The Pound proved to be the most powerful currency against the return of the US dollar gains vs most major currencies. Yesterday, the GBP/USD losses did not exceed 1.2330 before stabilizing around the 1.2400 resistance at the beginning of today’s trading. Analysts believe that the fading dollar shortage in the global financial system thanks to a series of interventions by the US Federal Reserve appears to be a decisive engine behind the continued recovery in the value of the British Pound.

On Tuesday, the bank launched another program to pump more dollars into the global economy by launching temporary repurchase facilities for foreign central banks that should support the smooth functioning of financial markets, which in turn benefits the UK's large financial services sector and relieves pressure on the British pound. The bank’s actions appear to have halted the net outflow of capital from the UK, allowing the pound to recover, not only against the dollar but against the Euro and other global currencies.

In announcing this program, the Fed said that it would allow participants to temporarily exchange US Treasury bonds against the dollar, which could then be made available to institutions in their jurisdiction. The demand for the dollar increased during the collapse of global markets in the first half of March, as investors liquidated investments amid increasing fears of coronary virus outbreaks, a period that coincides with sharp and profound sales of the British pound. At that time, the US Federal Reserve took steps to pump more dollars into the global financial system, and demand for the US dollar declined since then, in conjunction with a widespread recovery in the British pound.

The additional measures taken on Tuesday to provide more dollars in the global system coincide with another noticeable increase in the value of the GBP, and the reason the sterling appears to have benefited is that the UK has a large financial services sector and the dollar shortage in the global financial system appears to coincides with outflows from British financial institutions, putting downward pressure on the British pound, not only against the dollar, but against a host of global currencies.

For economic news. Final survey data from IHS Markit showed that UK manufacturing activity contracted in March due to coronavirus outbreaks and containment efforts. The industrial purchasing managers' index fell to 47.8 in March from 51.7 in February. Expectations were for a reading of 48.0. Production has fallen to its lowest since July 2012 after a similar sharp drop in new business intakes. The effect has appeared on the labor market and across supply chains. Manufacturers said the decline in production and demand was caused by the disruption due to the Covid19 outbreak, declining market confidence and corporate closures.

Export business has fallen to its lowest since mid-2012 as there have been reports of project delays, cancellations and transportation issues. Employment decreased at the fastest rate since July 2009. Moreover, manufacturers reduced purchasing activity due to lower production requirements and efforts to protect cash flows. Moreover, corporate sentiment slipped to a record low in March, as manufacturers see further economic turmoil and uncertainty.

Inflationary pressures remained relatively confined, with input costs and production fees increasing only moderately.

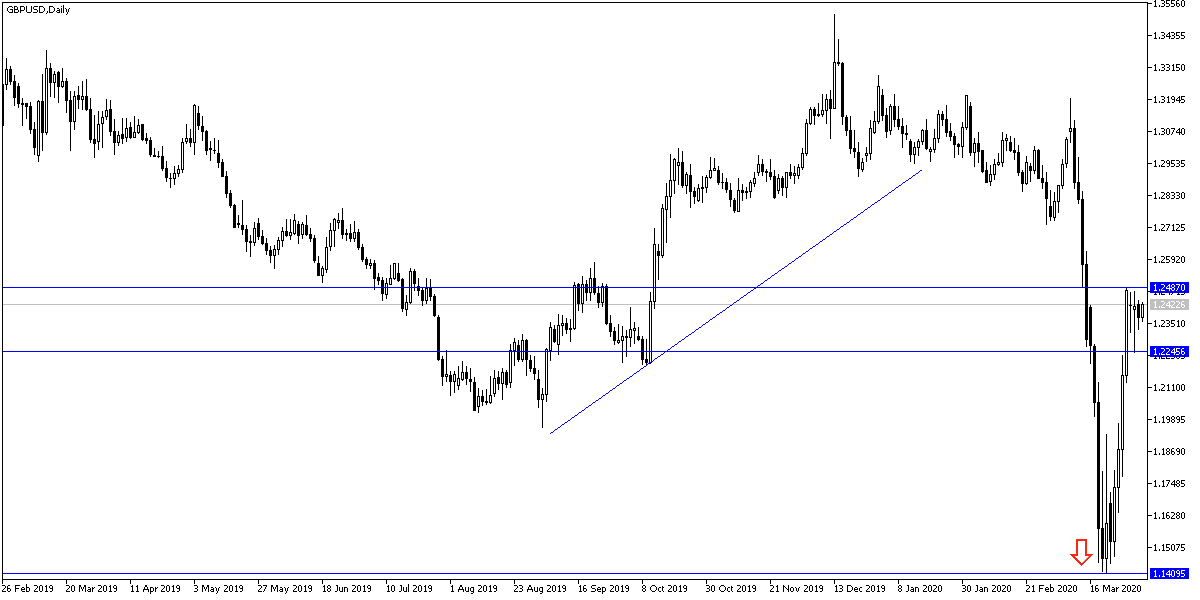

According to the technical analysis of the pair: As per the performance on the daily chart, there is stability for the GBP/USD in a limited range for several sessions, which indicates the upcoming strong movement of the pair in one direction or the other. I still lean to the possibility of a decline, as it appears that the technical indicators have reached overbought areas and the bears will gain more control in the event of a move towards the support levels of 1.2320, 1.2220 and 1.2000, respectively. The reversal may be stronger if it moves towards 1.2585 resistance, and it is necessary to take into consideration the risks facing the pound from the Brexit future and the effects of the corona shock.

As for the economic calendar data: All focus will be on the results of the US economic data, which includes the unemployed claims, the trade balance, and factory orders.