Prior to the announcement of job and wage numbers in Britain, the GBP/USD pair stabilizes lower around the 1.2388 support at the time of writing, with the return of the dollar strength amid strong demand for it as a safe haven amid increasing global concerns, especially with the collapse in crude oil futures prices to levels that were never seen before, confirming the depth of the global economic crisis caused by the Corona epidemic. This is in addition to renewed fears about the future of Brexit negotiations between the European Union and Britain, especially in light of the spread of this epidemic.

Trade negotiations have resumed for the exit of Britain from the European Union, and must provide another dimension to the British pound trading in the coming weeks. Therefore, the markets should "fear" from the deadline at the first of July, whereas, the UK and the European Union have until July 01 to agree to extend the transitional period, which is scheduled to end at the end of the year in order to reach a free trade agreement, and if no such extension is agreed upon, analysts warn that the British pound may be exposed to noticeable pressure during the second half of 2020. Especially with the British government keen not to request for an extension.

The coronavirus is still the main driver of the Forex market, so we expect the British pound to become more sensitive to the flow of news regarding trade negotiations now that it has been restarted. Because of the delay in the negotiations after the coronavirus outbreak, the European Union said it would be open to extending the Brexit transition period fr to allow talks to continue, but the UK has repeatedly said it will not support such a request. In this context, David Frost, the chief British negotiator, said, “As we prepare for the next rounds of negotiations, I would like to repeat the government's position regarding the transitional period that emerged after our withdrawal from the European Union. The move will end on December 31 this year. We will not ask to extend it. And if the European Union asks, "We will say no."

"The extension would simply prolong the negotiations, create more uncertainty, leave us vulnerable to pushing more into the European Union in the future, and keep us committed to developing EU laws at a time when we need to control our own affairs. In short, it is not in the interest of the United Kingdom to extend”

We note that the return of the headlines related to Brexit, coincided with the stoppage of the pound's recovery streak against major currencies such as the Euro, the dollar and other currencies. Talks between the European Union and the United Kingdom have been stalled in recent weeks due to the more pressing covid-19 crisis, with key negotiators on both sides having to isolate themselves, and only one of the three official rounds of negotiations that were supposed to take place so far has been completed due to outbreak.

Last week, chief negotiator Michel Barnier and David Frost met via a video link to agree on a timetable for reviving the talks, and agreed to hold three more rounds of negotiations.

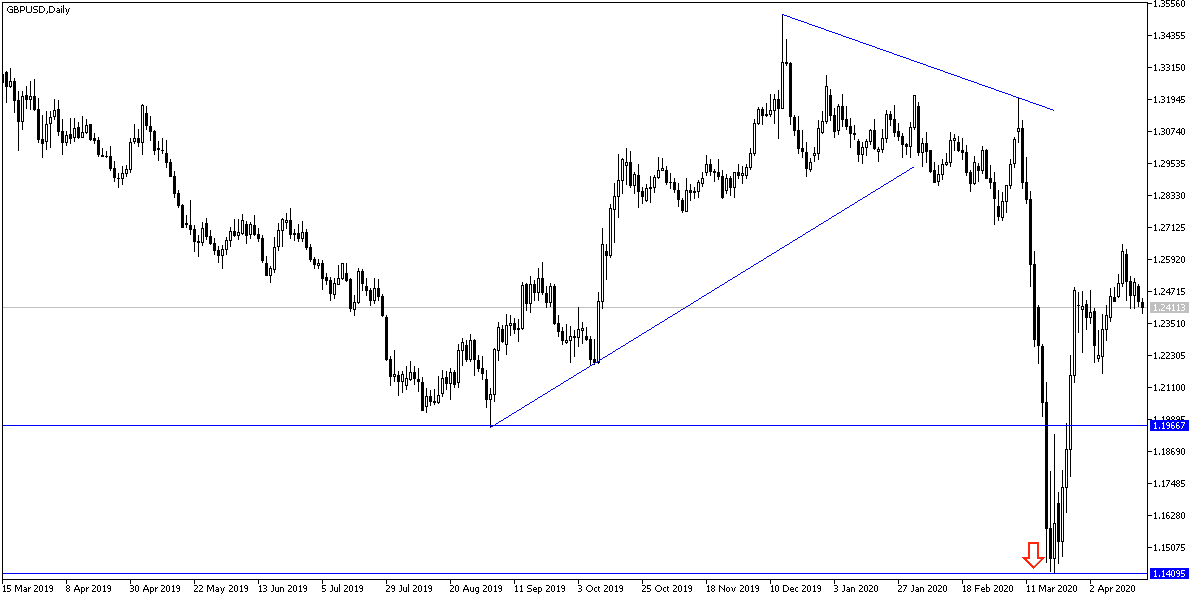

According to the technical analysis of the pair: GBP/USD is in a neutral stage now, and returning to the 1.2300 support area will support the bear's control of the performance again, and mark the beginning the exit from the bullish channel that appeared recently. The pair must go back above the 1.2600 resistance barrier to continue with the last correction. In general, the closest support levels for the pair are currently 1.2375, 1.2290 and 1.2200, respectively, and the last level is the beginning of a stronger collapse for the pair. I still prefer to sell the pair from every upper level, especially as the skirmishes for Brexit are back.

As for the economic calendar data today: From Britain, the average wages, the change in employment and the unemployment rate will be announced, then the sales of US existing homes will be released.