Despite the decline in the GBP/USD pair to the 1.2436 support with the return of the USD strength and after gains extended to the 1.2647 resistance, its highest level in more than a month, the general trend is still receiving support for the upward correction. The pair is stable around the 1.2525 level in early Thursday trading. The demand for buying the US dollar as a safe haven returned after official statistics revealed a historical decline in US retail sales last month and another record decline in manufacturing activity in New York State, the results confirm the extent of the global economy suffering from the Coronavirus.

The US Census Bureau announced yesterday, that retail sales fell by -8.7% on a monthly basis in March, adding to a previous decline of -0.5% which led to a worse-than-expected result with a low reading of -8.0%. Almost half of the decline was driven by lower auto sales.

Core US retail sales, which excludes auto sales, fell -4.5% last month. This added to a previous contraction of -0.4%, but was better than expectations, which were looking for a decrease of -4.9%. The core figure usually attracts more attention from the market because it represents a line to more accurately represent the underlying trend, despite the two series having witnessed historical decreases in gross domestic product last month.

It should be borne in mind that the March data contain only half a month of coronavirus containment measures, and as a result, further declines are likely when April numbers are released next month. Retail sales differ from “consumer spending” and account for about 5.5% of GDP, according to St. Louis Federal Reserve numbers.

The drop in retail sales was accompanied by a more significant drop in the Empire State Manufacturing Index from the New York Federal Reserve, which fell from -21.5 to -78.2 for April. New York is the epicenter of the coronavirus in the United States and is a memorial to the economic impact of measures to contain the disease, which has made New York a deserted ghost city instead of "the city that never sleeps" this year.

The Fed figures separately indicated that the broader measure of industrial production fell by -5.4% nationwide in March. This covers mining and utilities production as well as production from the manufacturing sector. However, all of these indicators are widely expected to set new lows in the coming months despite standard measures by the Federal Reserve and the government to reduce the impact of the virus on the economy.

And the United States of America is not alone, as much of the global economy is also on the same path, and thus increased demand for the dollar as a safe haven.

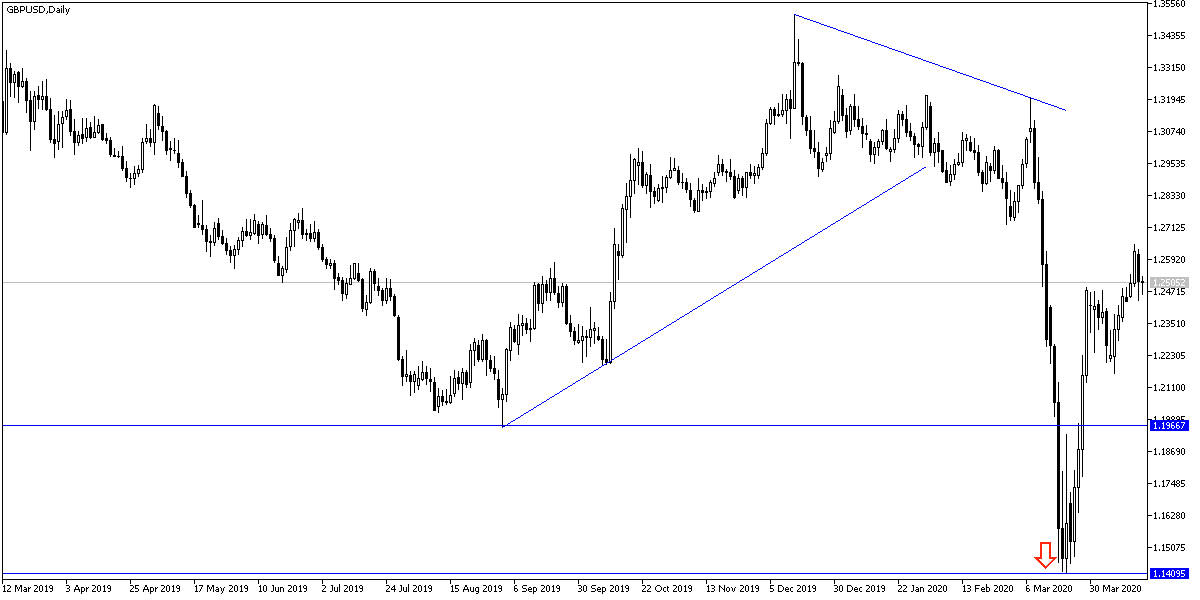

According to the technical analysis of the pair: Despite the recent decline, the price of the GBP/USD pair still has the opportunity to complete the upward correction. Especially if it returns to stability above the 1.2600 resistance, which gives bulls the momentum to test stronger bullish levels. If the outlook worsens for the future of the global economy and the Coronavirus continues to claim more lives and tighten economic closures, it will support stronger gains for the US dollar as a haven, and therefore it may return to decline to the support levels 1.2465, 1.2380 and 1.2270 respectively.

As for the economic calendar data today: All focus will be on the results of the US economic data, weekly jobless claims, building permits, and the Philadelphia Industrial Index.