Increased uncertainty and weakening of the US dollar were motivating factors for gold investors to push gold prices up to the $1692 resistance, its highest in seven years, before it closed last week’s trading around the $1675 resistance. Gold is closest to the $1700 historical resistance, which paves the way for testing new record and historical levels, especially if the world economy continues to suffer from the devastating effects of the coronavirus. Since the largest economy in the world is most affected by this epidemic, it was necessary for the Federal Reserve Bank of the United States and the US government to provide more stimulus plans to support American companies and families in the face of the economic shock of this epidemic, especially with the release of millions of Americans from their jobs amid the strict economic closure to contain the spread of the disease.

The Trump administration and congressional leaders seem ready to start new talks between the two parties about a new aid package for the Coronavirus, with hopes to begin this path this week.

Democrat Senate Chuck Schumer said that he spoke to Treasury Secretary Stephen Manuchin on Friday, and the Trump administration agreed to continue negotiations between the two parties in the Senate and House to renew the $350 billion "salary protection" program for companies. House Speaker Nancy Pelosi, in a call with Manuchin, recommended joint talks so that Congress can "act quickly" to confront the crisis. Senate Majority Leader Mitch McConnell admitted the failure of the vote last week: "We will have to do it again at some point." And "there will be additional discussions."

Developments come a day after Democrats strangled an attempt by the Senate to accelerate the injection of $250 billion into the business program by a vote. Democrats' demands for an additional $250 billion to be added to states and hospitals. This stalemate came with the country's unemployment rising to more than 16 million people.

As for the Chinese economic stimulus. Data from the People's Bank of China showed last Friday that Chinese bank lending increased more than expected in March, indicating that measures to support the economy helped lift demand for credit. In March, Chinese banks lent 2.85 trillion Yuan, compared to expectations of 1.8 trillion Yuan. Total social financing rose to a record level of 5.15 trillion Yuan, which was also higher than the forecast of 2.8 trillion Yuan.

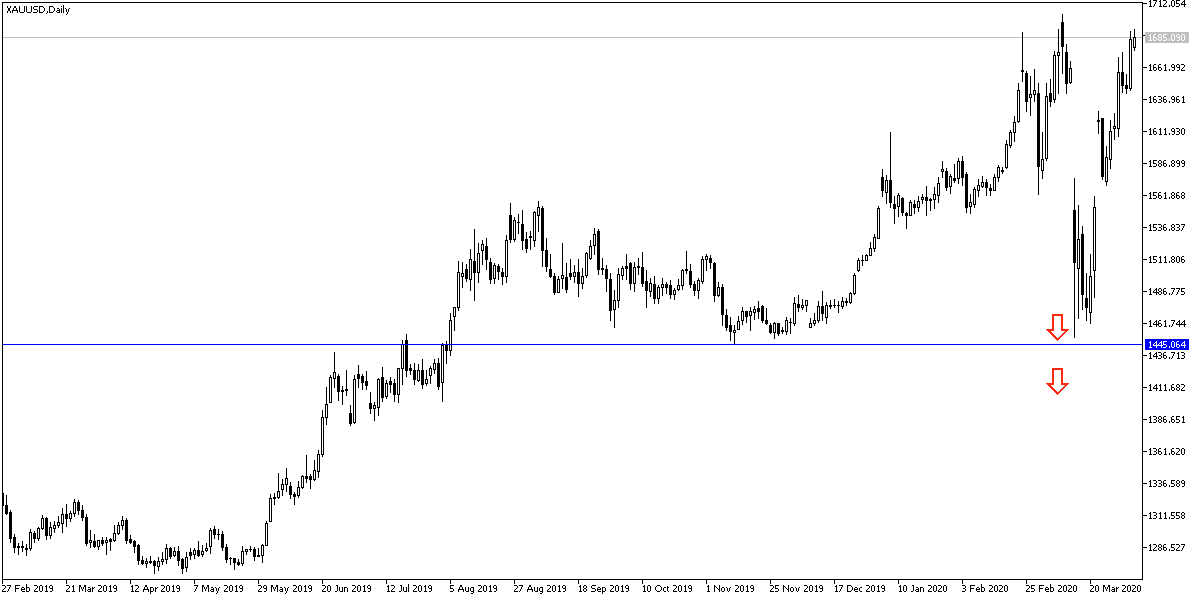

According to gold technical analysis: bulls got a strong momentum from the decline of the US dollar, and accordingly, the price of gold may continue to move higher, especially if it managed to overcome the $1700 psychological resistance barrier, which paves the way for stronger and closer resistance levels at 1715, 1733 and 1760, respectively. On the other hand, we must take into consideration that the recent gains pushed the technical indicators to strong overbought areas and if the yellow metal did not gain more momentum, we may see profit taking sale-offs that could push it towards the support levels 1663, 1650 and 1635, respectively.

Today's economic calendar has no important economic data due to the Easter holiday, and therefore we may witness movements in limited ranges, and gold will interact more with the latest figures of global losses from the Corona pandemic.