As soon as it was announced that British Prime Minister Boris Johnson will enter intensive care, as his health condition, which suffers from symptoms of the Coronavirus, deteriorates, the pressure on the GBP/USD price increased, pushing it lower towards the 1.2209 support before settling around the 1.2225 support in the beginning of trading on Tuesday. The British Pound losses were not large and continuous amid a wave of rise in global stock markets, as investors were optimistic about the decline in infection numbers and deaths from the coronary virus epidemic. Reports say that the Prime Minister was hospitalized on medical advice and that the move was a precaution and was not an emergency admission.

The sentiment of the British pound investors will interact strongly with monitoring the health of British Prime Minister Boris Johnson in the coming days. The longer he stays in hospital, the greater the risk to the British pound. On the contrary, the British pound may benefit if Johnson returns to 10 Downing Street by Easter. The deterioration of Johnson's situation will increase the political uncertainty in the UK, and recent years have shown that the British pound does not favor uncertainty.

Stability in global markets since mid-March was due to significant intervention by the US Federal Reserve which appears to have been a positive thing for the British pound. However, American job numbers and the rate of layoffs have cost the American economy its luster and strength ahead of the spread of the disease. March's non-farm payrolls reading of -701K, a deeper decline from the -100K forecast. The unemployment rate rose to 4.4%, from the 3.5% rate in the previous month.

Regarding monetary policy in Britain. The Bank of England has revealed that a major lending plan aimed at supporting UK small and medium-sized companies to cope with the coronary virus crisis will be available from April 15, well ahead of schedule. The temporary financing scheme with additional incentives for Small and Medium Enterprises (TFSME) is one of the initiatives announced by the Bank of England and the Treasury to support families and companies during the "Corona Crisis". TFSME allows lenders access to four-year financing at rates very close to the bank's interest rate, which is currently 0.1%.

This scheme is designed to motivate lenders to provide credit to companies and families to see them during the current period of economic turmoil and uncertainty caused by the Coronavirus. In his statement, the Bank of England said that making TFSME financing available as soon as possible would enhance the ability of SMEs to access financing from the banking system, helping them to continue to pay wages and bills.

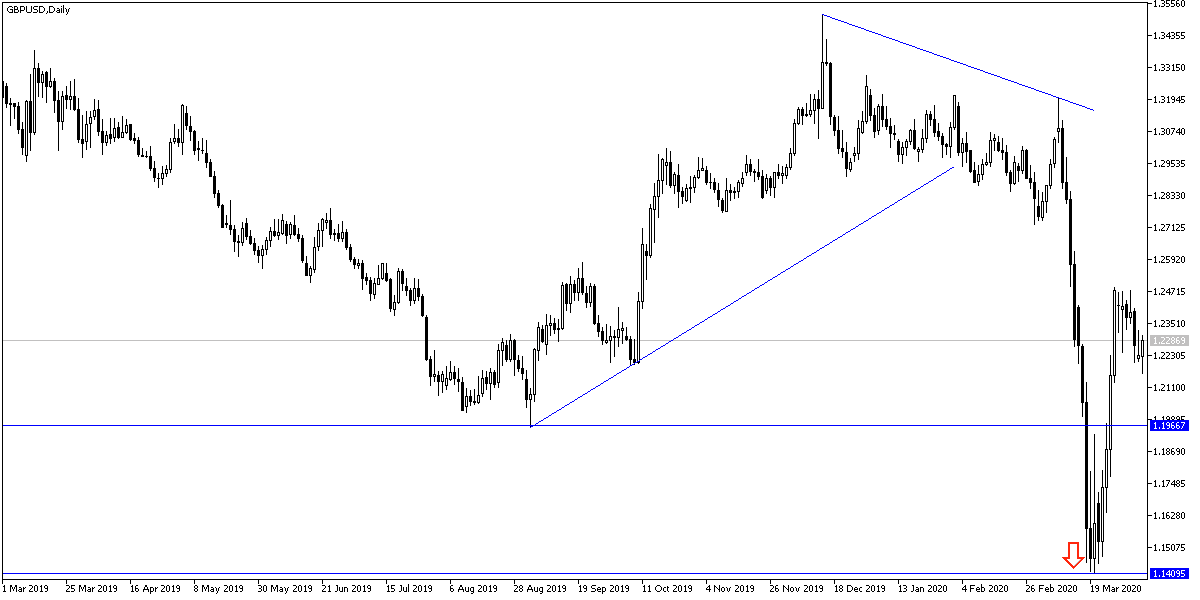

According to the technical analysis: In addition to the strength of the US dollar as a safe haven, pressure has increased on the GBP/USD amid deteriorating health condition of the British Prime Minister, and therefore the general downward trend strength may increase as the pair moves to stronger support levels, the nearest of which is currently 1.2145 and 1.2080 as well as the 1.2000 psychological support. The gains of the pair will remain at any time temporary and aim for sell offs again.

As for today's economic data: Halifax and UK Home Price Index will be announced.