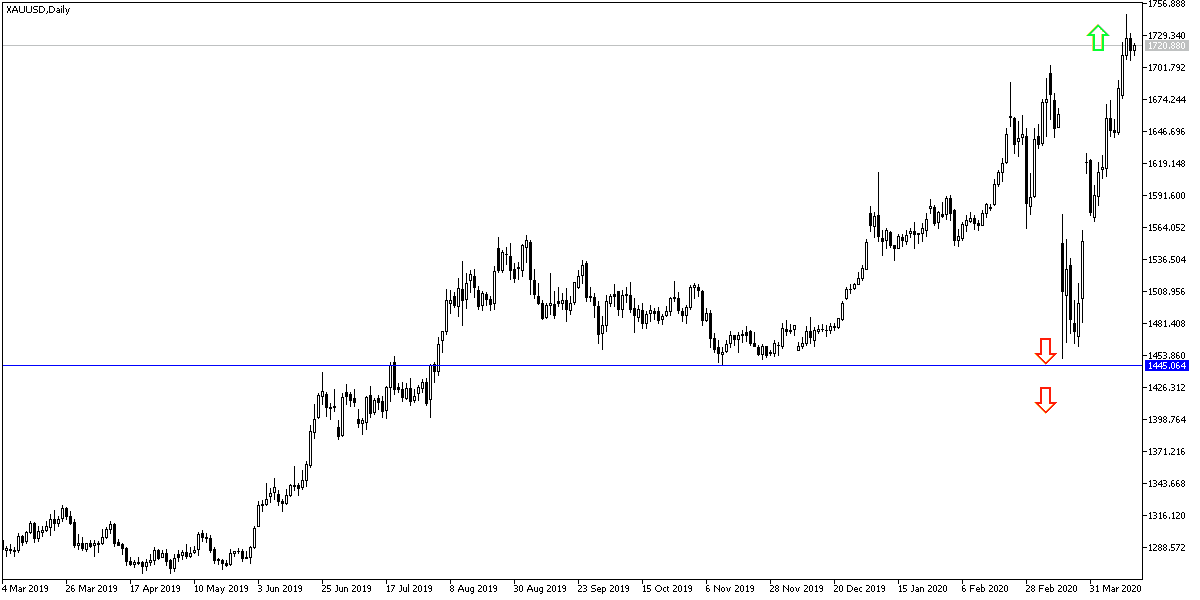

According to the technical analysis of gold: On the daily chart, the price of gold is still moving within the formation of its bullish channel and is ready to test new record resistance levels as long as it is stable above the 1700 resistance that confirms the extent of the bulls control over performance, and the closest resistance levels to the price of the yellow metal are currently 1735, 1760 and 1785, respectively. These expectations may be affected if gold returns to stability below the $1680 level again.

Gold prices will interact with the results of the US economic data, weekly jobless claims, building permits, and the Philadelphia Industrial Index.