The sell-off at the beginning of yesterday's session pushed the GBP/USD pair towards the 1.2243 support, but soon the dollar retreated and the pair jumped again to the 1.2423 resistance in the beginning of trading on Wednesday. This coincided with the US stocks on Wall Street recording the worst quarterly performance since 2008. And with a new intervention by the Federal Reserve in an attempt to calm lending markets in the world, this time by lending dollars to other central banks in exchange for Treasury bonds.

The Fed's latest move is its latest determined effort to keep borrowing rates down and ensure that financial markets continue to function in the face of a Covid-19 outbreak. The epidemic has shut down economic activity in the United States and abroad, making it difficult for some banks and companies to borrow. The Fed is trying to facilitate lending and boost confidence that it will do its utmost to support the global financial system.

And from the UK. Some attributed the pound's gains to reports indicating the possibility of extending Britain's exit from the European Union due to the ongoing collapse caused by the outbreak of the coronavirus. Economists believe that the British pound may get a boost if British Prime Minister Boris Johnson asked the European Union to extend the transition period aftr Britain left the European Union for a year or two. And he does, it will remove the negative risk of the pound sterling from the failure of the European Union and the United Kingdom to agree to a trade agreement beginning January 1, 2021 - the day after the end of Brexit transition period.

For economic news. The Office for National Statistics reported that the UK current account deficit was “greatly narrowed” at the end of 2020, as it decreased to 5.6 billion pounds in the last three months of 2019. The deficit is now 1.0% of GDP, down from 2.8% (8.3 billion pounds) in the third quarter of 2019. This was the lowest deficit since the second quarter of 2011 when it recorded 2.3 billion pounds, or 0.6% of GDP.

As is well known, the UK's current account deficit is a measure of the country's balance of payments with the rest of the world in trade, primary income and secondary income. The National Statistics Office attributes the shrinking of the current account deficit to the increase in exports of non-cash gold and other precious metals, which are described as irregular. It also caused a narrowing of the current account deficit, although to a lesser extent, and a narrowing of the basic income deficit, which was mostly due to lower UK payments to foreign investors.

On the basis of excluding non-monetary gold and other precious metals, the UK's primary current account balance narrowed slightly to a deficit of 17.1 billion pounds in the fourth quarter of 2019, or 3.1% of GDP.

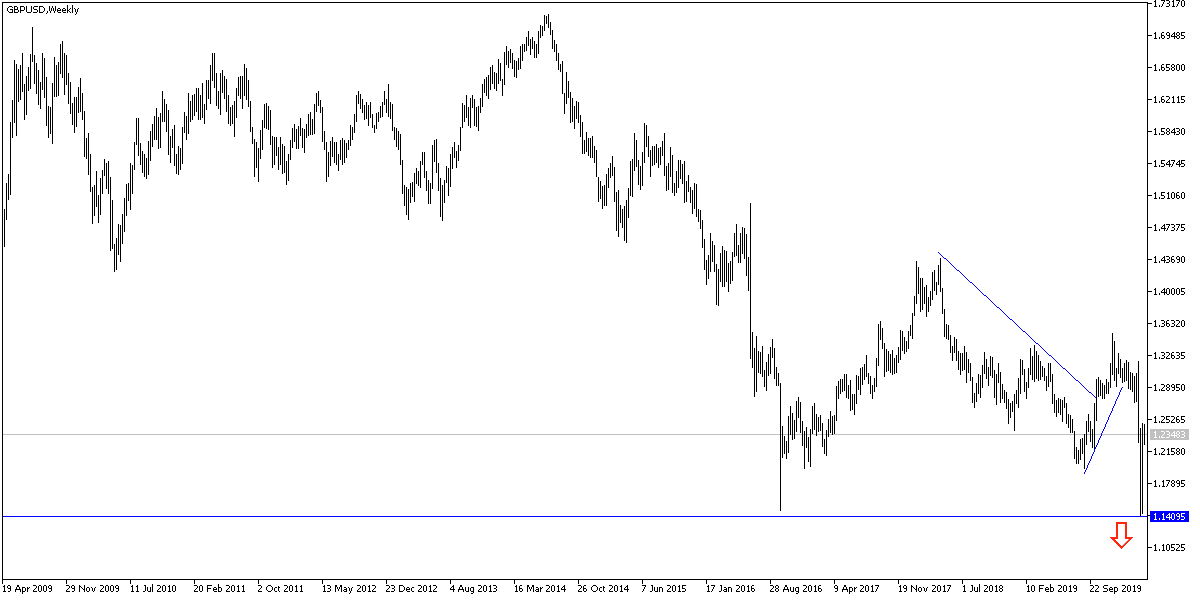

According to the technical analysis of the pair: The GBP/USD pair is still moving inside its recently formed bullish channel, which is visible clearly on the daily and four hour charts. As I mentioned in recent technical analyzes, the pair needs to move towards the 1.2585 and 1.2720 resistance levels to confirm the strength of the general trend reversal. As is the performance on the daily chart, the bears will have control again if the pair moves below 1.2185 because it will support the move towards the 1.2000 psychological support again.

As for the economic calendar data: From Britain, attention will be given to the announcement of the industrial purchasing managers' index data. From the United States, ADP change in the numbers of non-agricultural American jobs and the ISM Manufacturing PMI data will be release.