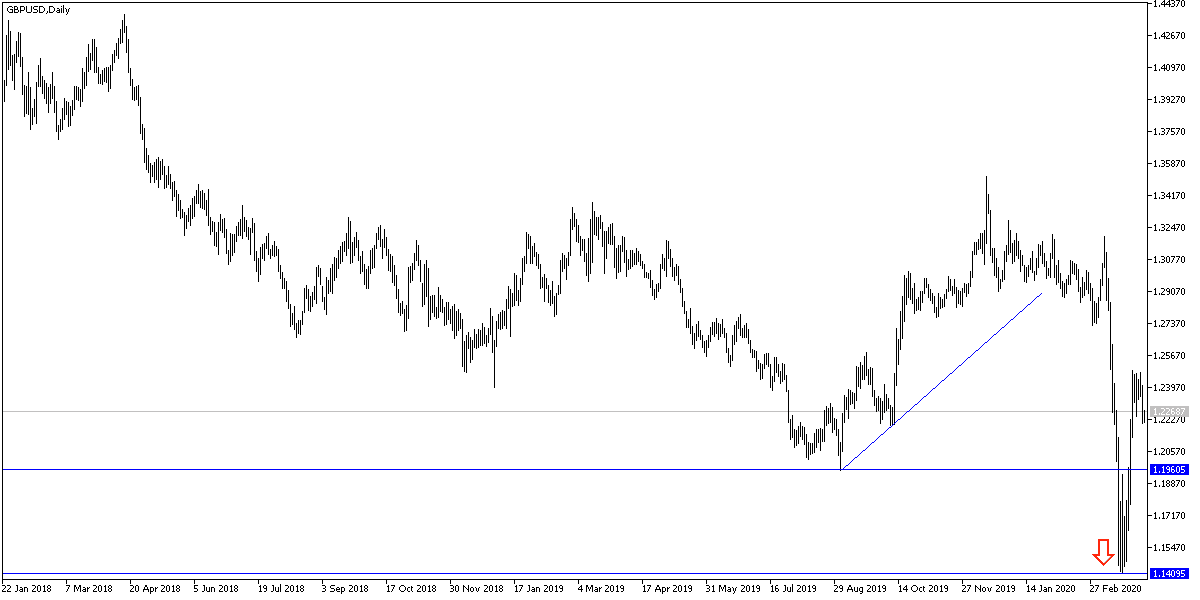

After a steadfast journey of the GBP/USD pair, which extended for five trading sessions in a row, it ended in failure and movement lower towards the 1.2204 support at the end of last week’s trading. At the beginning of this week’s trading, the pair is not far from that level, as it settled around 1.2230 at the time of writing. The pair suffered a loss of -1.58% last week, and still is in a good position to regain its recent lost gains. Losses were suddenly stopped after the release of the US Department of Labor report for March. Coronavirus has eroded US job gains in recent years.

In just one month, the virus eliminated nearly all of the new jobs created during the Trump presidency, which had long been a pride for him and for the Federal Reserve Bank, led by Jerome Powell. This raised investor concerns and increased demand for the dollar as a safe haven. Technical analysts see that the price of the GBP/USD is still in consolidation and vulnerable, although it found support coming from the 21-day moving average on the basis of last Friday's close, and is said to have a range to reach the 200-day average at 1.2660 in the coming days .

Employers in the United States of America cut hundreds of thousands of jobs last month due to the outbreak of the virus that brought the economy to a dead end. Ministry of Labor has reported that 701,000 jobs have been lost and is the result of nearly a decade of continuous job growth, the longest period of job growth in the country. The US unemployment rate increased in March from its lowest level in 50 years from 3.5% to 4.4% - the highest one-month jump in the US unemployment rate since 1975.

For the April jobs report to be released in early May, economists expect a loss of up to 20 million jobs and an unemployment rate of around 15%, the highest level since the 1930s.

As is well known, the massive scale of job cuts is causing long-term damage to economies in the United States and abroad, which are widely believed to be plunging into severe recessions. At the same time, as more and more people lose their jobs – or fear that - consumer spending will shrink. This decline in spending, which is the main driver of the economy, puts more pressure on those companies that are still operating.

According to technical analysis of the pair: the success of the bears in moving the GBP/USD below the 1.2200 support will increase sales operations and push the pair towards the 1.2130 support and 1.2000 psychological support, which confirms the reversal of the general trend on the short term. on the long term, the general trend is still downward. The return of the bulls by pushing the price of the pair above the 1.2475 resistance gives new hope in pushing the pair towards better resistance levels for the bullish reversal journey that we witnessed in trading last week.

As for the economic calendar data today: The British Construction PMI will be announced. There are no significant US economic releases today.