Gold markets rallied significantly during the trading session on Monday, breaking above the important $1700 level. The fact that the market did close above there is a very good sign and it’s likely that any pullbacks at this point will be bought. This should drive the gold markets higher, perhaps reaching towards the $1750 level. Above there, the market should then go to the $1800 level, perhaps even the $2000 level.

Looking at the size of the candlestick, it’s very likely that the market will see plenty of buyers in general, and of course the gold market continues to see inflow due to the fact that there is a huge push towards safety, and of course the US dollar is starting to show signs of giving up some of its strength. That’s two different reasons to think that perhaps this market could rally. Central banks around the world continue to for the markets with cheap fiat currency, not the least of which will be the Federal Reserve which is extraordinarily dovish and willing to throw a ton of cash into the market.

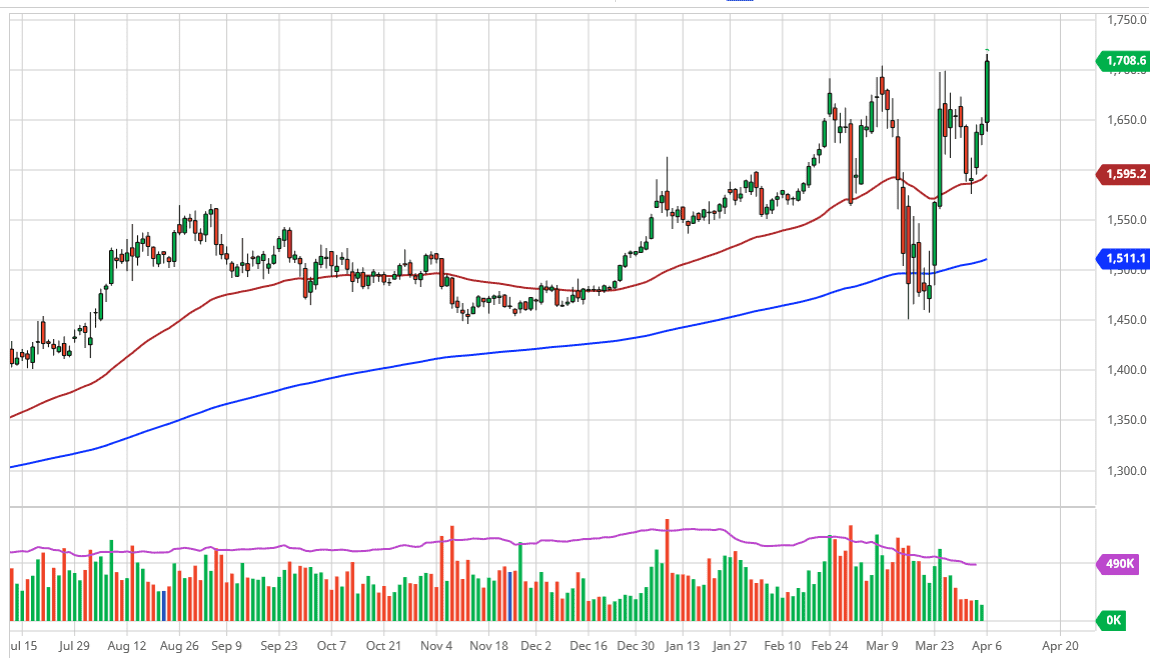

Looking at this chart, the 50 day EMA is showing signs of support near the $1600 level, so if we can hold that, I think the uptrend is intact. Quite frankly, I think the $1650 level will also offer a significant amount of support. With that being the case I like buying pullbacks because they do offer a bit of value in a market that is most determinedly in a massive uptrend. I do believe that gold will continue to be a focal point for traders around the world but considering that even if the stock market’s rally the way they did in gold rallied the way it did, it’s very likely that the market should continue to see an upward motion. I have no interest in shorting this market, at least not until we break down below the 200 day EMA on a daily close. That is quite far away from here, almost $200 so I don’t think it’s very likely to happen anytime soon. Ultimately, there’s no reason to think that gold will lose its luster in this environment, simply because there are far too many questions out there when it comes to safety and of course central bank actions. Longer-term, I think that buying on dips and adding to a core position will probably continue to work out quite well.