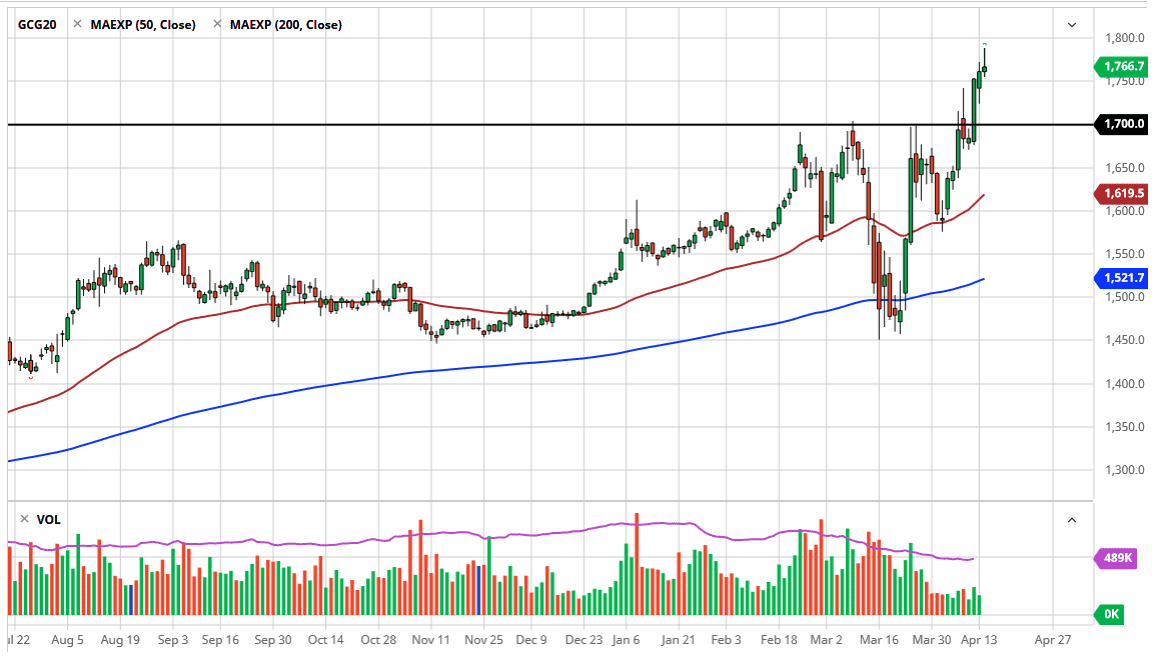

Gold markets rallied significantly during the trading session on Tuesday but gave back quite a bit of the gains in order to show signs of weakness. At this point, the market seems like it is simply exhausted, not necessarily in any significant amount of trouble. The shooting star suggests that we are getting a little ahead of ourselves, and as a result it’s likely that the market needs to pullback in order find more buyers. Don’t be wrong, I do believe it happens and I am bullish so I’m not looking to sell this pullback, rather I’m looking for a bit of value underneath, most specifically at the $1700 level, but that is a significant distance from this level, so it could be more of a multi-day pullback.

The alternate scenario of course is that we simply go higher and break above the top of the candlestick for the trading session, which is yet another bullish sign, but we would have to contend with the $1800 level. That’s my short-term target anyway, but once we get past their then we are starting to talk about $2000 per ounce. We are in an uptrend, and that is the most important thing you should be paying attention to. Ultimately, I do think that it is only a matter of time before we break much higher, and quite frankly it would take a significant change in the attitude of markets in general to have this market break down.

The $1700 level I think it extends down to the $1690 level as far as support is concerned, so I don’t think we breakdown through there. However, even if we did then I would be looking at the 50 day EMA as a potential support level as well. I do think that we will be moving based upon the latest headline, and that of course something that needs to be paid attention to but given enough time the overall trend will win out the day. Look at pullbacks as opportunities to pick up a bit of value in a strong uptrend that has plenty of fundamental reasons to lift it. Not only is there a major concern when it comes to the economic landscape, and of course there is so much in the way of liquidity when it comes to the Federal Reserve flooding the market with dollars. Gold is the first place that a lot of people go to.