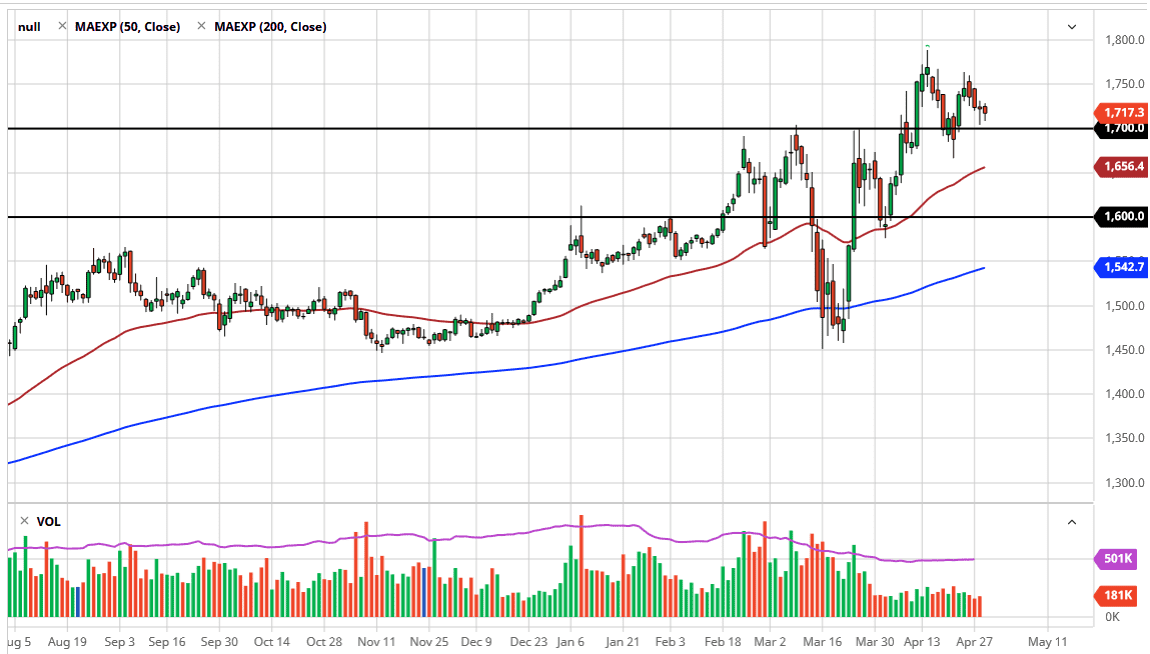

The markets continue to find buyers in general as we have reached towards the $1700 level only to find quite a bit of buying pressure to form a massive hammer. That being said, the market is likely to continue seeing a lot of choppy behavior on the whole, as the latest economic headlines will throw the market around. Keep in mind that a lot of what is going on is based upon the latest coronavirus headline, which of course can cause a lot of headaches for traders.

Nonetheless, we are obviously in an uptrend and therefore it is a situation where you are looking for value to buy. You did not quite get all the way down to the $1700 level, but the fact that we have formed a couple of hammers suggests that we are ready to bounce from here. With that being the case, if we can break above the $1725 level, then we can be buyers and hang on for the larger move. I anticipate that the $1750 level will be targeted initially, and then possibly even the $1800 level. If we can break above the $1800 level, then it is possible that we could go much higher than that, perhaps reaching towards the $2000 level over the longer term.

Quite frankly, central banks around the world continue to throw money at everything that moves and therefore it does drive up the price of gold. The US dollar has been getting crushed, which also helps gold as it is priced in that currency. At this juncture, I believe that it is probably going to be a scenario where we see pullbacks looked at as potential value, as gold should continue to be looked upon with favor. Underneath the $1700 level, I believe that the $1680 level should continue to offer support, building a bit of a buffer zone for traders to use as a floor. If that is going to be the case, then it is likely that we will see buyers come in to pick up value every time they get the opportunity. Quite frankly, I have no interest in shorting this market, because it simply has shown a resiliency that is to be admired. Furthermore, we also have a lot of economic headlines out there that cause concerned, so that should also have a major effect on gold.