For the seventh straight day, GBP/USD is attempting an upward correction, but gains stopped around 1.2517 before settling around 1.2471 at the time of writing. The Pound's attempts to launch collide with pressure from Britain's position towards dealing with the epidemic, especially with global economies heading to reopen, and Britain is lagging in this regard, in addition to stopping sharp and non-constructive negotiations between the two sides of the Brexit, especially with the running out of time. The pound's gains since mid-March eventually ceased in recent days, but they still have a chance, and therefore the month of May could see the same trend, especially as global stock markets continue to improve, with the world heading to coexist with the Coronavirus until a vaccine is produced that eliminates the disease.

British Prime Minister Boris Johnson returned to work this week after recovering from Covid-19, and in a speech outside Downing Street, he said it was time to unveil measures to revitalize the country. Meanwhile, there has been a steady stream of British media in recent days regarding various plans to ease the closure, including plans to reopen schools. Media reports indicate that some easing measures could be announced Thursday or Friday. However, opinion polls confirm that the British public continues to strongly support closures as long as they are required, and this may cause the government to continue to take a slow and steady approach. This, in turn, could contribute to the case of the British Pound for a longer period.

From the United States of America. The first quarter GDP decreased by -4.8%, and this slowdown was expected in light of the current crisis. The result exceeded expectations, which were indicating a -4% slowdown. This is a decline in wealth for an economy that grew at a steady annual rate of 2.1% in the last quarter of 2019. The drop in first-quarter GDP is partly due to the response to the spread of COVID-19, as the US government issued orders to “stay home” in March. This led to rapid changes in demand, as companies and schools shifted their activity to teleworking or canceling operations, and consumers canceled, restricted, or redirected their spending.

The collapse in “personal consumption expenditures” was the main driver of deflation, although non-residential fixed assets investments, exports and changes in stocks between firms were also among the contributors to the decline. Partially offset by increases in investment in residential fixed assets and government spending, as well as lower imports, which are tantamount to subtracting GDP.

It will take longer for economies to recover from the economic devastation caused by the Coronavirus. In general, the deflation over two quarters in 2020 will be greater than the GDP loss witnessed over three years in the aftermath of World War II, the end of which led to an industrial contraction.

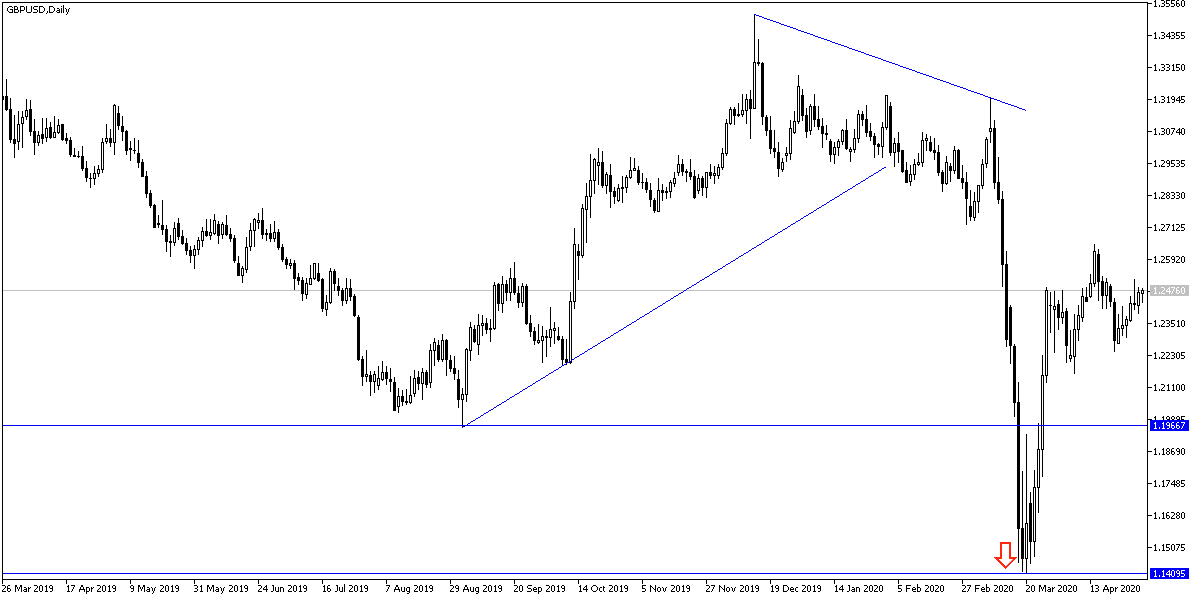

According to technical analysis of the pair: Head and shoulders formation for the GBP/USD performance has become more prominent on the daily chart, which may support the continuation of the bear's control for a longer period, especially if the pair returned to move below the 1.2400 level, which may support the downward rally towards levels of 1.2320 and 1.2245 and 1.2180 respectively. The US dollar as a safe haven will be more favored if the recent opening of the global economy leads to a more violent wave of the epidemic. The 1.2650 resistance remains the most important for the trend turning bullish. I still prefer to sell the pair from every upside level.

For today's economic calendar data: There are no significant UK economic releases today. All focus will be on US data, CPI, unemployed claims, and the Chicago PMI.