What was notable during last week's trading was a conflict occurred between the return of the US dollar strength, and the Pound's attempt to keep its recent gains, which is confirmed by the move of the GBP/USD currency pair between the 1.2647 resistance, its highest in a month, and the 1.2407 support, before closing trading around the 1.2476 level. The future of Brexit has returned to influence the Sterling. The UK and European Union plan to hold monthly meetings starting this week to negotiate a new trade agreement. British Prime Minister Johnson, who is recently recovering from Coronavirus symptoms, had previously warned that if the European Union did not move towards its target by mid-year, the United Kingdom would withdraw from the talks. Apparently, three meetings are planned here in the second quarter, starting next week. The European Commission has already expressed concern about the timeframe before the beginning of the Coronavirus crisis.

However, the UK government should not be expected to change its insistence to respect the current time frame by ending all arrangements before the end of 2020. The British government still has many difficult tasks ahead, including checking borders, the new immigration system, and introducing new and complex customs borders with Northern Ireland.

Sterling's recent gains, supported by an improvement in Boris Johnson's health, coupled with risk appetite, albeit limited, by investors after announcing successful trials of some vaccines to counter the Corona epidemic. This raised some optimism about the possibility of lowering the human cost of the virus at a time when the daily numbers of infection increasingly confirm that the peak of the outbreak of COVID-19 has been reached in major economies. However, some analysts have warned that markets are getting ahead of themselves and that the peak of the virus outbreak does not necessarily mean that a return to normalcy will come quickly.

Normalization is expected to be intertwined, which could lead to a slow and uneven global economic recovery and the return of volatile currency exchange rates. Increasingly, many also point to a new increase in demand for the dollar, which would be bad for the price of the pound against the dollar, and more subtle differences in movements in the exchange rates up. Until Friday trading, the currency market was driven by bilateral changes in risk appetite and the resulting impact on demand for the US dollar as a safe haven.

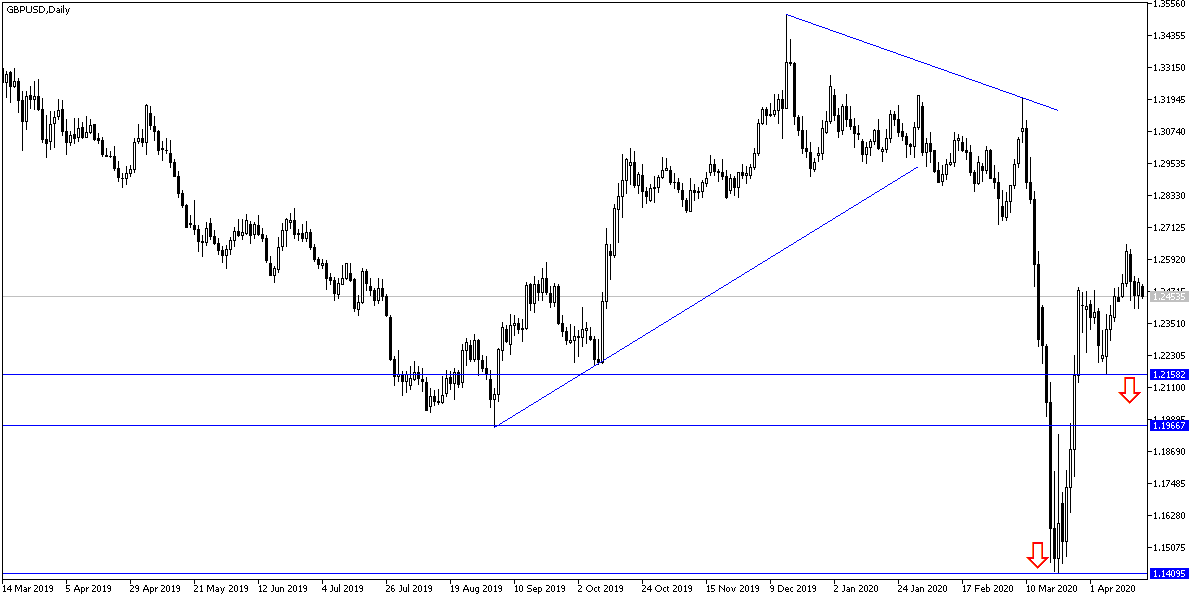

According to technical analysis of the pair: The positive outlook for the dollar still exists after the price of the GBP/USD failed to overcome the 61.8% Fibonacci retracement of its downtrend for 2020 for the fourth consecutive week. Therefore, the GBP/USD pair still needs to surpass the 1.2720 resistance as shown on the performance on the daily chart below, so that the correction opportunity is stronger because it will support the next move towards the 1.3000 psychological resistance. As I mentioned earlier, any move below the 1.2320 support will end current bullish hopes.

The pair is not expecting any important economic data, either from Britain or the United States of America today.