The cable quickly recovered from recent sell-offs in the currency trading market against most major currencies after British Prime Minister Boris Johnson was admitted to the intensive care due to worsening health condition of coronavirus symptoms. The recovery came after British minister statements that Johnson will soon recover and return to normal work. During yesterday's session, the GBP/USD pair jumped from the 1.2165 support to the 1.2383 resistance, before settling around the 1.2298 level at the time of writing. British Prime Minister Boris Johnson is still in the intensive care unit that he moved to late Monday. Meanwhile, the UK recorded 768 new deaths from the Coronavirus, the country's highest toll in a single day.

In contrast. The United States of America has the most confirmed cases of the virus with a total of 379,965 cases and 11,851 deaths. This is according to data collected by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University. New York State Governor Andrew Como said that the state recorded its largest one-day increase in COVID-19 deaths on Tuesday, with 731 deaths recorded in the state, bringing the total to 5,489. There are now 138,836 coronavirus cases in New York, making it the epidemic center in the United States.

For economic news. Labor productivity in the United Kingdom increased for the second time in a row in the fourth quarter of 2019, the National Statistics Office said on Tuesday. Hourly output grew 0.3 percent compared to the fourth quarter of last year, the same rate that we saw in the third quarter. It was the second straight rise. Historically, the 0.3% productivity growth rate remains very low, the office said.

The growth of 0.3 percent in output per hour was largely due to the strong performance of construction, while industrialization made the largest negative contribution to the growth of macroeconomic productivity.

Capital Economics expects a 15% drop in British GDP on a quarterly basis in the second quarter of 2020.

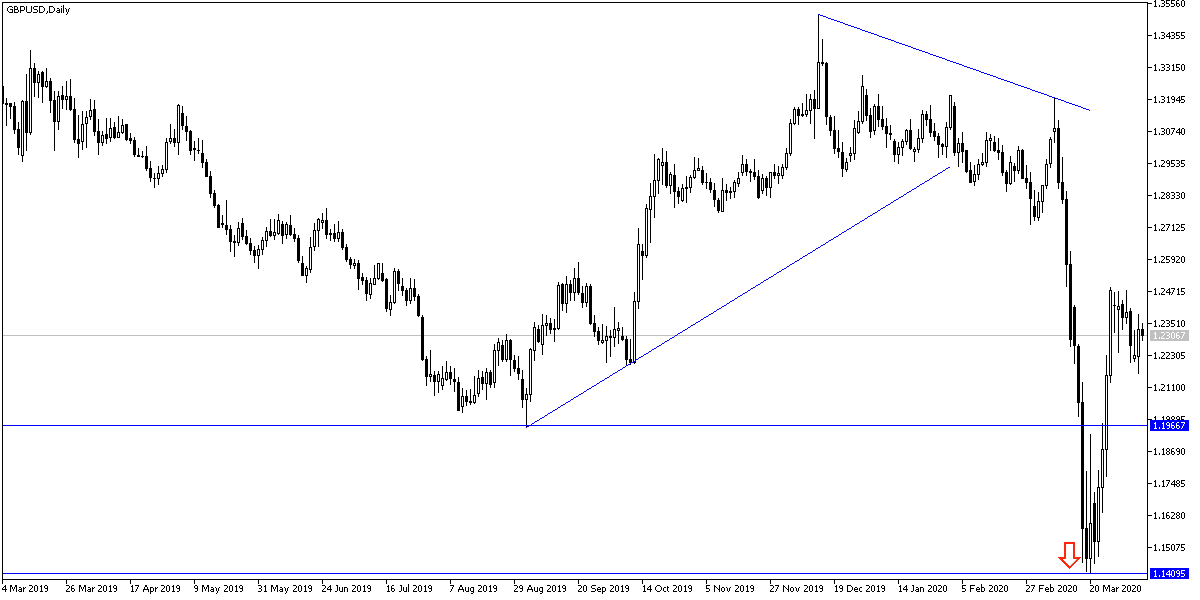

According to the technical analysis: On the daily chart, the GBP/USD pair is still under downward pressure and its gains may evaporate quickly and be the target of new sales. The nearest resistance levels for the pair are 1.2450, 1.2520 and 1.2600, respectively. Bears may be able to control performance if the pair returns to move below the 1.2250 support again. The Pound will interact a lot with the developments in the health of the British Prime Minister and will also increase the appetite of investors to buy the dollar as a safe haven in case confirmed cases of infection and deaths caused by the Coronavirus continue to increase.

As for the economic calendar data today: There are no significant British economic releases today. From the United States, the focus will be on the content of the Federal Reserve’s minutes.