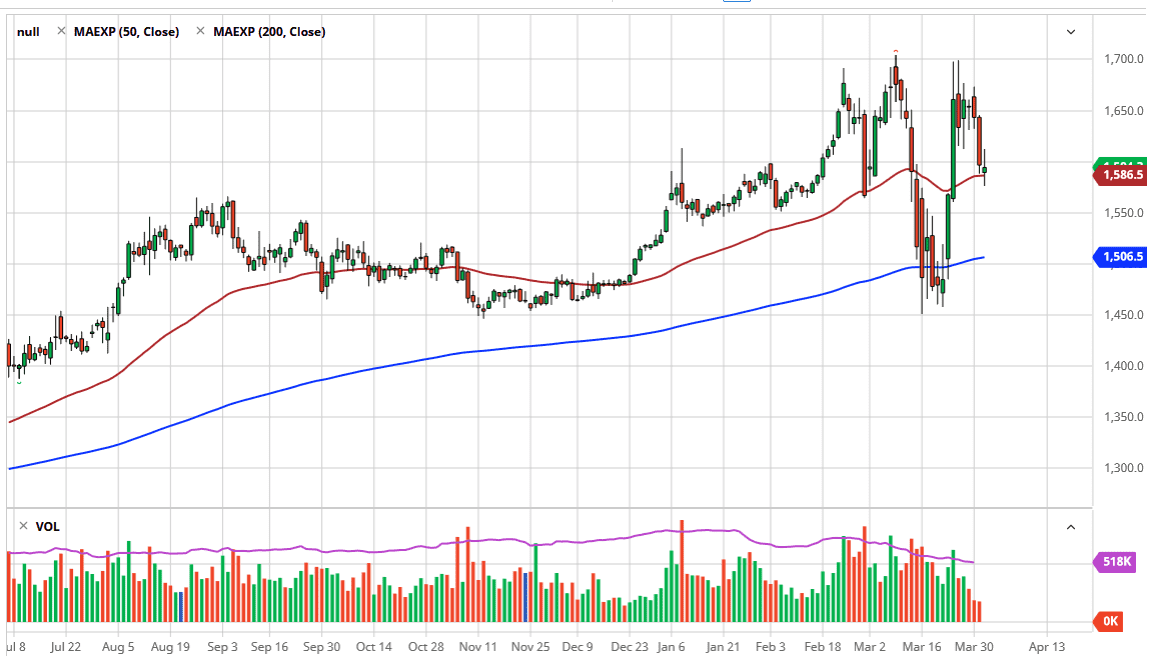

Gold markets have gone back and forth during the trading session on Wednesday, as we dipped a below the 50 day EMA only to turn around and show signs of strength. At this point, the market is very likely to see a lot of volatility, due to the fact that there are so many concerns about the growth situation out there with the coronavirus shutting everything down. Furthermore, the US dollar is going to be crucial in its influence as well. Beyond all of that, we have to worry about the jobs number on Friday and there is likely going to be a lot of noise because of this as well.

If the market was to break down below the lows of the Wednesday session, then I think the gold markets go looking towards the $1550 level, and then possibly the $1506 level where the 200 day EMA sits. I think a pullback offers value that people will be taking a look at and would be willing to start buying. In a world that is so uncertain, it’s not a huge surprise to realize that the gold continues to show plenty of interest, and with that being the case I think that even if you were to short the market, you would have to be very cautious about doing so for any significant length of time.

All of that being said, if gold markets were to break down below the $1450 level, it would kill the uptrend and we could go much lower. At that point, one would have to think that it would be more gold liquidation in order to cover massive debts in other markets, but we are away from these levels, and of course the leverage has been taken out of a lot of markets recently. That being said, we could always find the markets act erratically again, so keep in mind that you should also pay attention to volume which has been dropping a rather drastically. All of that being said, the market was to break above the $1700 level, it allows the market to go looking towards the $1800 level, possibly even the $2000 level given enough time. I am bullish longer term, but I also recognize that these are very dangerous times and a lot of leverage should not be used at this point. Small longer-term positions are probably preferred more than anything else.