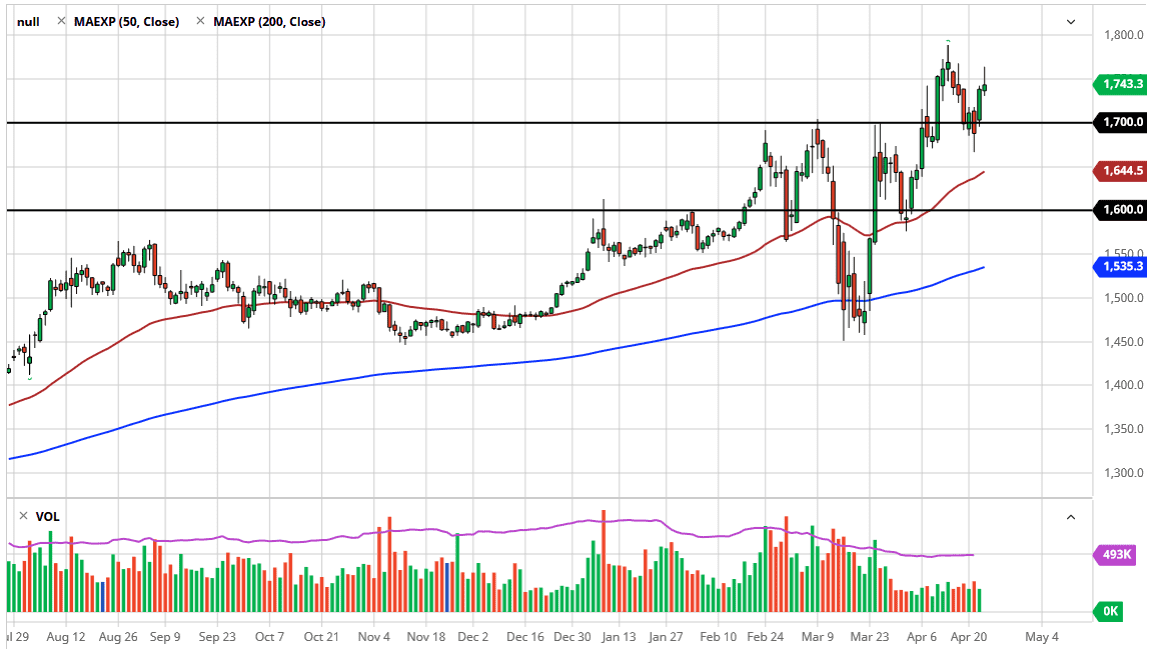

Gold markets initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains above the $1750 level. By forming the exhaustive looking shooting star shaped candle, I believe that the market probably pulls back heading into the weekend, with the $1700 level underneath offering plenty of support. At this point in time, I look at it as a potential buying opportunity based upon value, and I think that the $1700 level extends down to the $1680 level. All things being equal, I believe that it is only a matter of time before value hunters come in and try to pick up gold because clearly, we have a lot of things to worry about globally.

To the upside, the $1800 level offers quite a bit of resistance, so we can break above that level then the market is likely to continue going much higher, perhaps all the way to the $2000 level which is my longer-term target. I think it is can it take a significant amount of time before we get there, and it is more or less a longer-term trade. I think that it is only a matter of time before we see buyers come in and push to the upside due to the fact that central banks around the world continue to liquefy markets, doing all kinds of quantitative easing and the like. Beyond that, there are a lot of concerns around the world so therefore safety traders will be looking to buy gold as well.

The trend has been higher for some time and I think this will simply be yet another pullback that people can take advantage of. Ultimately, it would take a huge change in the attitude of markets to see this commodity rollover, so therefore I do believe that being a bit patient and simply waiting for buying opportunities is the way to go. After all, the trend is going to continue to be your friend, and you do not necessarily need to make every time it that the market offers. You do not need to be shorting this market because we could of course turn around and go higher during the Friday session. The odds favor the upside move, and that is essentially what you need to pay attention to. If we do get a pull back and then another pullback, then it means you get to buy gold at an even cheaper level.