Financial markets welcomed the return of British Prime Minister Boris Johnson to his office after a period of treatment for symptoms of the Coronavirus, which contributed to a positive start to the GBP/USD towards the 1.2454 resistance level before settling around the 1.2425 level in the beginning of Tuesday’s trading. The pound was also motivated by Johnson's comments that measures to ease closures could be announced soon. The British pound may become more sensitive to developments related to the UK exit strategy from closure, and Johnson suggested that in the coming days the government could announce the lifting of restrictions, which is very important, as Britain and the British are being left behind by their peers who have already returned to normality.

Currency analysts note that those countries that succeeded in lifting closures at the earliest time, see that their economies are recovering, which may support the value of their currencies as well. Hence, the British Pound may be in danger if the United Kingdom lags behind the same trend of other global economies. For Johnson, it is more important for the UK to avoid a second wave of Covid 19 infection outbreak rather than rushing to lift the restrictions, as this could be more harmful. Accordingly, Johnson stated on the first day of his return to work after a short absence due to his illness that the second peak of the disease outbreak may lead to an "economic disaster." "I ask you to contain your impatience." He said that there is "real evidence now that we are going through the peak", including registering fewer hospitalized patients and that there are fewer Covid-19 patients in intensive care.

Accordingly, Johnson confirmed that the government will announce "in the coming days" how it plans to end the closure. The longer the restrictions period, the greater the capacity that the economy loses, which increases the effort required for recovery, which in turn may negatively affect the future of the British pound in the exchange markets during the coming weeks.

In Europe, Italy announced a set of measures to ease restrictions, stressing that the most affected economy in Europe is emerging from the other side of a dark chapter in post-war history. In the United States of America, the governor of New York, the hardest hit state, has set a date to ease some restrictions.

What may support the pound sterling in the coming period are the strong measures that the government has put in place to mitigate the economic impact of the closures, as the country commits about 13% of GDP to combat the negative economic impacts. This contrasts with the European Union, where the partial response and the inability to settle a financial response at the Eurozone level remains a concern for the markets.

According to a report published by The Times, the plans being considered by the British government will require companies to put up signs telling workers to stay two meters away from each other and direct employees to go home if they show symptoms of Covid-19.

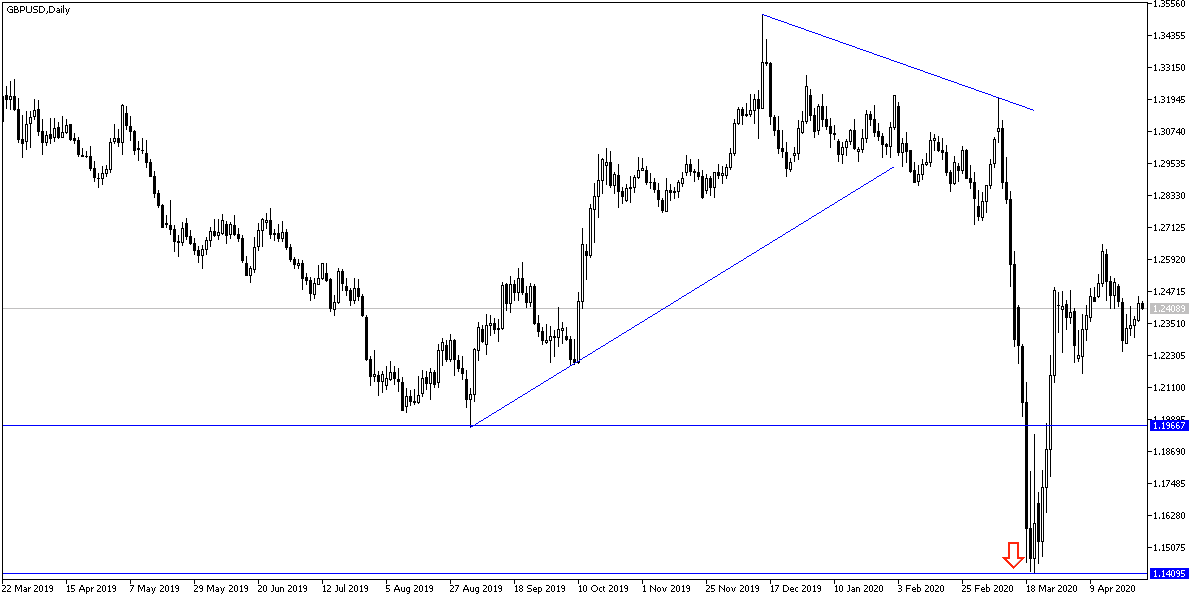

According to technical analysis of the pair: On the GBP/USD daily chart, confirmation of a head and shoulders formation started, which is a threat to any attempts for a bullish correction, especially if the pair fails to surpass the 1.2540 resistance as operations will start that might push the pair towards the support levels at 1.2365, 1.2290 and 1.2170, respectively. The British exit files from the closure and the future of the Brexit will have a strong influence on the pair’s trends in the coming period. The pair will react more to the results of the US economic data today, which includes the announcement of the commodity trade balance, consumer confidence and the Richmond Industrial Index.